US Bank 2012 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2012 US Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14 U.S. BANCORP

A Rich Heritage | A Strong Future

Powering Payments and Commerce

Around the World

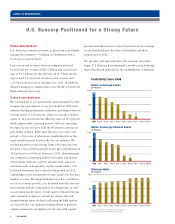

U.S. Bancorp has positioned itself in the payments space

to take full advantage of a recovering economy. From

global merchant acquiring, to card processing, to mobile

payments, to the burgeoning prepaid marketplace, we

have continued to invest in new opportunities and new

partnerships at home and around the world. As tens of

millions now use their smartphones and tablets to keep

their social, shopping, browsing and work worlds close at

hand, we have taken an aggressive approach to developing

services that meet their banking and payment needs. The

latest in a history of successful market moves, including

expansion into Mexico in 2010 and Brazil in 2011, is our

February acquisition of Collective Point of Sale Solutions

Ltd. (Collective POS) in Toronto, Canada. The deal

expands Elavon’s presence and distribution network in

Canada and aligns with Elavon’s global growth strategy.

Mobile payments for small merchants now a big business

As consumer adoption of mobile technology drives a

demand for business innovation, U.S. Bank and Elavon

continue to explore and pilot innovative mobile payment

options that will bring value to cardholders and businesses

accepting payments. The flood of mobile payment innova-

tions has created new, organic growth opportunities with

“micro-merchants.” These small, independent businesses

have, historically, not been able to consider credit card

acceptance through traditional payment programs, but

mobile solutions are changing their options. Elavon is at

the forefront of developing industry leading options that

enable commerce for small and independent business

owners. Last year, Elavon was first to market in Europe

with an EMV- (Europay, MasterCard, Visa) enabled chip

and PIN security mobile payments option. Similarly,

Elavon launched VirtualMerchant Mobile in the United

States in 2011, providing our distribution partners a

competitive solution offering. Our internal talent and

innovation, and working with leading technology firms,

app developers and major card companies, position us

to develop viable mobile payment solutions that benefit

everyone across the payments life cycle.

U.S. Bank prepaid cards: a customer convenience, a growing business

U.S. Bank continues to enhance its prepaid card business with a number of

card options for a wide range of customer segments, all with competitive pricing

and superior features. Convenient Cash, was rated #1 in lowest cost prepaid

card for customers by nerdwallet.com allowing free cash loans at U.S. Bank

branches and free cash withdrawals at U.S. Bank ATMs. U.S. Bank’s AccelaPay®

Visa Card is designed to replace costly paper paychecks. Employers deposit

funds to the card each pay period, similar to direct deposit, and employees

can access their funds in multiple ways. Both employer and employee gain

convenience, safety and security. U.S. Bank recently launched a true, all-in-one,

campus ID and prepaid Debit MasterCard.

®

Colleges and universities reduce

operating costs for financial aid disbursement, and students enjoy the conve-

nience, worldwide transaction capability and mobile banking functionality

integrated into their student ID card. This innovative product allows us to

expand beyond our traditional U.S. Bank footprint. Paybefore chose U.S. Bank’s

Contour Campus Card as a 2013 Paybefore Awards winner in the “Most Effective

Solution” category.

Scan the cards and

see why U.S. Bank is

going back to school.