United Healthcare 2003 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2003 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UnitedHealth Group 23

Operating Costs

The operating cost ratio (operating costs as a percentage of total revenues) for 2003 was 16.9%, down

from 17.5% in 2002. This decrease was driven primarily by revenue mix changes, with greater growth

from premium revenues than from service revenues, and productivity gains from technology

deployment and other cost management initiatives. Our premium-based products have lower operating

cost ratios than our fee-based products. The impact of operating cost efficiencies in 2003 was partially

offset by the continued incremental costs associated with the development, deployment, adoption and

maintenance of new technology releases.

On an absolute dollar basis, operating costs for 2003 increased $488 million, or 11%, over 2002.

This increase was driven by a 6% increase in total individuals served by Health Care Services and

Uniprise during 2003, increases in broker commissions and premium taxes due to increased revenues,

general operating cost inflation and additional operating costs associated with change initiatives and

acquired businesses.

Depreciation and Amortization

Depreciation and amortization in 2003 was $299 million, an increase of $44 million over 2002.

This increase was due to additional depreciation and amortization from higher levels of computer

equipment and capitalized software as a result of technology enhancements, business growth and

businesses acquired since the beginning of 2002.

Income Taxes

Our effective income tax rate was 35.7% in 2003, compared to 35.5% in 2002. The change from 2002

was due to changes in business and income mix between states with differing income tax rates.

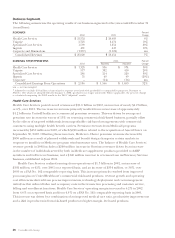

Business Segments

The following summarizes the operating results of our business segments for the years ended December 31

(in millions):

REVENUES

Percent

2003 2002 Change

Health Care Services

$24,807

$21,552 15%

Uniprise

3,107

2,725 14%

Specialized Care Services

1,878

1,509 24%

Ingenix

574

491 17%

Corporate and Eliminations

(1,543)

(1,257) nm

Consolidated Revenues

$28,823

$25,020 15%

EARNINGS FROM OPERATIONS

Percent

2003 2002 Change

Health Care Services

$1,865

$1,328 40%

Uniprise

610

517 18%

Specialized Care Services

385

286 35%

Ingenix

75

55 36%

Consolidated Earnings From Operations

$2,935

$2,186 34%

nm — not meaningful