US Bank 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 US Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1863-2013

A Rich Heritage | A Strong Future

U.S. BANCORP 2012 Annual Report

Table of contents

-

Page 1

U.S. BANCORP 2012 Annual Report A Rich Heritage | A Strong Future 1863 - 2013 -

Page 2

... Bank System, the name of U.S. Bancorp until 1997. Its merger with Firstar in 2001 created the "new" U.S. Bancorp. In 1933, banks were reeling. To avoid a panic, the Cincinnati Clearing House authorized banks to limit withdrawals to five percent of a customer's account. Only The First National Bank... -

Page 3

...System Inc., with Portland, OR-based U.S. Bancorp in 1997. First National Bank of Minneapolis received its charter in 1865 - before that it had been a private banking house called Sidel, Wolford & Co. These two First Nationals formed a holding company in early 1929, which then became known as First... -

Page 4

... two National Bank Acts that established a system of national banks, established the Office of the Comptroller of the Currency and authorized the Comptroller to examine and regulate nationally chartered banks. On July 13, 1863, The First National Bank of Cincinnati was formed under national Charter... -

Page 5

... regional consumer and business banking and wealth management services; national wholesale banking, commercial real estate and trust services; and global payments services to more than 17.6 million customers. Enhanced Content At year-end 2012, the company operated 3,084 banking ofï¬ces and 5,065... -

Page 6

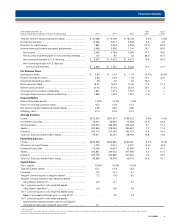

...Return on Average Common Equity (In Percents) Dividend Payout Ratio (In Percents) 1.65 1.53 13.9 1.21 1.0 1.16 10 8.2 12.7 15.8 16.2 50 .82 104.9 2.0 20 100 .20 .50 20.2 0 08 09 10 11 12 0 08 09 10 11 12 0 08 09 10 11 12 Net...' Equity (Dollars in Millions) Total Risk-based... -

Page 7

... value per share...Market value per share ...Average common shares outstanding...Average diluted common shares outstanding... Financial Ratios Return on average assets...Return on average common equity ...Net interest margin (taxable-equivalent basis) ...Efï¬ciency ratio (a) ... Average Balances... -

Page 8

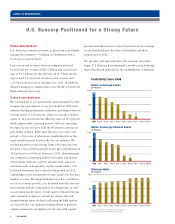

...deepen relationships with our current customer base, gain new customers and, consequently, capture market share. Our fee-based businesses also realized solid growth in 2012, capitalizing on the investments we have made over the past number of years. Mortgage banking was a key contributor environment... -

Page 9

... to continue to adjust our programs to exceed our customer expectations. Richard K. Davis Chairman, President and Chief Executive Officer Earning and keeping trust in U.S. Bancorp Following the disruption in the ï¬nancial markets and the continuing economic downturn, the American people lost the... -

Page 10

... (In Billions) 4 3.24 • Mortgage banking • In-store and on-site branches +44% • Wholesale banking expansion • Ascent Private Capital Management • International payments expansion • Internet and mobile banking channels • Tier 4 data center • Call center telephony 2003-2007 2008... -

Page 11

..., Commercial Real Estate Richard J. Hidy, Executive Vice President and Chief Risk Officer Andrew Cecere, Vice Chairman and Chief Financial Officer Kent V. Stone, Vice Chairman, Consumer Banking Sales and Support U.S. Bancorp Board of Directors (left to right) Doreen Woo Ho; President, San Francisco... -

Page 12

... Bank customers can waive monthly maintenance fees. They also recognized U.S. Bank for offering advanced features such as the ability for customers to deposit a check from their mobile phone or tablet. The magazine noted that student checking accounts have no monthly maintenance fees, robust mobile... -

Page 13

... customers' phones don't run apps. With our mobile apps, mobile website and text banking, customers can easily pay bills, review transactions, locate branches and ATMs and check balances. They can even send and receive money with our Person to Person service, receive text alerts about their accounts... -

Page 14

... life or seeking to grow and pass on their wealth or to make a mark on the world. *Top 40 Wealth Managers ranked by client assets in accounts of $5 million or more as of June 30, 2012. Leaving a legacy of health and hope After losing her husband Mike to cancer, Kathie Heimerdinger and her children... -

Page 15

... team, experienced employees and commitment to service, product and technology improvements position us well for the future. Over the past year, U.S. Bank Global Corporate Trust Services implemented a new automated account opening process and plans are underway for a soon-to-be-released customer... -

Page 16

...-credit ï¬nancial solutions for real estate developers, real estate investment trusts (REITs), and commercial property owners across the United States, while other groups have expertise in asset-based lending, leasing, dealer commercial services, healthcare and food industries, government banking... -

Page 17

... of our corporate and commercial customers who are key to driving an economic recovery. U.S. Bank is proud to be part of that process as we provide companies throughout the nation with a comprehensive range of deposit, loan, payments, treasury management and other ï¬nancial services, all backed... -

Page 18

.... Convenient Cash, was rated #1 in lowest cost prepaid card for customers by nerdwallet.com allowing free cash loans at U.S. Bank branches and free cash withdrawals at U.S. Bank ATMs. U.S. Bank's AccelaPay® Visa Card is designed to replace costly paper paychecks. Employers deposit funds to the card... -

Page 19

... Citi, to create a new merchant services company to offer payment services to the Brazilian marketplace for both small and national level merchants. The timing was right for Elavon's arrival as the ï¬rst global merchant acquiring player - Brazil has experienced 20+ percent annual credit card market... -

Page 20

... interest rate reduction and/or term extension. Another option is a partial-claim plan for FHA-insured loans that advance repayable funds to bring the mortgage current. Every customer is important to us On this page, we share excerpts from home mortgage customers who have sought help from U.S. Bank... -

Page 21

...Resource Team that travelled to Kuwait to teach job-search skills to National Guard troops. We support the individual service member and his or her family with a full range of beneï¬ts and development programs. Our policies and procedures regarding leave, beneï¬ts and pay differential for National... -

Page 22

... million. Further, our lending and investment programs help address the affordable housing and economic development issues facing many communities. 2012 U.S. Bank Foundation Giving 2% 18% 23 % 28 % Our employees care not only for each other through our Employee Assistance Fund for colleagues facing... -

Page 23

...-banks; changes in customer behavior and preferences; effects of mergers and acquisitions and related integration; effects of critical accounting policies and judgments; and management's ability to effectively manage credit risk, residual value risk, market risk, operational risk, interest rate risk... -

Page 24

.... The Company experienced solid growth in loans and deposits during 2012, as it continued to expand and deepen relationships with current customers, as well as acquire new customers and market share. The Company's fee-based revenues also grew over the prior year, led by mortgage banking, which... -

Page 25

... ...Net charge-offs as a percent of average loans outstanding ... Average Balances Loans ...Loans held for sale ...Investment securities (c) ...Earning assets ...Assets ...Noninterest-bearing deposits ...Deposits ...Short-term borrowings ...Long-term debt ...Total U.S. Bancorp shareholders' equity... -

Page 26

... in lower cost core deposit funding and the positive impact from long-term debt repricing. Noninterest income increased primarily due to higher mortgage banking revenue, trust and investment management fees, merchant processing services revenue, and commercial products revenue, partially offset by... -

Page 27

... or discounts recorded related to the transfer of investment securities at fair value from available-for-sale to held-to-maturity. Average investment securities in 2012 were $8.9 billion (13.9 percent) higher than 2011, primarily due to purchases of government agency mortgage-backed securities, net... -

Page 28

...Volume (a) 2012 v 2011 2011 v 2010 Total Volume Yield/Rate Total Volume Yield/Rate Year Ended December 31 (Dollars in Millions) Increase (decrease) in Interest Income Investment securities ...Loans held for sale ...Loans Commercial ...Commercial real estate ...Residential mortgages ...Credit card... -

Page 29

... debit card revenue ...Corporate payment products revenue ...Merchant processing services ...ATM processing services ...Trust and investment management fees ...Deposit service charges ...Treasury management fees ...Commercial products revenue ...Mortgage banking revenue ...Investment products fees... -

Page 30

...decrease in deposit service charges of 7.2 percent as a result of 2010 legislative and pricing changes. Trust and investment management fees declined 7.4 percent as a result of the sale of the Company's proprietary long-term mutual fund business and lower money market investment management fees, due... -

Page 31

... and litigation related costs. Pension Plans Because of the long-term nature of pension The following table shows an analysis of hypothetical changes in the long-term rate of return ("LTROR") and discount rate: LTROR (Dollars in Millions) Incremental benefit (expense) ...Percent of 2012 net income... -

Page 32

... development ...Total commercial real estate ... Residential Mortgages Residential mortgages ...Home equity loans, first liens ...Total residential mortgages ... Credit Card ...Other Retail Retail leasing ...Home equity and second mortgages...Revolving credit ...Installment ...Automobile ...Student... -

Page 33

... asset/liability management activities, assessment of product profitability, credit risk, liquidity needs, and capital implications. If the Company's intent or ability to hold an existing portfolio loan changes, it is transferred to loans held for sale. Credit Card Total credit card loans decreased... -

Page 34

... ...Arizona, Nevada, New Mexico, Utah ...Total banking region ...Florida, Michigan, New York, Pennsylvania, Texas ...All other states ...Total outside Company's banking region ...Total ... Other Retail Total other retail loans, which include retail leasing, home equity and second mortgages and other... -

Page 35

..., Nebraska, North Dakota, South Dakota ...Arkansas, Indiana, Kentucky, Tennessee ...Idaho, Montana, Wyoming ...Arizona, Nevada, New Mexico, Utah ...Total banking region ...Florida, Michigan, New York, Pennsylvania, Texas ...All other states ...Total outside Company's banking region ...Total ...TABLE... -

Page 36

... market, were TABLE 12 Selected Loan Maturity Distribution One Year or Less Over One Through Five Years Over Five Years Total At December 31, 2012 (Dollars in Millions) Commercial ...Commercial real estate ...Residential mortgages ...Credit card ...Other retail ...Covered loans ...Total loans... -

Page 37

...amortized cost balances, excluding any premiums or discounts recorded related to the transfer of investment securities at fair value from available-for-sale to held-to-maturity. Average yield and maturity calculations exclude equity securities that have no stated yield or maturity. 2012 At December... -

Page 38

...for public deposits and wholesale funding sources. While the Company intends to hold its investment securities indefinitely, it may sell available-for-sale securities in response to structural changes in the balance sheet and related interest rate risk and to meet liquidity requirements, among other... -

Page 39

...deposit balances was related to increases in money market savings, interest checking and savings account balances. The $5.1 billion (11.2 percent) increase in money market savings account balances was primarily due to higher Wholesale Banking and Commercial Real Estate, and corporate trust balances... -

Page 40

... related to fraud, processing errors, technology, breaches of internal controls and in data security, and business continuation and disaster recovery. Operational risk also includes legal and compliance risks, risk management includes well-defined, centralized credit policies, uniform underwriting... -

Page 41

... as revolving consumer lines, auto loans and leases, student loans, and home equity loans and lines. Home equity or second mortgage loans are junior lien closed-end accounts fully disbursed at origination. These loans typically are fixed rate loans, secured by residential real estate, with a 10 or... -

Page 42

... lending, commercial real estate, health care and correspondent banking. The Company also offers an array of consumer lending products, including residential mortgages, credit card loans, automobile loans, retail leases, home equity, revolving credit, lending to students and other consumer loans... -

Page 43

...model and/or home price indices values, or lack of necessary valuation data on acquired loans. The following tables provide summary information for the LTVs of residential mortgages and home equity and second mortgages by borrower type at December 31, 2012: Residential mortgages (Dollars in Millions... -

Page 44

.... Credit card and other retail loans principally reflect the Company's focus on consumers within its geographical footprint of branches and certain niche lending activities that are nationally focused. Approximately 68.6 percent of the Company's credit card balances relate to cards originated... -

Page 45

... ratios are an indicator, among other considerations, of credit risk within the Company's loan portfolios. The entire balance of an account is considered delinquent if the minimum payment contractually required to be made is not received by the specified date on the billing statement. The Company... -

Page 46

... table provides summary delinquency information for residential mortgages, credit card and other retail loans included in the consumer lending segment: Amount At December 31 (Dollars in Millions) 2012 2011 As a Percent of Ending Loan Balances 2012 2011 Residential Mortgages (a) 30-89 days ...90... -

Page 47

... dates or deferrals of payments, capitalization of accrued interest and/or outstanding advances, or in limited situations, partial forgiveness of loan principal. In most instances, participation in residential mortgage loan restructuring programs requires the customer to complete a short-term... -

Page 48

... by the Company or acquired under FDIC loss sharing agreements that substantially reduce the risk of credit losses to the Company. Interest payments collected from assets on nonaccrual status are generally applied against the principal balance and not recorded as income. At December 31, 2012, total... -

Page 49

..., home equity and second mortgage) and commercial (commercial and commercial real estate) loan balances: At December 31, (Dollars in Millions) Amount 2012 2011 As a Percent of Ending Loan Balances 2012 2011 Residential Minnesota ...$ 20 Illinois ...19 California ...16 Washington ...14 Florida... -

Page 50

... real estate owned. (e) Charge-offs exclude actions for certain card products and loan sales that were not classified as nonperforming at the time the charge-off occurred. (f) Residential mortgage information excludes changes related to residential mortgages serviced by others. 46 U.S. BANCORP -

Page 51

...Construction and development ...Total commercial real estate ... Residential Mortgages ...Credit Card (a) ...Other Retail Retail leasing ...Home equity and second mortgages ...Other ...Total other retail ...Total loans, excluding covered loans ... Covered Loans ...Total loans ... (a) Net charge-off... -

Page 52

..., as net charge-offs continue to decline due to stabilizing economic conditions. Management determined the allowance for credit losses was appropriate at December 31, 2012. The allowance recorded for loans in the commercial lending segment is based on reviews of individual credit relationships and... -

Page 53

... commercial ...Commercial real estate Commercial mortgages ...Construction and development ...Total commercial real estate ...Residential mortgages ...Credit card ...Other retail Retail leasing ...Home equity and second mortgages ...Other ...Total other retail...Covered loans (a) ...Total net charge... -

Page 54

... and development ...Total commercial real estate ... Residential Mortgages ...Credit Card ...Other Retail Retail leasing ...Home equity and second mortgages ...Other ...Total other retail ... Covered Loans ...Total allowance ... the Company considers the delinquency and modification status of... -

Page 55

... limited to, the risk of fraud by employees or persons outside the Company, unauthorized access to its computer systems, the execution of unauthorized transactions by employees, errors relating to transaction processing and technology, breaches of internal controls and in data security, compliance... -

Page 56

... Company's Annual Report on Form 10-K for further discussion of the regulatory framework applicable to bank holding companies and their subsidiaries, and the substantial changes to that regulation. Business lines have direct and primary responsibility and accountability for identifying, controlling... -

Page 57

... limits the estimated change in net interest income in a gradual 200 bps rate change scenario to a 4.0 percent decline of forecasted net interest income over the next 12 months. At December 31, 2012 and 2011, the Company was within policy. Market Value of Equity Modeling The Company also manages... -

Page 58

...Risk Management In addition to interest rate risk, the Company is exposed to other forms of market risk, principally related to trading activities which support customers' strategies to manage their own foreign currency, interest rate risk and funding activities. The Company's Market Risk Committee... -

Page 59

... deposit funding within its market areas and in domestic and global capital markets. The Risk Management Committee of the Company's Board of Directors oversees the Company's liquidity risk management process and approves the Company's liquidity policy and contingency funding plan. The ALCO reviews... -

Page 60

... to the wholesale funding markets or dividends from subsidiaries, for 12 months when forecasted payments of common stock dividends are included and 24 months assuming dividends were reduced to zero. The parent company currently has available funds considerably greater than the amounts required to... -

Page 61

... the Company does not offer commercial lending services in Europe, it does provide financing to domestic multinational corporations that generate revenue from customers in European countries and provides a limited number of corporate credit cards to their European subsidiaries. While an economic... -

Page 62

... lending activities in which indemnifications are provided to customers; indemnification or buy-back provisions related to sales of loans and tax credit investments; merchant charge-back guarantees through the Company's involvement in providing merchant processing services; and minimum revenue... -

Page 63

..., including the United States Department of Housing and Urban Development, Government National Mortgage Association, Federal Home Loan Mortgage Corporation and the Federal National Mortgage Association. At December 31, 2012, U.S. Bank National Association met these requirements. Table 22 provides... -

Page 64

...basis) (a) ...Efficiency ratio ...(a) Interest and rates are presented on a fully taxable-equivalent basis utilizing a tax rate of 35 percent. merchant settlement gain, the $130 million expense accrual related to mortgage servicing matters and a provision for credit losses less than net charge-offs... -

Page 65

... bond underwriting fees and commercial leasing revenue, partially offset by lower syndication fees. Mortgage banking revenue increased $173 million (57.1 percent) over the fourth quarter of 2011 principally due to higher origination and sales revenue, as well as an increase in loan servicing revenue... -

Page 66

...effect on net interest income of asset/liability management activities is included in Treasury and Corporate Support. Noninterest income and expenses directly managed by each business line, including fees, service charges, salaries and benefits, and other direct revenues and costs are accounted for... -

Page 67

...management, capital markets, international trade services and other financial services to middle market, large corporate, commercial real estate, financial institution and public sector clients. Wholesale Banking and Commercial Real Estate contributed $1.3 billion of the Company's net income in 2012... -

Page 68

... Services Payment Services includes consumer and business credit cards, stored-value cards, debit cards, corporate and purchasing card services, consumer lines of credit and merchant processing. Payment Services contributed $1.3 billion of the Company's net income in 2012, or a 64 U.S. BANCORP -

Page 69

... covered commercial and commercial real estate loans and related other real estate owned, funding, capital management, interest rate risk management, the net effect of transfer pricing related to average balances and the residual aggregate of those expenses associated with corporate activities that... -

Page 70

... and mortgage servicing rights, and other adjustments. Accounting Changes To the extent the adoption of new accounting standards materially affects the Company's financial condition or results of operations, the impacts are discussed in the applicable section(s) of the Management's Discussion... -

Page 71

... market and highly leveraged enterprise-value credits, in determining the overall level of the allowance for credit losses. The Company's determination of the allowance for commercial lending segment loans is sensitive to the assigned credit risk ratings and inherent loss rates at December 31, 2012... -

Page 72

..., other than in a forced or liquidation sale. Fair value is based on quoted market prices in an active market, or if market prices are not available, is estimated using models employing techniques such as matrix pricing or discounting expected cash flows. The significant assumptions used in the... -

Page 73

... economic and regulatory capital requirements, and includes deductions and limitations related to certain types of assets including MSRs, purchased credit card relationship intangibles, and capital markets activity in the Company's Wholesale Banking and Commercial Real Estate segment. The Company... -

Page 74

... Exchange Act of 1934 (the "Exchange Act")). Based upon this evaluation, the principal executive officer and principal financial officer have concluded that, as of the end of the period covered by this report, the Company's disclosure controls and procedures were effective. During the most recently... -

Page 75

... to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. The Board of Directors of the Company has an Audit Committee composed of directors who are independent of U.S. Bancorp. The Audit... -

Page 76

... in the period ended December 31, 2012, in conformity with U.S. generally accepted accounting principles. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), U.S. Bancorp's internal control over financial reporting as of December... -

Page 77

... Public Company Accounting Oversight Board (United States), the consolidated balance sheets of U.S. Bancorp as of December 31, 2012 and 2011, and the related consolidated statements of income, comprehensive income, shareholders' equity, and cash flows for each of the three years in the period ended... -

Page 78

... on Cash and Due From Banks ...Note 4 - Investment Securities ...Note 5 - Loans and Allowance for Credit Losses ...Note 6 - Leases ...Note 7 - Accounting for Transfers and Servicing of Financial Assets and Variable Interest Entities ...Note 8 - Premises and Equipment ...Note 9 - Mortgage Servicing... -

Page 79

...respectively) (a) ...Available-for-sale ($1,906 and $6,831 pledged as collateral, respectively) (a) ...Loans held for sale (included $7,957 and $6,925 of mortgage loans carried at fair value, respectively) ...Loans Commercial ...Commercial real estate ...Residential mortgages ...Credit card ...Other... -

Page 80

... debit card revenue ...Corporate payment products revenue ...Merchant processing services ...ATM processing services ...Trust and investment management fees ...Deposit service charges ...Treasury management fees ...Commercial products revenue ...Mortgage banking revenue ...Investment products fees... -

Page 81

...on securities transferred from available-for-sale to held-to-maturity . . Changes in unrealized gains (losses) on derivative hedges ...Foreign currency translation ...Reclassification to earnings of realized gains and losses ...Unrealized gains (losses) on retirement plans ...Income taxes related to... -

Page 82

... Equity Interests (Dollars and Shares in Millions) Capital Surplus Retained Earnings Total Equity Balance December 31, 2009 ...Change in accounting principle ...Net income (loss) ...Other comprehensive income (loss) ...Preferred stock dividends ...Common stock dividends ...Issuance of preferred... -

Page 83

... sales of loans ...Purchases of loans ...Acquisitions, net of cash acquired ...Other, net ...Net cash used in investing activities ... Financing Activities Net increase in deposits ...Net increase (decrease) in short-term borrowings ...Proceeds from issuance of long-term debt ...Principal payments... -

Page 84

...stored-value cards, debit cards, corporate and purchasing card services, consumer lines of credit and merchant processing. Treasury and Corporate Support Treasury and Corporate Support includes the Company's investment portfolios, most covered commercial and commercial real estate loans and related... -

Page 85

.... Held-to-maturity Securities Debt securities for which the The Company's accounting methods for loans differ depending on whether the loans are originated or purchased, and for purchased loans, whether the loans were acquired at a discount related to evidence of credit deterioration since date of... -

Page 86

principal balance at the date of acquisition are recorded in interest income over the life of the loans. Covered Assets Loans covered under loss sharing or similar credit protection agreements with the Federal Deposit Insurance Corporation ("FDIC") are reported in loans along with the related ... -

Page 87

...are generally not placed on nonaccrual status because of the relative short period of time to charge-off. Certain retail customers having financial difficulties may have the terms of their credit card and other loan agreements modified to require only principal payments and, as such, are reported as... -

Page 88

... dates or deferrals of payments, capitalization of accrued interest and/or outstanding advances, or in limited situations, partial forgiveness of loan principal. In most instances, participation in residential mortgage loan restructuring programs requires the customer to complete a short-term... -

Page 89

.... Loans Held for Sale Loans held for sale ("LHFS") represent mortgage loan originations intended to be sold in the secondary market and other loans that management has an active plan to sell. LHFS are carried at the lower-of-cost-or-fair value as determined on an aggregate basis by type of loan... -

Page 90

...and Corporate Payment Products Revenue Credit and debit card revenue includes interchange primarily includes revenue related to ancillary services provided to Wholesale Banking and Commercial Real Estate customers including standby letter of credit fees, non-yield related loan fees, capital markets... -

Page 91

... high quality corporate bonds available in the marketplace with maturities equal to projected cash flows of future benefit payments as of the measurement date. Periodic pension expense (or income) includes service costs, interest costs based on the assumed discount rate, the expected return on plan... -

Page 92

... Community Bank of New Mexico ("FCB") from the FDIC. The FCB transaction did not include a loss sharing agreement. The Company acquired 38 branch locations and approximately $1.8 billion in assets, assumed approximately $2.1 billion in liabilities, and received approximately $412 million in cash... -

Page 93

... transfer from the available-for-sale to held-to-maturity category, adjusted for amortization of premiums and accretion of discounts and credit-related other-than-temporary impairment. (b) Available-for-sale investment securities are carried at fair value with unrealized net gains or losses reported... -

Page 94

... ("SIVs") from certain money market funds managed by an affiliate of the Company. Subsequent to the initial purchase, the Company exchanged its interest in the SIVs for a pro-rata portion of the underlying investment securities according to the applicable restructuring agreements. The SIVs and the... -

Page 95

..., the Company determines at acquisition date the categorization based on asset pool characteristics (such as weighted-average credit score, loan-to-value, loan type, prevalence of low documentation loans) and deal performance (such as pool delinquencies and security market spreads). (b) Includes... -

Page 96

..., the Company determines at acquisition date the categorization based on asset pool characteristics (such as weighted-average credit score, loan-to-value, loan type, prevalence of low documentation loans) and deal performance (such as pool delinquencies and security market spreads). (c) Includes... -

Page 97

... development ...Total commercial real estate ... Residential Mortgages Residential mortgages ...Home equity loans, first liens ...Total residential mortgages ... Credit Card ...Other Retail Retail leasing ...Home equity and second mortgages ...Revolving credit ...Installment ...Automobile ...Student... -

Page 98

... relates to changes in variable rates, and in 2012 to a change in the Company's expectations regarding potential sale of modified covered loans at the end of the indemnification agreements which results in a reduction in the expected contractual interest payments included in the accretable balance... -

Page 99

...: Commercial Real Estate Residential Mortgages Credit Card Other Retail Total Loans, Excluding Covered Loans Covered Loans Total Loans (Dollars in Millions) Commercial Allowance Balance at December 31, 2012 Related to Loans individually evaluated for impairment (a) ...TDRs collectively evaluated... -

Page 100

... Company's internal credit quality rating: Special Mention Total Criticized (Dollars in Millions) Pass Classified (a) Total December 31, 2012 Commercial ...Commercial real estate ...Residential mortgages (b) ...Credit card ...Other retail ...Total loans, excluding covered loans ...Covered loans... -

Page 101

... (a) Unpaid Principal Balance Commitments to Lend Additional Funds (Dollars in Millions) Valuation Allowance December 31, 2012 Commercial ...Commercial real estate ...Residential mortgages ...Credit card ...Other retail ...Total impaired loans, excluding GNMA and covered loans ...Loans purchased... -

Page 102

... Income Recognized (Dollars in Millions) 2012 Commercial ...Commercial real estate ...Residential mortgages ...Credit card ...Other retail ...Total impaired loans, excluding GNMA and covered loans ...Loans purchased from GNMA mortgage pools ...Covered loans ...Total ...$ 470 1,314 2,717 510... -

Page 103

... class: Number of Loans Pre-Modification Outstanding Loan Balance Post-Modification Outstanding Loan Balance (Dollars in Millions) 2012 Commercial ...Commercial real estate ...Residential mortgages ...Credit card ...Other retail ...Total loans, excluding GNMA and covered loans ...Loans purchased... -

Page 104

... charged-off or became 90 days or more past due) for the years ended December 31, that were modified as TDRs within 12 months previous to default. (Dollars in Millions) Number of Loans Amount Defaulted 2012 Commercial ...Commercial real estate ...Residential mortgages ...Credit card ...Other... -

Page 105

.... Upon transfer, any servicing assets and other interests that continue to be held by the Company are initially recognized at fair value. For further information on MSRs, refer to Note 9. On a limited basis, the Company may acquire and package highgrade corporate bonds for select corporate customers... -

Page 106

... it previously transferred high-grade investment securities. The Company consolidates the conduit because of its ability to manage the activities of the conduit. At December 31, 2012, $144 million of the held-to-maturity investment securities on the Company's Consolidated Balance Sheet related to... -

Page 107

...Company's servicing portfolio consists of the distinct portfolios of government-insured mortgages, conventional mortgages and Mortgage Revenue Bond Programs ("MRBP"). The servicing portfolios are predominantly comprised of fixed-rate agency loans with limited adjustable-rate or jumbo mortgage loans... -

Page 108

... not amortized. Mortgage servicing rights are recorded at fair value, and are not amortized. Aggregate amortization expense consisted of the following: Year Ended December 31 (Dollars in Millions) 2012 2011 2010 Merchant processing contracts ...Core deposit benefits ...Trust relationships ...Other... -

Page 109

... value of goodwill for the years ended December 31, 2012, 2011 and 2010: (Dollars in Millions) Wholesale Banking and Commercial Real Estate Consumer and Small Business Banking Wealth Management and Securities Services Payment Services Treasury and Corporate Support Consolidated Company Balance... -

Page 110

..., Federal Home Loan Bank advances and bank notes were 2.55 percent, .36 percent and .06 percent, respectively. (b) All remaining outstanding balances were redeemed by the Company during 2012. (c) Other includes consolidated community development and tax-advantaged investment VIEs, debt issuance fees... -

Page 111

... a full and unconditional guarantee by the Company, on a junior subordinated basis, of the payment obligations of the trust. During 2010, the Company exchanged depositary shares representing an ownership interest in the Company's Series A Preferred Stock to acquire a portion of the ITS issued by... -

Page 112

... on the Series D Preferred Stock. Both series are redeemable at the Company's option, on or after specific dates, subject to the prior approval of the Federal Reserve Board. During 2012, 2011 and 2010, the Company repurchased shares of its common stock under various authorizations approved by its... -

Page 113

... off-balance sheet exposures, such as unfunded loan commitments, letters of credit, and derivative contracts. The Company is also subject to a leverage ratio requirement, a non risk-based asset ratio, which is defined as Tier 1 capital as a percentage of average assets adjusted for goodwill and... -

Page 114

... of the Office of the Comptroller of the Currency. Earnings Per Share The components of earnings per share were: Year Ended December 31 (Dollars and Shares in Millions, Except Per Share Data) 2012 2011 2010 Net income attributable to U.S. Bancorp ...Preferred dividends ...Equity portion of... -

Page 115

... reducing long-term funding requirements and pension costs. The Company has an established process for evaluating all of the plans, their performance and significant plan assumptions, including the assumed discount rate and the long-term rate of return ("LTROR"). Annually, the Company's Compensation... -

Page 116

... the changes in benefit obligations and plan assets for the years ended December 31, and the funded status and amounts recognized in the Consolidated Balance Sheet at December 31 for the retirement plans: Pension Plans (Dollars in Millions) 2012 2011 Postretirement Welfare Plan 2012 2011 Change in... -

Page 117

... average assumptions used to determine the projected benefit obligations at December 31: Pension Plans (Dollars in Millions) 2012 2011 Postretirement Welfare Plan 2012 2011 Discount rate (a) ...Rate of compensation increase (b) ...Health care cost trend rate for the next year (c) Prior to age... -

Page 118

...to determine net periodic benefit cost for the years ended December 31: Pension Plans (Dollars in Millions) 2012 2011 2010 Postretirement Welfare Plan 2012 2011 2010 Discount rate (a) ...Expected return on plan assets (b) ...Rate of compensation increase (c) ...Health care cost trend rate (d) Prior... -

Page 119

plan invests in a money market mutual fund with cash collateral from its securities lending arrangement, whose fair value is determined based on quoted prices in markets that are less active and therefore is classified as Level 2. Additionally, the qualified pension plan has investments in limited ... -

Page 120

... of acquired companies are generally terminated at the merger closing dates. Participants under such plans receive the Company's common stock, or options to buy the Company's stock, based on the conversion terms of the various merger agreements. At December 31, 2012, there were 58 million shares... -

Page 121

...of the status of the Company's restricted shares of stock and unit awards is presented below: 2012 WeightedAverage Grant-Date Fair Value 2011 WeightedAverage Grant-Date Fair Value 2010 WeightedAverage Grant-Date Fair Value Year Ended December 31 Shares Shares Shares Nonvested Shares Outstanding... -

Page 122

... Company's tax returns for the years ended December 31, 2009 and 2010 are under examination by the Internal Revenue Service. The years open to examination by state and local government authorities vary by jurisdiction. A reconciliation of the changes in the federal, state and foreign unrecognized... -

Page 123

... by changes in foreign currency exchange rates ("net investment hedge"); or a designation is not made as it is a customer-related transaction, an economic hedge for asset/liability risk management purposes or another stand-alone derivative created through the Company's operations ("free-standing... -

Page 124

... the market and liquidity risk associated with these customer derivatives, the Company enters into similar offsetting positions with broker-dealers. The Company also has derivative contracts that are created through its operations, including commitments to originate mortgage loans held for sale and... -

Page 125

... ...Foreign exchange cross-currency swaps ...Cash flow hedges Interest rate contracts Pay fixed/receive floating swaps ...Receive fixed/pay floating swaps ...Net investment hedges Foreign exchange forward contracts ...Other economic hedges Interest rate contracts Futures and forwards Buy ...Sell... -

Page 126

...) - - Note: Ineffectiveness on cash flow and net investment hedges was not material for the years ended December 31, 2012, 2011 and 2010. (a) Gains (Losses) reclassified from other comprehensive income (loss) into interest income on loans and interest expense on long-term debt. 122 U.S. BANCORP -

Page 127

... any related collateral posted, through a single payment and in a single currency. Collateral agreements require the counterparty to post, on a daily basis, collateral (typically cash or money market investments) equal to the Company's net derivative receivable. For highly-rated counterparties... -

Page 128

...Company's Model Risk Governance Policy and Program, as maintained by the Company's credit administration department. The purpose of model validation is to assess the accuracy of the models' input, processing, and reporting components. All models are required to be independently reviewed and approved... -

Page 129

... obligations and collateralized loan obligations, certain corporate debt securities and SIV-related securities. Mortgage Loans Held For Sale MLHFS measured at fair value, for which an active secondary market and readily available market prices exist, are initially valued at the transaction price and... -

Page 130

... Refer to Note 7 for further information on community development and tax-advantaged related assets and liabilities. Fair value is provided for disclosure purposes only. Deposit Liabilities The fair value of demand deposits, savings accounts and certain money market deposits is equal to the amount... -

Page 131

... rate. Prepayment rates generally move in the opposite direction of market interest rates. Discount rates are generally impacted by changes in market return requirements. Minimum Maximum Average The following table shows the significant valuation assumption ranges for MSRs at December 31, 2012... -

Page 132

...an increase in the derivative asset or a reduction in the derivative liability. Expected loan close rates and the inherent MSR values are directly impacted by changes in market rates and will generally move in the same direction as interest rates. The following table shows the significant valuation... -

Page 133

... of state and political subdivisions ...Obligations of foreign governments ...Corporate debt securities ...Perpetual preferred securities ...Other investments ...Total available-for-sale ...Mortgage loans held for sale ...Mortgage servicing rights ...Derivative assets ...Other assets ...Total... -

Page 134

...) Relating Other End to Assets Comprehensive Principal of Period Still Held at Income (Loss) Purchases Sales Payments Issuances Settlements Balance End of Period (Dollars in Millions) Net Gains Beginning (Losses) of Period Included in Balance Net Income 2012 Available-for-sale securities Mortgage... -

Page 135

..., Sales Principal Payments, Issuances and Settlements Net Change in Unrealized Gains (Losses) Relating to Assets Still Held at End of Period (Dollars in Millions) Beginning of Period Balance Net Gains (Losses) Included in Net Income End of Period Balance Available-for-sale securities Mortgage... -

Page 136

... with disclosure guidance related to fair values of financial instruments, the Company did not include assets and liabilities that are not financial instruments, such as the value of goodwill, long-term relationships with deposit, credit card, merchant processing and trust customers, other purchased... -

Page 137

... IPO and through reductions to the conversion ratio applicable to the Class B shares held by Visa U.S.A. member banks, Visa Inc. has funded an escrow account for the benefit of member financial institutions to fund their indemnification obligations associated with the Visa Litigation. The receivable... -

Page 138

... party. The guarantees frequently support public and private borrowing arrangements, including commercial paper issuances, bond financings and other similar transactions. The Company issues commercial letters of credit on behalf of customers to ensure payment or collection in connection with trade... -

Page 139

... after the occurrence of a triggering event such as delinquency. For these types of loan sales, the maximum potential future payments is generally the unpaid principal balance of loans sold measured at the end of the current reporting period. Actual losses will be significantly less than the maximum... -

Page 140

...related liability of $19 million. Checking Account Overdraft Fee Litigation The Company is a defendant in three separate cases primarily challenging the Company's daily ordering of debit transactions posted to customer checking accounts for the period from 2003 to 2010. On July 2, 2012, the Company... -

Page 141

... short sale approvals and loan modifications. The NOTE 22 impact of these concessions is reflected in the Company's allowance for loan losses and discounts on acquired loans. The Company is currently subject to other investigations and examinations by government agencies concerning mortgage-related... -

Page 142

...) financing activities ...Change in cash and due from banks ...Cash and due from banks at beginning of year ...Cash and due from banks at end of year ... Transfer of funds (dividends, loans or advances) from bank subsidiaries to the Company is restricted. Federal law requires loans to the Company or... -

Page 143

U.S. Bancorp Consolidated Balance Sheet - Five Year Summary (Unaudited) At December 31 (Dollars in Millions) 2012 2011 2010 2009 2008 % Change 2012 v 2011 Assets Cash and due from banks ...Held-to-maturity securities ...Available-for-sale securities ...Loans held for sale ...Loans ...Less allowance... -

Page 144

... debit card revenue ...Corporate payment products revenue ...Merchant processing services ...ATM processing services ...Trust and investment management fees ...Deposit service charges ...Treasury management fees ...Commercial products revenue ...Mortgage banking revenue ...Investment products fees... -

Page 145

... debit card revenue ...Corporate payment products revenue ...Merchant processing services ...ATM processing services ...Trust and investment management fees ...Deposit service charges ...Treasury management fees ...Commercial products revenue ...Mortgage banking revenue ...Investment products fees... -

Page 146

...) 2012 Average Balances Yields and Rates Average Balances 2011 Yields and Rates Year Ended December 31 (Dollars in Millions) Interest Interest Assets Investment securities ...Loans held for sale ...Loans (b) Commercial ...Commercial real estate ...Residential mortgages ...Credit card ...Other... -

Page 147

2010 Average Balances Yields and Rates Average Balances 2009 Yields and Rates Average Balances 2008 Yields and Rates 2012 v 2011 % Change Average Balances Interest Interest Interest $ 47,... 8,716 3.40% 3.32% 4.95% 1.28 3.67% 3.59% $ 7,866 3.29% 3.23% 5.87% 2.21 3.66% 3.60% U.S. BANCORP 143 -

Page 148

... per common share ...Ratios $ 2.85 2.84 .78 $ 2.47 2.46 .50 $ 1.74 1.73 .20 $ .97 .97 .20 $ 1.62 1.61 1.70 Return on average assets ...Return on average common equity ...Average total U.S. Bancorp shareholders' equity to average assets . . Dividends per common share to net income per... -

Page 149

... in credit card services, merchant and ATM processing, mortgage banking, insurance, brokerage and leasing. U.S. Bancorp's banking subsidiaries are engaged in the general banking business, principally in domestic markets. The subsidiaries range in size from $51 million to $254 billion in deposits and... -

Page 150

... of which affect the Company's net interest margin. Federal Reserve Board policies can also materially affect the value of financial instruments that the Company holds, such as debt securities, certain mortgage loans held for sale and mortgage servicing rights ("MSRs"). Its policies also can affect... -

Page 151

...the Company's net interest margin and net interest income. In addition, the Company's bank customers could take their money out of the bank and put it in alternative investments. Checking and savings account balances and other forms of customer deposits may decrease when customers U.S. BANCORP 147 -

Page 152

... can pay bills and transfer funds directly without going through a bank. This process of eliminating banks as intermediaries, known as "disintermediation," could result in the loss of fee income, as well as the loss of customer deposits and income generated from those deposits. In addition, changes... -

Page 153

... borrower type, or location of the borrower or collateral. For example, the Company's credit risk and credit losses can increase if borrowers who engage in similar activities are uniquely or disproportionately affected by economic or market conditions, or by regulation, such as regulation related to... -

Page 154

...interest rate risk. As a result of these factors, mortgage banking revenue can experience significant volatility. Maintaining or increasing the Company's market share may depend on lowering prices and market acceptance of new products and services The Company's success depends, in 150 U.S. BANCORP -

Page 155

...the Company's actual or alleged conduct in any number of activities, including lending practices, mortgage servicing and foreclosure practices, corporate governance, regulatory compliance, mergers and acquisitions, and related disclosure, sharing or inadequate protection of customer information, and... -

Page 156

... benefits of the acquisition. Also, the negative effect of any divestitures required by regulatory authorities in acquisitions or business combinations may be greater than expected. The Company must generally receive federal regulatory approval before it can acquire a bank or bank holding company... -

Page 157

...are the principal source of funds to pay dividends on the Company's stock and interest and principal on its debt. Various federal and state laws and regulations limit the amount of dividends that its bank subsidiaries and certain of its non-bank subsidiaries may pay to the Company without regulatory... -

Page 158

... of other companies that investors deem comparable to the Company; • new technology used or services offered by the Company's competitors; • news reports relating to trends, concerns and other issues in the financial services industry; and • changes in government regulations. General market... -

Page 159

... Executive Vice President and National Group Head of Commercial Real Estate at U.S. Bancorp, having previously served as Senior Vice President and Group Head of Commercial Real Estate since joining U.S. Bancorp in 1992. Pamela A. Joseph Ms. Joseph is Vice Chairman, Payment Services, of U.S. Bancorp... -

Page 160

...as Chief Financial Officer of the Payment Services business from October 2006 until September 2007. From March 2001 until July 2005, he served as Senior Vice President and Director of Investor Relations at U.S. Bancorp. Lee R. Mitau Mr. Mitau served as Executive Vice President and General Counsel of... -

Page 161

... (Government) San Francisco, California 1. Executive Committee 2. Compensation and Human Resources Committee 3. Audit Committee 4. Community Reinvestment and Public Policy Committee 5. Governance Committee 6. Risk Management Committee Joel W. Johnson3,6 Retired Chairman and Chief Executive Officer... -

Page 162

... earnings, news releases, quarterly ï¬nancial data reported on Form 10-Q, Form 10-K and additional copies of our annual reports. Please contact: U.S. Bancorp Investor Relations 800 Nicollet Mall Minneapolis, MN 55402 [email protected] Phone: 866-775-9668 Common Stock Listing and Trading... -

Page 163

U.S. Bancorp 800 Nicollet Mall Minneapolis, MN 55402 usbank.com