Ubisoft 2001 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2001 Ubisoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

UBI SOFT'S

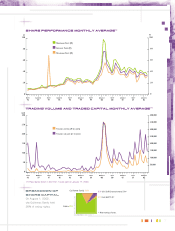

SHARE PERFORMANCE

Shareholder information

www.ubisoft.finance.com

Ubi Soft has been listed on the Euronext Paris

stock exchange since 1996.

Ubi Soft is included in the SBF120 index and has been a component of the

Euronext Next Economy index since January 2002.

Today, four securities are listed on the Premier Marché of Euronext Paris:

33..8800%%

CCOONNVVEERRTTIIBBLLEE

BBOONNDD

(Euroclear: 18 062)

Issue price: 164.64

(FF 1,080) per bond

(at July 16, 1998).

(As a consequence

of the 5-for-1 stock split,

one bond allows five shares

to be subscribed with

a face value of 0.31.)

Maturity period: 7 years

Annual yield: 3.80% per

year or 6.26 per bond,

payable as of July 16

of each year.

O

OCCEEAANNEE

(Euroclear: 18 812)

Issue price: 47.50 (at

November 30, 2001)

Maturity period: 5 years

The annual rate of interest

was set at 2.5%, payable

when installments are due

on November 30 each year,

plus a 2% premium per

year, payable at maturity.

E

EQQUUIITTYY

WWAARRRRAANNTTSS

(Euroclear: 22,552)

Issue price: 136

(FF 892.10)

Exercise Price: 170

(FF 1115.13)

Exercise period:

November 3, 1999

to November 2, 2002

inclusive.

SSEECCUURRIITTYY

(Euroclear: 5447,

Reuters: UBIP.PA,

Bloomberg: UBI FP)

Shares listed as of March 31,

2002: 17,368,732