US Bank 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 US Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

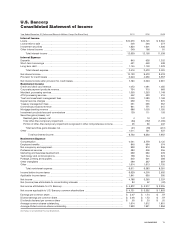

U.S. Bancorp

Consolidated Balance Sheet

At December 31 (Dollars in Millions) 2011 2010

Assets

Cash and due from banks ........................................................................................ $ 13,962 $ 14,487

Investment securities

Held-to-maturity (fair value $19,216 and $1,419, respectively) ................................................. 18,877 1,469

Available-for-sale .............................................................................................. 51,937 51,509

Loans held for sale (included $6,925 and $8,100 of mortgage loans carried at fair value, respectively) .......... 7,156 8,371

Loans

Commercial .................................................................................................... 56,648 48,398

Commercial real estate......................................................................................... 35,851 34,695

Residential mortgages ......................................................................................... 37,082 30,732

Credit card ..................................................................................................... 17,360 16,803

Other retail ..................................................................................................... 48,107 48,391

Total loans, excluding covered loans ........................................................................ 195,048 179,019

Covered loans .................................................................................................. 14,787 18,042

Total loans ................................................................................................... 209,835 197,061

Less allowance for loan losses ............................................................................ (4,753) (5,310)

Net loans.................................................................................................. 205,082 191,751

Premises and equipment ......................................................................................... 2,657 2,487

Goodwill .......................................................................................................... 8,927 8,954

Other intangible assets ........................................................................................... 2,736 3,213

Other assets ...................................................................................................... 28,788 25,545

Total assets.................................................................................................. $340,122 $307,786

Liabilities and Shareholders’ Equity

Deposits

Noninterest-bearing ............................................................................................ $ 68,579 $ 45,314

Interest-bearing ................................................................................................ 134,757 129,381

Time deposits greater than $100,000 .......................................................................... 27,549 29,557

Total deposits ............................................................................................... 230,885 204,252

Short-term borrowings ............................................................................................ 30,468 32,557

Long-term debt ................................................................................................... 31,953 31,537

Other liabilities .................................................................................................... 11,845 9,118

Total liabilities ............................................................................................... 305,151 277,464

Shareholders’ equity

Preferred stock ................................................................................................. 2,606 1,930

Common stock, par value $0.01 a share—authorized: 4,000,000,000 shares;

issued: 2011 and 2010—2,125,725,742 shares ............................................................. 21 21

Capital surplus ................................................................................................. 8,238 8,294

Retained earnings .............................................................................................. 30,785 27,005

Less cost of common stock in treasury: 2011—215,904,019 shares; 2010—204,822,330 shares ............. (6,472) (6,262)

Accumulated other comprehensive income (loss) .............................................................. (1,200) (1,469)

Total U.S. Bancorp shareholders’ equity .................................................................... 33,978 29,519

Noncontrolling interests ........................................................................................ 993 803

Total equity .................................................................................................. 34,971 30,322

Total liabilities and equity .................................................................................... $340,122 $307,786

See Notes to Consolidated Financial Statements.

70 U.S. BANCORP