Ubisoft 2012 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2012 Ubisoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192

|

|

Management Report

2012

10

1.2.7 CHANGE IN THE WORKING CAPITAL REQUIREMENT (WCR) AND

DEBT LEVELS

The working capital requirements decreased by €35.2 million compared with a decrease of €25.9

million the previous year. The principal variations related to:

- Decrease in trade receivables €(65) million and inventory €(25) million,

- Increase in trade payables (€17 million) and other assets (€35 million).

The sharp fall in receivables is related to reduced activity at year-end and reduced recovery times. The

reduction in the inventory item reflects increased efforts in the management of inventories and

destocking activities.

The cash position at March 31, 2012 stood at €84.6 million against €99.2 million at March 31, 2011.

This variation is primarily due to:

Generation of cash flow from operating activities of €8.2 million,

Investment in property, plant and equipment and intangible assets of €(25.5) million,

Net buyback of Ubisoft shares of €(1.3) million,

Disposal of Gameloft shares of €13.7 million,

Acquisitions for a total of €(17.5) million,

Translation adjustments of €7.8 million.

1.2.8 ASSET FINANCING POLICY

The Company does not use securitization agreements, Dailly Act assignment of receivables,

repurchase agreements (with the exception of one-off operations), market opportunity functions,

factoring expenses of rights to Credit Multimedia shares in Canada (September 2011 and March 2012)

or research tax credit in France (September 2011).

However, the Company does use invoice discounting and receivables factoring, mostly in Germany

and the United Kingdom.

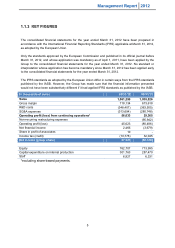

The factoring position is as follows:

in millions of euros

03/31/12

03/31/11

03/31/10

United Kingdom

10.2

15.8

19.8

Germany

6.8

12.6

20.4

Total

17.0

28.4

40.2

The Company finances its peak cash requirements using confirmed credit facilities of €275 million,

including a syndicated loan of €180 million as well as €95 million in bilateral credit lines.