Unilever 1999 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 1999 Unilever annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Unilever Group Notes to the consolidated accounts

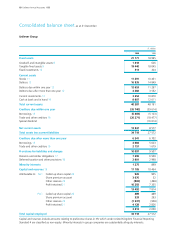

18 Deferred taxation and other provisions

Fl. million

1999 1998

Deferred taxation on:

Accelerated depreciation 2527 2 547

Stock reliefs 153 126

Pension and similar provisions (1 226) (1 016)

Short-term and other timing differences (2 430) (2 305)

(976) (648)

Less asset balances reclassified

as debtors due after more than

one year 12 2596 1 939

1620 1 291

Restructuring provisions 800 1 216

Other provisions 381 491

2801 2 998

Movements in deferred taxation:

1 January (648)

Currency retranslation 45

Acquisition/disposal of group companies (2)

Profit and loss account (371)

31 December (976)

On a SSAP 15 basis the deferred

taxation asset would be: (404) (148)

Movements in restructuring

provisions:

1 January 1216

Currency retranslation 18

Profit and loss account – new charges 438

– releases (130)

Utilisation (742)

31 December 800

Restructuring provisions include

primarily provisions for severance

costs in connection with business

reorganisations which have been

announced.

Movements in other provisions:

1 January 491

Currency retranslation 35

Acquisition/disposal of group companies (1)

Profit and loss account (34)

Utilisation (110)

31 December 381

19 Capital and reserves

Fl. million

1999 1998

Movements during the year:

1 January 10 464 24 734

Profit of the year retained 3 319 (12 628)

Goodwill movements 83 6

Currency retranslation 774 (1 329)

Change in book value of shares

or certificates held in connection

with share options (582) (319)

Issue of new shares under PLC

share option schemes 2—

Issue of new NV preference shares 3 045

31 December 17 105 10 464

As required by United Kingdom

Financial Reporting Standard 4 capital

and reserves can be analysed as follows:

Equity:

Ordinary capital 13 795 10 199

Non-equity:

7% Cumulative Preference 29 29

6% Cumulative Preference 161 161

4% Cumulative Preference 75 75

10 cents Cumulative Preference 3 045

Total non-equity 3 310 265

17 105 10 464

Share capital and share premium

On 9 June 1999 NV issued 211 473 785 cumulative preference

shares to those shareholders who elected to receive shares instead

of the special dividend. The 10 cents cumulative preference shares

were issued at a notional value of Fl. 14.50 per share, which is

equal to the amount of the special dividend, of which Fl. 14.40

was credited to the share premium account. Further details are set

out in note 20 on page 20 and in the share premium account note

on page 45.

The issued share capital of NV increased by Fl. 21 million as a

result of the issue of the 10 cents cumulative preference shares.

NV share premium account increased by Fl. 3 024 million after

charging issue costs of Fl. 21 million.

A small number of PLC shares were allotted during the year under

the PLC 1985 Executive Share Option Schemes.

19 Unilever Annual Accounts 1999