Unilever 1999 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 1999 Unilever annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Unilever Group Notes to the consolidated accounts

4 Exceptional items (continued)

Exceptional items are those items within ordinary activities which,

because of their size or nature, are disclosed to give a proper

understanding of the underlying result for the period. These

include restructuring charges associated with reorganising

businesses (comprising impairment of fixed assets, costs of

severance, and other costs directly attributable to the

restructuring), and profits and losses on disposal of businesses.

Provisions for impairment of fixed assets are recognised

immediately the decision to reorganise is taken; provisions for

other costs are taken when the obligation arises – normally on

announcement; consequential costs within restructuring which

arise in the ongoing business e.g. training, relocation and

information technology, are recognised as they arise and are not

normally treated as exceptional.

On 22 February 2000, the Group announced a series of linked

initiatives to align the organisation behind plans for accelerating

growth and expanding margins. These initiatives are estimated to

cost Fl. 11.0 billion over five years, most of which is expected to be

exceptional restructuring costs. Provisions for these costs and asset

write downs will be made as necessary consultations are

completed and plans finalised.

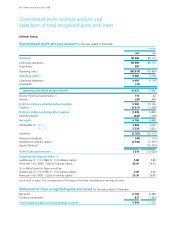

5 Interest

Fl. million

1999 1998

Interest payable and similar

charges:

Bank loans and overdrafts (350) (424)

Bonds and other loans (638) (424)

Interest receivable and similar

income 929 1 187

Exchange differences 29 5

(30) 344

6 Taxation on profit on ordinary activities

Parent and group companies

(a)

(3 005) (3 333)

Joint ventures (12) (5)

(3 017) (3 338)

Of which:

Adjustments to previous years 291 146

(a) United Kingdom Corporation

Tax at 30.0% (1998: 31.0%) (981) (803)

less: double tax relief 531 172

plus: non-United Kingdom taxes (2 555) (2 702)

(3 005) (3 333)

Deferred taxation has been

included on a full provision basis for:

Accelerated depreciation 187 177

Other 184 (125)

371 52

On a SSAP 15 basis the

credit/(charge) for deferred

taxation would be: 307 (87)

Profit on ordinary activities after

taxation on a SSAP 15 basis would be: 6485 6 667

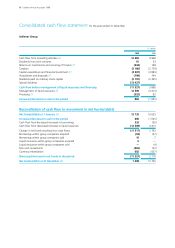

6 Taxation on profit on ordinary activities (continued)

Europe is Unilever’s domestic tax base. The reconciliation between

the computed rate of income tax expense which is generally

applicable to Unilever’s European companies and the actual rate of

taxation charged, expressed in percentages of the profit on

ordinary activities before taxation, is as follows:

%

1999 1998

Computed rate of tax (see below) 32 32

Differences due to:

Other rates applicable to

non-European countries 21

Incentive tax credits (2) (1)

Withholding tax on dividends 21

Adjustments to previous years (3) (1)

Other 11

Actual rate of tax 32 33

In the above reconciliation, the computed rate of tax is the

average of the standard rates of tax applicable in the European

countries in which Unilever operates, weighted by the amount of

profit on ordinary activities before taxation generated in each of

those countries.

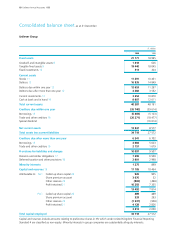

7 Dividends on ordinary capital

Dividends on ordinary capital

– Interim (857) (831)

– Normal final (1 886) (1 896)

– Special final

(a)

—(16 374)

(a) Assuming all shareholders had elected to take the cash

dividend, further details are set out in note 19 on page 19 and

note 20 on page 20.

8 Goodwill and intangible assets

(a)

Cost

1 January 641

Acquisitions/disposals 731

Currency retranslation 115

31 December

(b)

1 487

Amortisation

1 January 15

Charged to profit and loss account 50

Currency retranslation 4

31 December 69

Net book value 31 December

(b)

1 418

(a) Arising on businesses purchased after 1 January 1998.

(b) Of which identifiable intangibles have a net book value

of Fl. 205 million and a cost of Fl. 220 million.

14 Unilever Annual Accounts 1999