Unilever 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 Unilever annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Annual Report and Accounts This PDF version of the Unilever

Annual Report and Accounts 2004 is an exact copy of the document provided

to Unilever’s shareholders.

Certain sections of the Unilever Annual Report and Accounts 2004 have been

audited. Sections that have been audited are set out on pages 96 to 148, 154 to

170 and 172 to 173. The auditable part of the Directors’ Remuneration report

as set out on page 89 has also been audited.

The maintenance and integrity of the Unilever website is the responsibility of

the Directors; the work carried out by the auditors does not involve consideration

of these matters. Accordingly, the auditors accept no responsibility for any

changes that may have occurred to the financial statements since they were

initially placed on the website.

Legislation in the United Kingdom and the Netherlands governing the preparation

and dissemination of financial statements may differ from legislation in other

jurisdictions.

Disclaimer Except where you are a shareholder, this material is provided for

information purposes only and is not, in particular, intended to confer any legal

rights on you.

This Annual Report and Accounts does not constitute an invitation to invest in

Unilever shares. Any decisions you make in reliance on this information are solely

your responsibility.

The information is given as of the dates specified, is not updated, and any forward-

looking statements are made subject to the reservations specified on page 3 of

the Report.

Unilever accepts no responsibility for any information on other websites that may

be accessed from this site by hyperlinks.

Disclaimer

Table of contents

-

Page 1

..., intended to confer any legal rights on you. This Annual Report and Accounts does not constitute an invitation to invest in Unilever shares. Any decisions you make in reliance on this information are solely your responsibility. The information is given as of the dates specified, is not updated, and... -

Page 2

2004 Unilever Annual Report and Accounts Adding vitality to life -

Page 3

...personal care with brands that help people feel good, look good and get more out of life. Our deep roots in local cultures and markets around the world give us our strong relationship with consumers and are the foundation for our future growth. We will bring our wealth of knowledge and international... -

Page 4

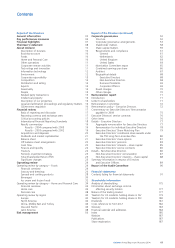

... About Unilever Description of business Business structure Foods Home and Personal Care Other operations Corporate venture activities Technology and innovation Information technology Environment Corporate responsibility Competition Distribution and selling Exports Seasonality People Related party... -

Page 5

... and Accounts for 2004 of NV and PLC. This document complies with Netherlands and United Kingdom regulations. It also forms the basis of the NV and PLC Annual Reports on Form 20-F to the Securities and Exchange Commission in the United States for the year ended 31 December 2004, and cross references... -

Page 6

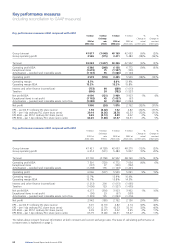

... value and cumulative goodwill written off directly to reserves under an earlier accounting policy. Ungeared free cash ï¬,ow is deï¬ned as cash ï¬,ow from group operating activities, less capital expenditure and ï¬nancial investment and less a tax charge adjusted to reï¬,ect an ungeared position... -

Page 7

...094) 2 762 2.82 42.33 4.02 60.31 1% 10% 29% 32% 32% 2% 2% 38% 40% 40% 11% 11% The tables above present ï¬nancial information at both constant and current exchange rates. The basis of calculating performance at constant rates is explained on page 2. 04 Unilever Annual Report and Accounts 2004 -

Page 8

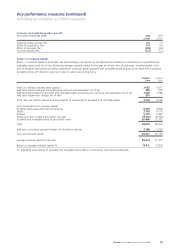

... ï¬xed investments Stocks Debtors Trade and other creditors due within one year Goodwill and intangible assets at gross book value Total Add back cumulative goodwill written off directly to reserves Year end invested capital Average invested capital for the year Return on average invested capital... -

Page 9

... GAAP measures) Ungeared free cash ï¬,ow Ungeared free cash ï¬,ow is cash ï¬,ow from group operating activities, less capital expenditure and ï¬nancial investment and less a tax charge adjusted to reï¬,ect an ungeared position, all expressed at current exchange rates. â,¬ million 2004 â,¬ million... -

Page 10

...payable for 2004 on NV New York shares and American Depositary Receipts of PLC may differ from those shown above, which include ï¬nal dividend values calculated using the rates of exchange ruling on 9 February 2005 (â,¬1.00 = $1.2762, £1.00 = $1.8618). Unilever Annual Report and Accounts 2004 07 -

Page 11

... of our turnover coming from brands in excess of â,¬0.5 billion. Our Vitality mission unites us all. It is a compelling vision that is right for our consumer, right for our brands and right for our business. However, after a promising start, including two good years of growth and market share gains... -

Page 12

... during their years of service. Ralph Kugler has been nominated for election as an Executive Director at the Annual General Meetings in May. He is currently Business President - Home and Personal Care - Europe. Looking to the future We expect a tough environment in 2005. Market growth will continue... -

Page 13

...life and delivers value to our business. Home care We are market leaders in laundry products in developing and emerging markets, and hold number two positions in North America and most of Europe. Our products have been developed to meet the diverse range of consumer needs to clean and care for their... -

Page 14

... in over 100 countries. Our household care products are designed to meet most cleaning and hygiene needs around the home. In this category, our heartland is Europe, where Cif and Domestos hold strong positions in the key markets in which they operate. Personal care We lead the global deodorants and... -

Page 15

... hub. Our sales force strategic automation technology - Siebel - continues to be deployed across the business. Good progress has been achieved in Asia and Latin America, using low-cost hand held devices, sharing learning and best practice across regions. An Asian trade funds management system has... -

Page 16

...environment report and on our website. More than two-thirds of the raw materials used in our products come from agriculture. This led us to develop our Sustainable Agriculture Programme, which, together with our partners, we are implementing across our supply chain. In 2004, the roll-out of our Good... -

Page 17

... Market and inclusion of other European countries in the European Union. Distribution and selling Unilever's products are generally sold through its sales force and through independent brokers, agents and distributors to chain, wholesale, co-operative and independent grocery accounts, food service... -

Page 18

...% participation rate. We want our people to feel directly involved in the performance of the business, so encourage participation in employee share plans; our internal communication processes help ensure that our people relate to the business. One of our ongoing goals is to help our business leaders... -

Page 19

... brands and technology. Description of our properties We have interests in properties in most of the countries where there are Unilever operations. However, none is material in the context of the Group as a whole. The properties are used predominantly to house production and distribution activities... -

Page 20

... of key ratios referred to in this review please refer to page 149. Reporting currency and exchange rates Foreign currency amounts for results and cash ï¬,ows are translated from underlying local currencies into euros using annual average exchange rates; balance sheet amounts are translated at year... -

Page 21

... growth and margin that are consistent with typical North American foods businesses. The review was based on a 10 year discounted cash ï¬,ow methodology using a pre-tax discount rate of 11%. Deferred tax Full provision is made for deferred taxation, as required under UK Financial Reporting Standard... -

Page 22

... main disposal impact arose from the sale of our chemicals business in India, certain household care brands in North America and the edible oils business in Mexico. Group turnover was â,¬40 169 million (2003: â,¬42 693 million). Our share of turnover from joint ventures continued to fall in 2004 to... -

Page 23

... full management control of the business with effect from 25 March 2003. On 14 October 2003, we announced the creation of Pepsi Lipton International, a 50:50 joint venture between Unilever and Pepsico, to market and distribute ready-to-drink tea in several international markets outside North America... -

Page 24

... Ambrosia in the United Kingdom, John West in Australasia, cheese businesses in Austria and Germany and the Pamol oil business in Malaysia. Various trademarks were also sold as part of our Path to Growth strategy, including Brut in the US and Latin America and a number of oral care brands in the US... -

Page 25

...at current exchange rates. This has enabled an increased dividend payout for 2004 and the announcement of a share buy-back programme for 2005. Finance and liquidity Unilever aims to be in the top third of a reference group for Total Shareholder Return of 21 international consumer goods companies, as... -

Page 26

... time. It combines share price appreciation and dividends paid to show the total return to the shareholder. The absolute level of the TSR will vary with stock markets, but the relative position reï¬,ects the market perception of overall performance relative to a reference group. Unilever calculates... -

Page 27

...ice cream and ready-to-drink tea. However we also lost market share in a number of categories where our market competitiveness was simply not good enough. In contrast, there were good performances in both North America and Latin America, while growth in Asia and Africa was modest. Our Foods business... -

Page 28

... was good growth in our ice cream and frozen foods business, particularly helped by excellent weather conditions in Europe. We recorded good growth in the Lipton Ice Tea business, again helped by the European weather. Slim•Fast results however were heavily affected in many countries by changing... -

Page 29

... rates. We are developing our savoury and dressings brands through products that suit the changing lifestyles of our consumers. We are keeping them relevant through the creation of world-class communication and launches into new trade channels and markets. Underlying sales grew by 2.6%. Operating... -

Page 30

... Latin America was a ï¬ne example of the creative use of technology to target low-income consumers. Knorr frozen gained momentum, having an established presence in seven markets in Europe and with turnover exceeding â,¬100 million. Dressings had a good year, with strong performances in Europe and... -

Page 31

..., but signiï¬cant price reductions on our Sana brand to defend our market volume meant a decline in sales. Overall growth in the category was held back by lower sales of 'tail' brands which are being managed for value and in which investment is low. 28 Unilever Annual Report and Accounts 2004 -

Page 32

... a difï¬cult start to the year due to severe price pressures mainly in Europe. The launch of dairy cream alternatives in several countries in Europe and Latin America in the fourth quarter progressed well. Innovation continued to be the key driver of growth in this category. Examples of adapting to... -

Page 33

... in Pakistan, which faced increased promotional activity by local competition. Our Pepsi Lipton International joint venture, launched in 2003 to accelerate our growth in under-developed ready-to-drink tea markets, is producing strong results. Our health and wellness brands, largely made up of Slim... -

Page 34

.... We also expanded our successful North American partnership with Pepsi to include many more countries. We continued to have strong positions in key traditional tea markets. In 2003, we had a very successful relaunch of the Brooke Bond brand in India. Unilever Annual Report and Accounts 2004 31 -

Page 35

... share in a highly competitive market. Key to this success has been meeting consumer demand for health and wellness lines such as low-carb, low-sugar, lactose-free and yoghurt products, which now represent over 20% of our portfolio. In Latin America we successfully launched AdeS Kibon ice cream... -

Page 36

... performance of the business after eliminating these exchange translation effects is discussed below at constant exchange rates. Ice cream had a strong year with 4.3% underlying sales growth, assisted by good weather in Europe. In quarter one, the relaunch of the Heart brand strengthened its... -

Page 37

...ï¬cult trading conditions. In 2004 our Home and Personal Care business came under pressure from the combination of a sharp slowdown in market growth and a signiï¬cant rise in the level and intensity of competitive activity. The combination of lower prices, particularly in the developed world, and... -

Page 38

...ï¬cation initiatives. We continued to focus our brand portfolio through the disposal of non-core business - including our oral care and Sunlight dishwash businesses in North America, Brut in North and Latin America, and the Bio Presto brand in Italy. Unilever Annual Report and Accounts 2004 35 -

Page 39

... brand Comfort. The household care business declined due to difï¬cult trading conditions in Europe, despite strong growth in developing and emerging markets. Attention was focused on the proï¬tability of the business, which improved signiï¬cantly. 36 Unilever Annual Report and Accounts... -

Page 40

... in the second half as innovation around the core business showed signs of a return to growth. Within the portfolio, Cif and Domestos remained leading brands with number one or number two positions in the majority of key markets in which they operate. Unilever Annual Report and Accounts 2004 37 -

Page 41

... exchange rates. In 2004, our personal care business had underlying sales growth of 2.1%. Market share improved in Europe and Africa, Middle East and Turkey; in a number of other regions, market share had started to recover by the end of the year following declines earlier in the year. Operating... -

Page 42

... weak economic conditions in key markets. The sale of the Valentino licence also contributed to the decline in turnover. Innovation in 2003 included the launch of Purple Orchid (Eternity), Truth for Men in Europe and Nautica Competition in the Americas. Unilever Annual Report and Accounts 2004 39 -

Page 43

...Underlying sales declined by 2.8%. In Western Europe, trading conditions were difï¬cult due to the continuing growth of hard discounters and the responses of traditional retailers, looking to compete through value on both branded and private label products. In addition, ice cream and ready-to-drink... -

Page 44

... of price-competitive markets in laundry. In foods, growth by category in part reï¬,ected the exceptionally hot summer weather, with strong gains in ready-to-drink tea and ice cream, but lower consumption in savoury, frozen meals and cooking products. Highlights of another good year in personal care... -

Page 45

... rates of exchange. Underlying sales grew by 1.5%. Our Foods business grew well following the successful implementation of a new 'go-to-market' approach in 2003 and the rapid launch of a range of low-carb products across much of the portfolio in the ï¬rst half of 2004. Our US ice cream brands... -

Page 46

... trade de-stocking and weak out-of-home channels in the ï¬rst half of the year, diluted underlying sales growth by 3.6%. Turnover, including the impact of disposals, declined by 7%. In mass personal care we improved our overall market position through Axe deodorants, and established the Dove brand... -

Page 47

...constant rates of exchange. Underlying sales grew by 3.1%. Nigeria had a strong year in both Foods and Home and Personal Care. South East Africa performed well in difï¬cult conditions. In South Africa there has been improved volume growth, but negative pricing as we took action to ensure our brands... -

Page 48

... achieved the leading position in hair care in Turkey. In Foods, growth in savoury was led by Knorr, and included the launch into a number of countries in the Middle East. Ice cream and Lipton tea also grew well, while volumes declined in cooking oils, especially in French West Africa. The regional... -

Page 49

... it was a difï¬cult year for tea in Pakistan, which faced increased promotional activity by local competition. There was strong growth of our ice cream businesses, particularly in Indonesia and China. In hair care in Japan, where we had previously made excellent market share gains, there was... -

Page 50

... and Lipton green tea bags were launched in China. Knorr Soupy Snax were launched in India and the Knorr brand grew well in China. The regional operating margin BEIA at 14.4% was 0.2% ahead of the previous year after a 0.4% increase in advertising and promotions. Unilever Annual Report and Accounts... -

Page 51

... potential repayment of certain sales tax credits in Brazil. Operating margin BEIA increased from 14.1% in 2003 to 16.4% in 2004 with the region beneï¬ting from strong top-line growth and cost savings as we extended our regional shared service centres. 48 Unilever Annual Report and Accounts 2004 -

Page 52

... positive volume growth in the second half of the year, but this was offset by continuing market declines in Foods categories, resulting in a 2.2% overall volume decline for the year. Including the impact of disposals, turnover increased 5.0%. The key drivers of growth were our personal care brands... -

Page 53

... would reduce the sales of our products. Customer relationships and distribution Unilever's products are generally sold through its sales force and through independent brokers, agents and distributors to chain, wholesale, co-operative and independent grocery accounts, food service distributors and... -

Page 54

... credit risks with any single counterparty as at the year end. As a result of the share option plans for employees, we are exposed to movements in our own share price. In recent years we have hedged this risk through buying Unilever shares in the market when the share option is granted and holding... -

Page 55

...the various markets can, and do, ï¬,uctuate. This happens for a number of reasons, including changes in exchange rates. However, over time the prices of NV and PLC shares do stay in close relation to each other, in particular because of our arrangements to pay dividends on an equalised basis. NV was... -

Page 56

...; approval of the Annual Report and Accounts; declaration of dividends; nominations for Board appointments; convening of shareholders' meetings; approval of Board Remuneration Policy; approval of corporate strategy; approval of Corporate Annual Plan; review of risks and controls; authorisation of... -

Page 57

... of NV and PLC and ï¬ve other members: the two Division Directors for Foods and for Home and Personal Care, the Corporate Development Director, the Financial Director and the Personnel Director. The Executive Committee has been entrusted, within the parameters set out in The Governance of Unilever... -

Page 58

... or connected persons, have with NV or PLC. A number of relationships, such as non-executive directorships, exist between several of our Non-Executive Directors and companies that provide banking, insurance or ï¬nancial advisory services to Unilever. Our Boards considered in each case the number of... -

Page 59

... advises on external matters of relevance to the business - including issues of corporate social responsibility - and reviews our corporate relations strategy. The Committee is supplied with necessary information by the Corporate Development Director. 56 Unilever Annual Report and Accounts 2004 -

Page 60

... Home and Personal Care Director, the Personnel Director, the General Counsel, the Chief Auditor and the Controller. It meets at least four times a year. The speciï¬c responsibilities of the Committee are, currently, as follows: • Identiï¬cation of risks of Corporate signiï¬cance, communicating... -

Page 61

... subsidiaries of NV and PLC. The members of our Nomination Committee act as Directors of NV Elma and of United Holdings Limited. This is to ensure that the nomination rights are only exercised so as to ensure the implementation of the decision of the full Boards. In addition, only persons who have... -

Page 62

...General Meetings to deal with speciï¬c resolutions. Under United Kingdom company law: • shareholders who together hold shares representing at least 5% of the total voting rights of PLC; or • at least 100 shareholders who hold on average £100 each in nominal value of PLC capital can require PLC... -

Page 63

... rate, as the price for 6.67 new PLC shares. Under the Equalisation Agreement (as amended in 1981) the two companies are permitted to pay different dividends in the following exceptional circumstances: • if the average annual sterling/euro exchange rate changed so substantially from one year... -

Page 64

... various rules into account in preparing the preceding description of our Board arrangements. The changes we made to our corporate governance arrangements at the NV and PLC Annual General Meetings in 2004 consisted of the appointment of Non-Executive Directors to join our Executive Directors on our... -

Page 65

... the Dutch Code invites us to give our shareholders that are not included elsewhere in this Annual Report and Accounts. Board and Committee structures As already indicated, NV has a single-tier Board, consisting of both Executive and, as a majority, Independent Non-Executive Directors. We achieve... -

Page 66

...Audit Committee has been regularly informed of the progress of the review. In light of the above, the Board considers that the internal risk management and control systems are appropriate for our business and in compliance with bpp II.1.4. Share options In line with bpp II.2.2, the awards and grants... -

Page 67

... of the duties and responsibilities referred to in the Dutch Code. The exceptions are supervision over the ï¬nancing of the Company, tax planning and the application of information and communication technology (bpp III.5.4), where our Audit Committee assists the Board in fulï¬lling its oversight... -

Page 68

... in 2004 and 2005 applicable to both foreign and US listed companies in preparing the changes to its corporate governance arrangements that became effective from the NV and PLC Annual General Meetings held on 12 May 2004. These changes included the appointment of Non-Executive Directors to join our... -

Page 69

... â,¬0.51 share, and by 71.4 to ï¬nd the amount per 1.4p share. Despite the Equalisation Agreement, NV and PLC are independent corporations, and are subject to different laws and regulations governing dividend payments in the Netherlands and the United 66 Unilever Annual Report and Accounts 2004 -

Page 70

...practice designed to ensure their independence from Unilever, including, for example, the periodic rotation of key team members. The lead partner in charge of the audit changed in 2001. See note 2 on page 108 for the actual fees payable to PricewaterhouseCoopers. Unilever Annual Report and Accounts... -

Page 71

...Senior Vice-President, Global Ice Cream category 1995. Chairman, Lipton-Sais Switzerland 1993. Foods Member East Asia Paciï¬c Regional Management 1990. Marketing and Grocery Sales Director, Frigo, Spain 1986. President Europe designate. * â-† â-² 1 2 3 Member Executive Committee Appointed 12 May... -

Page 72

...1970. Appointed Business President 1998. Previous position: Business Group President Africa. Bernd Ellmann, Europe, Ice Cream and Frozen Foods Aged 56. Joined Unilever 1973. Appointed Business President 2004. Previous position: Chairman, European bakery business. John Rice â-², North America Aged 53... -

Page 73

...the Boards. Their colleagues wish to thank them for their contributions to Unilever over the past 34, 31 and 34 years respectively. Ralph Kugler is nominated for election as an Executive Director of NV and PLC at the 2005 AGMs. He is currently Business President - Home and Personal Care - Europe and... -

Page 74

... Directors for that year were low. We strive to ensure that the remuneration package for Executive Directors continues to deliver the best possible value for shareholders. Bertrand Collomb Chairman of the Remuneration Committee David Simon Jeroen van der Veer Unilever Annual Report and Accounts... -

Page 75

...fees earned from outside directorships are paid directly to Unilever. Reward structure The Executive Directors' total remuneration package consists of Base salary; Annual performance bonus; Long-term incentives; Pension provision; and Other beneï¬ts and allowances. The Committee regularly reviews... -

Page 76

...: Shares in NV and PLC to the combined value of â,¬500 000; and • US-based Executive Director: Shares in NV and PLC to the combined value of â,¬400 000. The conditional awards vest three years after date of grant but the number of shares to vest is dependent on Unilever's Total Shareholder Return... -

Page 77

... 2001, as part of the changes in the remuneration package of the Executive Directors, approved by shareholders at that time. No further rights to premium options arise on grants made under the NV and PLC plans from 2001 onwards. All-Employee Share Plans Executive Directors are able to participate in... -

Page 78

... in earnings per share BEIA at current exchange rates and (b) the sales growth of the leading brands. The maximum bonus in respect of these Corporate targets is 80% of base salary. • Personal: these were based on agreed key objectives relative to the Executive Director's speciï¬c responsibilities... -

Page 79

... the Unilever UK Pension Fund (UPF) and by making a corresponding increase in the top-up provided by the company. The Committee is continuing to review this position depending on the ï¬nal form of the UK Government's new tax rules. Executive Directors' service contracts The Executive Directors have... -

Page 80

Remuneration report Details - Executive Directors The following section contains detailed information on the Executive Directors' annual remuneration, long-term incentives, pension beneï¬ts, service contracts and share interests in respect of 2004. Aggregate remuneration for Executive Directors ... -

Page 81

... 8) All such beneï¬ts in kind are taxable in the country of residence of the Executive Director concerned (apart from the value of residential accommodation provided for Netherlands based Executive Directors which is tax-free in the Netherlands). 78 Unilever Annual Report and Accounts 2004 -

Page 82

... these shares each Executive Director is awarded, on a conditional basis, an equivalent number of matching shares which are not included above. The value of these matching shares totalling â,¬257 000 [£174 000] will be reported when they vest in 2008. (6) Total includes all annual emoluments earned... -

Page 83

...the conditional rights in NV and PLC shares awarded in March 2002 under the TSR LTIP plan will vest in 2005. 14 21 The reference group, including Unilever, consists of 21 companies. Unilever's position is based on TSR over a three-year rolling period. 80 Unilever Annual Report and Accounts 2004 -

Page 84

... Weighted average Number exercise of shares price Share type Balance of options at 1 January 2004 Number of options granted in 2004 First exercisable date Final expiry date A Burgmans Executive Plan Executive Plan NL All-Employee Plan UK ShareSave Plan P J Cescau Executive Plan Executive Plan... -

Page 85

... â,¬230 318 [£156 179]. The term 'Executive Plan' refers to options granted under the PLC, NV or NA Executive Option Plans (see page 74). The closing market prices of ordinary shares at 31 December 2004 were â,¬49.33 (NV shares), 512p (PLC shares), $66.71 (NV New York shares) and $39.52 (per ADR... -

Page 86

... the effect of salary increases, additional service, beneï¬t enhancements and any changes in actuarial bases. Changes in the bases during 2004 had the effect of signiï¬cantly increasing transfer values, especially for the UK based Executive Directors. Unilever Annual Report and Accounts 2004 83 -

Page 87

...by the Unilever Netherlands pension plan (Progress), as prescribed by the Netherlands Ministry of Social Affairs and Employment. The transfer values for the UK based Executive Directors' arrangement are calculated on the market related basis used by the Unilever United Kingdom pension plan (UPF), in... -

Page 88

... that class of share. Except as stated above, all shareholdings are beneï¬cial. The only changes in the interests of the Executive Directors and their families in NV and PLC ordinary shares between 31 December 2004 and 25 February 2005 were that: (i) The holding of the Unilever Employee Share Trust... -

Page 89

...comparable companies in the UK and continental Europe. This review concluded that the level of fees payable by NV and PLC to Non-Executive Directors should be increased in order to take into account current market practice and their increased responsibilities as Directors. As a result of this change... -

Page 90

... of External Affairs and Corporate Relations Committee. Member of Audit Committee. Chairman of Audit Committee. Member of Nomination Committee and Remuneration Committee. Member of External Affairs and Corporate Relations Committee (retired May 2004). Unilever Annual Report and Accounts 2004 87 -

Page 91

... and PLC shares are ordinary 1.4p shares. (2) Held as American Depositary Receipts (ADRs). There were no changes in the interests of the Non-Executive Directors and their immediate families in NV and PLC ordinary shares between 31 December 2004 and 25 February 2005. 88 Unilever Annual Report and... -

Page 92

... options' on pages 81 and 82, 'Executive Directors' pensions' on pages 83 and 84, 'Executive Directors' interests: share capital' on page 85, 'Non-Executive Directors remuneration' on page 87 and 'Non-Executive Directors' interests - share capital' on page 88. Unilever Annual Report and Accounts... -

Page 93

... and control, and accounting developments. Risk management and internal control arrangements The Committee reviewed Unilever's overall approach to risk management and control, and its processes, outcomes and disclosure, including speciï¬cally: • Corporate Audit's interim and year-end reports on... -

Page 94

... accounts 1 Segmental information 2 Operating costs 3 Staff costs and employees 4 Exceptional items 5 Interest 6 Taxation on proï¬t on ordinary activities 7 Combined earnings per share 8 Dividends on ordinary capital 9 Goodwill and intangible assets 10 Tangible ï¬xed assets 11 Fixed investments... -

Page 95

...'s corporate internal audit function plays a key role in providing an objective view and continuous reassurance of the effectiveness of the risk management and related control systems throughout Unilever to both operating management and the Boards. The Group has an independent Audit Committee... -

Page 96

... of the ï¬nancial position of the Unilever Group and Unilever N.V. as at 31 December 2004 and of the result for the year then ended in accordance with United Kingdom accounting standards and comply with the ï¬nancial reporting requirements included in Part 9 of Book 2 of the Netherlands Civil Code... -

Page 97

...ï¬,ows of the Group for the year then ended. In our opinion the accounts of the Unilever Group and Unilever PLC have been properly prepared in accordance with the United Kingdom Companies Act 1985. In our opinion, the auditable part of the Directors' Remuneration Report has been properly prepared in... -

Page 98

... in the United States of America. Information relating to the nature and effect of such differences is presented in the determination of net proï¬t and capital and reserves as shown on pages 154 and 155. PricewaterhouseCoopers Accountants N.V. Rotterdam, The Netherlands As auditors of Unilever... -

Page 99

... be equal in value at the relevant rate of exchange to the dividends and other rights and beneï¬ts attaching to each £1 nominal of ordinary share capital of PLC, as if each such unit of capital formed part of the ordinary capital of one and the same company. For additional information please refer... -

Page 100

.... Current investments are liquid funds temporarily invested and are stated at their realisable value. The difference between this and their original cost is taken to interest in the proï¬t and loss account. Retirement beneï¬ts With effect from 1 January 2003, Unilever has accounted for pensions... -

Page 101

... payments are described in more detail in note 30 on pages 138 to 147. Shares held by employee share trusts The assets and liabilities of certain PLC trusts, NV and group companies which purchase and hold NV and PLC shares to satisfy options granted are included in the Group accounts. The book value... -

Page 102

...to 159. In accordance with Article 402 of Book 2 of the Civil Code in the Netherlands, the proï¬t and loss account of the entity NV on page 169 shows only the income from ï¬xed investments after taxation and other income and expenses as separate items. Unilever Annual Report and Accounts 2004 99 -

Page 103

...group operating activities 27 Dividends received from joint ventures Returns on investments and servicing of ï¬nance 28 Taxation Capital expenditure and ï¬nancial investment 28 Acquisitions and disposals 28 Dividends paid on ordinary share capital Cash inï¬,ow before management of liquid resources... -

Page 104

...similar obligations 18 Net pension asset for funded plans in surplus 18 Net pension liability for funded plans in deï¬cit 18 Net pension liability for unfunded plans 18 Minority interests Capital and reserves 21 Attributable to: NV: Called up share capital 22 Share premium account 21 Other reserves... -

Page 105

... management products, and nutritionally enhanced staples sold in developing markets. This product category was previously described as 'Health and wellness and beverages'. Ice cream and frozen foods - including sales of ice cream and frozen food. Home care - including sales of home care products... -

Page 106

... products Beverages â,¬ million Ice cream and frozen foods â,¬ million â,¬ million â,¬ million â,¬ million â,¬ million Total Home and Personal Personal Other care Care operations â,¬ million Analysis by operation 2002 Turnover Less: Share of turnover of joint ventures Group turnover Group operating... -

Page 107

...million Ice cream and frozen foods â,¬ million â,¬ million â,¬ million â,¬ million â,¬ million Total Home and Personal Personal Other care Care operations â,¬ million Analysis by operation 2004 Turnover At constant 2003 exchange rates Exchange rate adjustments At current 2004 exchange rates Trading... -

Page 108

...million Ice cream and frozen foods â,¬ million â,¬ million â,¬ million â,¬ million â,¬ million Total Home and Personal Personal Other care Care operations â,¬ million Analysis by operation Total Foods Home care Total Depreciation, amortisation and impairment 2004 At constant 2003 exchange rates... -

Page 109

... accounts Unilever Group 1 Segmental information (continued) â,¬ million â,¬ million North America â,¬ million Africa, Middle East & Turkey â,¬ million Asia & Paciï¬c â,¬ million Latin America â,¬ million Analysis by geographical area 2004 Turnover(d) Less: Share of turnover of joint ventures... -

Page 110

... different. Inter-segment sales between geographical areas and between product categories are not material. (h) For the United Kingdom and the Netherlands, the combined operating proï¬t was â,¬622 million (2003: â,¬918 million; 2002: â,¬750 million). Unilever Annual Report and Accounts 2004 107 -

Page 111

...ï¬ned on page 89. The average number of employees during the year was: '000 2004 '000 2003 '000 2002 Europe North America Africa, Middle East and Turkey Asia and Paciï¬c Latin America Total 53 18 52 74 30 227 57 20 53 79 31 240 65 22 52 84 35 258 108 Unilever Annual Report and Accounts 2004 -

Page 112

... has been made for businesses in advance of planned disposals. Other exceptional items in 2004 represent a charge of â,¬169 million relating to the potential repayment of certain sales tax credits in Brazil. In 2003, â,¬0.3 billion of net costs were incurred under Path to Growth programmes, of which... -

Page 113

..., the computed rate of tax is the average of the standard rate of tax applicable in the European countries in which Unilever operates, weighted by the amount of proï¬t on ordinary activities before taxation generated in each of those countries. 110 Unilever Annual Report and Accounts 2004 -

Page 114

Notes to the consolidated accounts Unilever Group 6 Taxation on proï¬t on ordinary activities (continued) The total charge in future periods will be affected by any changes to the corporate tax rates in force in the countries in which the Group operates. The current tax charges will also be ... -

Page 115

... NV and PLC in issue during the year, after deducting shares held to meet Unilever employee share options which are not yet exercised. For the calculation of combined ordinary capital, the exchange rate of £1 = Fl.12 = â,¬5.445 has been used, in accordance with the Equalisation Agreement. Earnings... -

Page 116

...ects the long-term value in this highly dynamic category. The discount rate used was based on a pre-tax weighted average cost of capital and was 11%. The result of the review indicated that a goodwill impairment charge of â,¬591 million was necessary. Unilever Annual Report and Accounts 2004 113 -

Page 117

... 2005. In each case the impairment recognised was based on the expected sales proceeds from disposal. Other small impairments were recognised during the course of the year for tea plantations and a bakery business in India, and a home and personal care business in North Africa. 10 Tangible ï¬xed... -

Page 118

... over this business. There was no change in the net carrying value arising from the reclassiï¬cation. (c) Other ï¬xed investments consist mainly of equity investments in a number of companies and ï¬nancial institutions in India, Europe and the US. Unilever Annual Report and Accounts 2004 115 -

Page 119

... to the consolidated accounts Unilever Group 11 Fixed investments (continued) â,¬ million 2004 â,¬ million 2003 Analysis of listed and unlisted investments Investments listed on a recognised stock exchange Unlisted investments Total ï¬xed investments Market value of listed investments 36 166 202... -

Page 120

...: 12.1%). A corresponding interest charge is included in the US dollar ï¬xed rate liabilities. (b) Includes euro leg of the currency derivatives relating to our intra-group loans, amounting to â,¬4 052 million for 2004 and â,¬5 084 million for 2003. Unilever Annual Report and Accounts 2004 117 -

Page 121

... relating to our intra-group loans, amounting to â,¬4 052 million for 2004 and â,¬5 084 million for 2003. (b) Includes ï¬nance lease creditors amounting to â,¬218 million. The average interest rate on short-term borrowings in 2004 was 3.1% (2003: 4.0%). 118 Unilever Annual Report and Accounts... -

Page 122

... (US $) Other India: 9.000% Debenture loan 2005 (Indian rupee) Japan: Floating rate note 2006 (Japanese yen) Thailand: 3.300% Bonds 2007 (Thai baht) South Africa: 10.200% Bonds 2008 (South African Rand) Commercial paper (South African Rand) Other Total other group companies Total bonds and other... -

Page 123

... of the instruments used for interest rate and foreign exchange exposure management, together with information on related exposures, are given below. Except for the description of Unilever's currency exposures as included on page 51 on treasury risks, all debtors and trade and other creditors (other... -

Page 124

...the net investments in our subsidiaries is discussed in the Financial Review on page 22. At the end of 2004, some 82% (2003: 90%) of Unilever's total capital and reserves were denominated in the currencies of the two parent companies, euros and sterling. Our policy for the management of counterparty... -

Page 125

... unfunded. The Group also operates a number of deï¬ned contribution plans, the assets of which are held in external funds. Accounting policies Accounting for pensions and similar obligations is in accordance with United Kingdom Financial Reporting Standard 17 'Retirement beneï¬ts' (FRS 17... -

Page 126

... With the objective of presenting pensions and other post-employment beneï¬t plans' assets and liabilities at their fair value on the balance sheet, assumptions for FRS 17 are set by reference to market conditions at the valuation date. The actuarial assumptions used to calculate the bene... -

Page 127

...the consolidated accounts Unilever Group 18 Pensions and similar obligations (continued) Balance Sheet The assets, liabilities and surplus/(deï¬cit) position of the pension and other post-employment beneï¬t plans and the expected rates of return on the plan assets, at the balance sheet date, were... -

Page 128

... Deï¬ned contribution plans Total operating cost Charged to other ï¬nance income/(cost): Interest on retirement beneï¬ts Refund of previously irrecoverable surplus Expected return on assets Total other ï¬nance income/(cost) Net impact on the proï¬t and loss account (before tax) (317) (135) (13... -

Page 129

... rate Salary increases Pension increases 5.10 3.60 2.20 5.50 3.70 2.20 5.70 4.50 n/a 6.10 4.50 n/a Assumptions for the remaining deï¬ned beneï¬ts plans vary considerably, depending on the economic conditions of the country where they are situated. 126 Unilever Annual Report and Accounts... -

Page 130

... returns over the long term commensurate with an acceptable level of risk. The Group also keeps a proportion of assets invested in bonds, property and cash. Most assets are managed by a number of external fund managers, with a small proportion managed in-house. Unilever Annual Report and Accounts... -

Page 131

Notes to the consolidated accounts Unilever Group 18 Pensions and similar obligations (continued) Funded status The funded status of the plans, reconciled to the amount reported in the statement of ï¬nancial position, is as follows: â,¬ million Pension plans 2004 â,¬ million â,¬ million â,¬ ... -

Page 132

... rates suitable risk premiums that take account of available historic market returns and current market expectations. Post-employment healthcare beneï¬ts Assumed healthcare cost trend rates have a signiï¬cant effect on the amounts reported for the healthcare plans. A one-percentage-point change... -

Page 133

... a â,¬169 million charge, taken in 2004, relating to the potential repayment of certain sales tax credits taken in Brazil. The cash impact of these balances is expected to be a cash outï¬,ow of â,¬0.1 billion in 2005, and â,¬0.5 billion thereafter. 130 Unilever Annual Report and Accounts 2004 -

Page 134

...premium account â,¬ million Other reserves â,¬ million Proï¬t retained â,¬ million Total 2004 1 January 2004 Result for the year retained Goodwill movements Actuarial gains/(losses) on pension schemes net of tax Change in book value of shares or certiï¬cates held in connection with share options... -

Page 135

.... The other classes of preferential share capital of NV and the deferred stock of PLC are not redeemable. For information on the rights of shareholders of NV and PLC and the operation of the Equalisation Agreement, see Corporate governance on pages 52, 53, 58 and 59. Internal holdings The ordinary... -

Page 136

... Dividends on ordinary capital Result for the year retained Goodwill movements Actuarial gains/(losses) on pension schemes net of tax Change in book value of shares or certiï¬cates held in connection with share options Share option credit(a) Unrealised gain on partial disposal of a group company... -

Page 137

...in subsidiary companies. In 2003 the principal transaction was the acquisition at the end of March of the remaining shares in Asian food businesses from our joint venture partner Ajinomoto of Japan. These businesses are now consolidated as subsidiaries. 134 Unilever Annual Report and Accounts 2004 -

Page 138

... Touch and Sunlight in North America, Capullo, Mazola and Inca in Chile and Mexico and Dalda oils in Pakistan. Our chemicals business in India (Hindustan Lever Chemicals) was merged with Tata Chemicals. Various other smaller brands were also sold as part of our Path to Growth strategy. In 2003, the... -

Page 139

... impairment Changes in working capital: Stocks Debtors Creditors Pensions and similar provisions less payments Restructuring and other provisions less payments Elimination of (proï¬ts)/losses on disposals Non-cash charge for share options Other adjustments Cash ï¬,ow from group operating activities... -

Page 140

... years Total Management of liquid resources Purchase of current investments Sale of current investments (Increase)/decrease in cash on deposit Total Financing Issue/purchase of shares by group companies to/(from) minority shareholders Capital injection to joint ventures Debt due within one year... -

Page 141

... share option and award plans by purchasing shares in advance and transferring them, in return for the exercise price, to Executive Directors and employees as the options are exercised or the awards vest. The numbers in this note include those for Executive Directors shown in the Remuneration report... -

Page 142

..., South Africa and United Kingdom. Group (a): The standard framework for these countries means, in principle, an annual grant of options over NV shares (Ireland: PLC shares), at the same grant date, exercise price (the market price on the grant date) and grant size (including part-time employees pro... -

Page 143

... rate NV New York shares option value information(b) Fair value per option(c) Valuation assumptions Expected option term Expected volatility Expected dividend yield Risk-free interest rate (b) Weighted average of options granted during each period. (c) Estimated using Black-Scholes option pricing... -

Page 144

...shares of Unilever PLC, at a price not lower than the market value on the day the options are granted. These options become exercisable over a three-year period from the date of grant and have a maximum term of ten years. Managers working in India can participate in an Executive Option Plan relating... -

Page 145

... interest rate PLC option value information(b) Fair value per option(c) NV Executive Option Plan PLC Executive Option Plan NA Executive Option Plan Valuation assumptions Expected option term Expected volatility Expected dividend yield Risk-free interest rate (b) Weighted average of options granted... -

Page 146

... managers participate in the North American Share Bonus Plan, the others in the Variable Pay in Shares Plan. A summary of the status of the Share Matching Plans as at 31 December 2004, 2003 and 2002 and changes during the years ended on these dates is presented below: 2004 Weighted average price... -

Page 147

... Long-Term Incentive Plan Under this plan, introduced in 2001, grants are made to Executive Directors and some senior executives. The level of share award which will vest three years later will vary in accordance with the Total Shareholder Return in comparison with a peer group (see description on... -

Page 148

... 2004 2003 2002 NV share award value information(b) Fair value per share award PLC share award value information(b) Fair value per share award (b) Weighted average of share awards granted during each period. $65.98 $9.64 $58.35 $9.14 $59.00 $8.35 Unilever Annual Report and Accounts 2004 145 -

Page 149

...) The Restricted Share Plan In speciï¬c one-off cases a number of executives are awarded the right to receive NV and PLC shares at a speciï¬ed date in the future, on the condition that they are still employed by Unilever at that time. A summary of the status of the Restricted Share Plan as at 31... -

Page 150

...the UK, Unilever formed a joint venture with Arlington Science Park Ltd. and sold it property at the Colworth site for a total consideration of â,¬46 million. In 2004 Patrick Cescau, the Chairman of Unilever PLC, and his wife purchased a house from Immobilia Transholme B.V., an NV group company, for... -

Page 151

...and loss account for the year ended 31 December â,¬ million NV 2004 â,¬ million NV 2003 â,¬ million NV 2002 â,¬ million PLC 2004 â,¬ million PLC 2003 â,¬ million PLC 2002 Group turnover Group operating proï¬t Total income from ï¬xed investments Interest Other ï¬nance income/(cost) - pensions and... -

Page 152

... assets at gross book value and cumulative goodwill written off directly to reserves under an earlier accounting policy. The average of ï¬ve quarter-end positions is taken. Cash ï¬,ow from group operating activities, less capital expenditure and ï¬nancial investment and less a tax charge adjusted... -

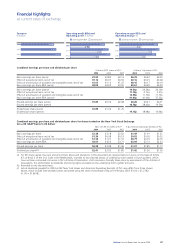

Page 153

... capital Ordinary dividends NV - euros per â,¬0.51 of ordinary capital PLC - pence per 1.4p of ordinary capital Consolidated balance sheet Goodwill and intangible assets Other ï¬xed assets and investments Stocks Debtors Acquired businesses held for resale Total cash and current investments Total... -

Page 154

... Funds from operations after interest and tax over net debt (%) Selected ï¬nancial data and key ratios on a US GAAP basis(f)(g) Group turnover Net proï¬t Capital and reserves Total assets Combined earnings per share(b) Euros per â,¬0.51 of ordinary capital Euro cents per 1.4p of ordinary capital... -

Page 155

... 19 014 1 768 129 20 911 Capital expenditure Foods Home and Personal Care Other operations 532 462 11 1 005 By geographical area â,¬ million 2004 â,¬ million 2003 â,¬ million 2002 â,¬ million 2001 â,¬ million 2000 Group turnover Europe North America Africa, Middle East and Turkey Asia and Paci... -

Page 156

... (continued) Unilever Group Exchange rates The information in the following table is based on exchange rates between euros and US dollars and euros and sterling. These translation rates were used in preparation of the accounts. 2004 2003 2002 2001 2000 Year end â,¬1 = $ â,¬1 = £ Annual average... -

Page 157

... with SFAS 123. The actual remuneration cost charged in each period is shown on page 139. Amounts for prior years were restated to reï¬,ect compensation costs for all the employee awards granted or modiï¬ed in ï¬scal years beginning after 1994. 154 Unilever Annual Report and Accounts 2004 -

Page 158

... with accounting principles which differ in certain respects from those generally accepted in the United States (US GAAP). The principal differences are set out below. Proï¬t or loss on disposal of businesses Unilever calculates proï¬t or loss on sale of businesses after writing back any goodwill... -

Page 159

... in the current year. During 2004 we reviewed the balances relating to the global Slim•Fast business in light of the signiï¬cant decline in the weight management category in North America during the second half of the year. Over the last few years, consumer tastes in this category have changed... -

Page 160

... goodwill of group companies, associates and joint ventures by reporting segment is given below: â,¬ million Savoury and dressings â,¬ million Spreads and cooking products â,¬ million â,¬ million Ice cream and frozen foods â,¬ million â,¬ million â,¬ million â,¬ million Total Home and Personal Care... -

Page 161

... consistent with UK GAAP. Unilever accounts for changes in the market value of current investments as interest receivable in the proï¬t and loss account for the year. Under US GAAP, such current asset investments are classiï¬ed as 'available for sale securities' and changes in market values, which... -

Page 162

... position or results of operations. Documents on display in the United States Unilever ï¬les and furnishes reports and information with the United States Securities and Exchange Commission (SEC), and such reports and information can be inspected and copied at the SEC's public reference facilities... -

Page 163

... account for the year ended 31 December 2004 Group turnover Operating costs Group operating proï¬t Share of operating proï¬t of joint ventures Operating proï¬t Share of operating proï¬t of associates Dividends Other income from ï¬xed investments Interest Other ï¬nance income/(cost) - pensions... -

Page 164

... account for the year ended 31 December 2003 Group turnover Operating costs Group operating proï¬t Share of operating proï¬t of joint ventures Operating proï¬t Share of operating proï¬t of associates Dividends Other income from ï¬xed investments Interest Other ï¬nance income/(cost) - pensions... -

Page 165

...ow from group operating activities Dividends from joint ventures Returns on investments and servicing of ï¬nance Taxation Capital expenditure and ï¬nancial investment Acquisitions and disposals Dividends paid on ordinary share capital Cash ï¬,ow before management of liquid resources and ï¬nancing... -

Page 166

... assets of subsidiaries (equity accounted) Total ï¬xed assets Stocks Amounts due from group companies Debtors due within one year Debtors due after more than one year Cash and current investments Total current assets Borrowings Amounts due to group companies Trade and other creditors Creditors due... -

Page 167

... assets of subsidiaries (equity accounted) Total ï¬xed assets Stocks Amounts due from group companies Debtors due within one year Debtors due after more than one year Cash and current investments Total current assets Borrowings Amounts due to group companies Trade and other creditors Creditors due... -

Page 168

... Annual Return of Unilever PLC. The main activities of the companies listed below are indicated according to the following key: Holding companies Foods Home and Personal Care Other Operations Unless otherwise indicated, the companies are incorporated and principally operate in the countries under... -

Page 169

.... Lipton Ltd. Unilever Bestfoods UK Ltd. Unilever Cosmetics International (UK) Ltd. Unilever Ice Cream & Frozen Food Ltd. Unilever PLC(2) Unilever UK Central Resources Ltd. Unilever UK Holdings Ltd. Unilever UK & CN Holdings Ltd. % North America Canada Unilever Canada Inc. United States of America... -

Page 170

... Unilever Services (Hefei) Limited Wall's (China) Company Ltd. China S.A.R. Unilever Bestfoods Hong Kong Ltd. Unilever Hong Kong Ltd. 51 85 India Hindustan Lever Ltd. Indonesia P.T. Unilever Indonesia Tbk Japan Nippon Lever KK Malaysia Unilever Foods (Malaysia) Sdn. Bhd. Unilever (Malaysia) Holdings... -

Page 171

... c F Ownership Activity a F Associated companies % 33 % 33 % 40 Europe United Kingdom Langholm Capital Partners North America United States of America JohnsonDiversey Holdings, Inc Africa Côte d'Ivoire Palmci b O a P Ownership b Activity O 168 Unilever Annual Report and Accounts 2004 -

Page 172

... respects with legislation in the Netherlands. As allowed by Article 362.1 of Book 2 of the Civil Code in the Netherlands, the company accounts are prepared in accordance with United Kingdom accounting standards. The Board of Directors 1 March 2005 Unilever Annual Report and Accounts 2004 169 -

Page 173

Notes to the company accounts Unilever N.V. Fixed investments Shares in group companies Book value of PLC shares held in connection with share options Less NV shares held by group companies â,¬ million 2004 â,¬ million 2003 Provisions for liabilities and charges (excluding pensions and similar ... -

Page 174

... for the year Preference dividends Proï¬t at disposal of the Annual General Meeting of shareholders Ordinary dividends Proï¬t for the year retained Changes in present value of net pension liability Realised proï¬t/(loss) on shares/certiï¬cates held to meet employee share options Proï¬t retained... -

Page 175

... Section 230 of the United Kingdom Companies Act 1985, an entity proï¬t and loss account is not included as part of the published company accounts for PLC. On behalf of the Board of Directors P J Cescau Chairman A Burgmans Vice-Chairman 1 March 2005 172 Unilever Annual Report and Accounts 2004 -

Page 176

... accounts Unilever PLC Fixed investments £ million 2004 £ million 2003 Other reserves £ million 2004 £ million 2003 Shares in group companies 2 237 2 237 Shares in group companies are stated at cost or valuation, less amounts written off. £ million 2004 1 January Change in book value... -

Page 177

... the year. Details of shares purchased by an employee share trust and Unilever group companies to satisfy options granted under PLC's employee share schemes are given in the Remuneration report on page 85 and in note 30 to the consolidated accounts on pages 138 to 147. Directors' report of PLC For... -

Page 178

... of PLC's shares or deferred stock on 25 February 2005. The voting rights of such shareholders are the same as for other holders of the class of share indicated. We take this information from the register we hold under section 211 of the UK Companies Act 1985. Title of class Name of holder Number of... -

Page 179

... options granted and by our hedging practice. Total number of shares purchased as part of publicly announced plans Total number of shares purchased(a) Average price paid per share January February March April May June July August September October November December NV shares PLC shares NV shares... -

Page 180

... changes in exchange rates. However, over time the prices of NV and PLC shares do stay in close relation to each other, in particular because of our equalisation arrangements. If you are a shareholder of NV, you have an interest in a Netherlands legal entity, your dividends will be paid in euros... -

Page 181

...31 52 49 65 57 527 487 38 33 Annual high and low prices for 2002, 2001 and 2000: 2002 2001 2000 NV per â,¬0.51 ordinary share in Amsterdam (in â,¬) NV per â,¬0.51 ordinary share in New York (in $) PLC per 1.4p ordinary share in London (in pence) PLC per American Depositary Receipt in New York (in... -

Page 182

... are subject to the Netherlands income tax or corporation tax, as appropriate, and the Netherlands tax on dividends will generally be applied at the full rate of 25%. This tax will be treated as foreign income tax eligible for credit against the shareholder's United States income taxes. Under the... -

Page 183

... the ex-dividend date, that PLC is a qualiï¬ed foreign corporation and certain other conditions are satisï¬ed. PLC is a qualiï¬ed foreign corporation for this purpose. Dividends received by an individual for taxable years after 2008 will be subject to tax at ordinary income rates. The dividend is... -

Page 184

...the â,¬0.51 ordinary shares of NV registered in New York. The above exchange rates were those ruling on the dates of declaration of the dividend. The ï¬nal euro dividend for 2004 is payable on 13 June 2005. The dollar dividend will be calculated with reference to the exchange rates prevailing on 10... -

Page 185

... and qualitative disclosures about market risk 50-51 4 Information on the company 4A History and development of the company 4B Business overview 4C Organisational structure 4D Property, plant and equipment 5 5A 5B 5C 12 Description of securities other than equity securities n/a 2, 20-21, 52, 137... -

Page 186

...common stock Stock option Additional paid-in capital relating to proceeds of sale of stock in excess of par value or paid-in surplus Stockholders' equity Shares outstanding Statement of comprehensive income Inventories Property, plant and equipment Sales revenues Unilever Annual Report and Accounts... -

Page 187

... 11:00 am Wednesday 11 May 2005 London Dividends on ordinary capital Final for 2004 - announced 10 February 2005 and to be declared 10 May 2005 (NV) and 11 May 2005 (PLC) Ex-dividend date Record date Payment date NV PLC NV - New York Shares PLC - American Depositary Receipts Interim for 2005 - to... -

Page 188

...10, 32-33 Corporate governance 52-71, 84, 90 Country Crock 10, 26, 28 Creditors 98, 101, 121-122, 148, 150, 163-164, 169-170, 172-173 Current investments 21-22, 97, 101, 117, 121, 137-138, 148, 150, 158, 163-164, 172-173 Hellmann's Home and Personal Care Home care Ice cream and frozen foods 10, 32... -

Page 189

... Taxation 4, 19-20, 51, 99-100, 110-111, 122, 148, 151, 154-155, 160-162, 170, 173, 179-180 Total shareholder return (TSR) 23, 76 Treasury 22, 51 Turnover 3-5, 7, 19-20, 24-51, 98-99, 102-104, 106-107, 148, 150-152, 158, 160-161 Unilever Foodsolutions 10, 24 United Kingdom (UK) 2, 17, 52, 55-56, 58... -

Page 190

... Unilever share price, our quarterly and annual results, performance charts, ï¬nancial news and investor relations speeches and presentations. It also includes conference and investor/analyst presentations. You can also view this year's and prior years' Annual Review and Annual Report and Accounts... -

Page 191

Designed and produced by Addison Corporate Marketing Photography by Igor Emmerich Typeset by Paufï¬,ey, London Printed by St Ives Westerham Press under ISO 14001 environmental accreditation. All paper used in the production of this report is recyclable and bio degradable and contains 50% recovered ... -

Page 192

..., PO Box 760 3000 DK Rotterdam The Netherlands T +31 (0)10 217 4000 F +31 (0)10 217 4798 Unilever PLC PO Box 68, Unilever House Blackfriars, London EC4P 4BQ United Kingdom T +44 (0)20 7822 5252 F +44 (0)20 7822 5951 Unilever PLC registered office Unilever PLC Port Sunlight Wirral Merseyside CH62 4ZD...