Ubisoft 2012 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2012 Ubisoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Report

2012

9

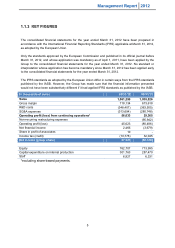

1.2.6 CHANGES IN THE INCOME STATEMENT

The gross profit margin has increased to €718.1 million, up significantly as a percentage of sales at

67.7% compared with 64.8% in 2010/2011. In line with the continued improvement observed in

2010/2011, this increase is mainly due to the considerable improvement in the gross profit margin of

the back catalogue and to the strong increase in online sales at a very high margin.

Current operating income excluding share-based payments amounts to €56.0 million; a significant

improvement compared to €29.4 million posted in 2010/2011. This figure is at the higher end of the

target range announced a year earlier (between €40 million and €60 million) and falls in line with the

recent upward revision of these targets (between €45 million and €65 million).

Current operating income before share-based payments is as follows:

Increase of €44.5 million in the gross profit margin.

Decrease of €15.1 million in research and development costs, which amount to €348.4 million

(32.8% of sales) compared with €363.5 million in 2010/2011 (35.0%), due to the fact that fewer

games were released on high-definition consoles during the period, partially offset by higher

royalties and a rise in certain online non-capitalized costs.

Increase of €33.0 million in SG&A expenses to €313.7 million (29.6%), compared with €280.7

million (27.0%) in 2010/2011:

− Variable marketing expenses are up at 16.7% of sales (€177.1 million) compared with

15.4% (€160.4 million) in the financial year 2010/2011. This increase is primarily related to

growth in online and dance activities.

− Structuring costs are up at 12.9% of sales (€136.6 million) compared with 11.5% (€120.3

million) in 2010/2011. This increase is primarily explained by higher expenses related to

online activities.

The operating profit, including €10.4 million in share-based payments, comes to €45.6 million

compared with an operating loss of €(80.4) million in 2010/2011, which included €95.9 million in non-

recurring expenses and €12.6 million in share-based payments.

Financial income amounts to €2.5 million compared with financial expenses of €3.7 million in the

financial year 2010/2011, breaks down as follows:

o €(2.5) million in financial expenses compared with €(5.0) million in 2010/2011, which

included €(3.6) million in factoring expenses of loss carry back refund claims.

o €(3.4) million in foreign exchange losses, compared with a loss of €(4.3) million over

the financial year 2010/2011.

o €8.5 million positive impact (compared with €5.7 million in 2010/2011) mainly from the

sale of 3.2 million Gameloft shares. At March 31, 2012, 3.1 million Gameloft shares are

recognized in the balance sheet.

Net profit of €37.3 million was posted, corresponding to earnings per share (diluted) of €0.39,

compared with a net loss of €(52.1) million and €(0.54) over the financial year 2010/2011.