US Bank 2004 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2004 US Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fellow Shareholders:

LETTER TO SHAREHOLDERS

I am pleased to tell you that in 2004, U.S. Bancorp

achieved its goals for the year and delivered on its

promises to you.

STRONG FINANCIAL RESULTS WITH

A FOCUS ON REVENUE GROWTH

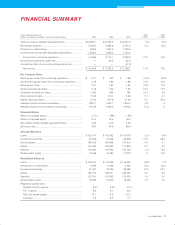

We reported record net income of $4.2 billion, a

13 percent increase in diluted earnings per share,

and industry-leading returns on assets and equity of

2.17 percent and 21.4 percent, respectively. Credit

quality trends continued to improve as credit losses

decreased signifi cantly from a year ago. And refl ecting

our priority to grow revenue, we achieved solid fee

income growth.

During the coming year, we will act to sustain those suc-

cesses. Revenue growth is our primary focus, particularly

net interest income from improved commercial lending

results. Our consumer lending business continues to grow,

and we have made a number of changes surrounding our

commercial banking and small business banking lines

of business to increase commercial loan growth. We saw

middle market commercial loan balances move upward in

fourth quarter 2004.

We are very disciplined in our acquisitions, focusing

only on those which will enhance revenue growth, create

operating scale, build a more profi table business line or

strengthen a critical competitive advantage. This strategy

has proved very successful, most notably in our payments

business, which reported 10.6 percent net revenue growth

in 2004.

Our capital position remains strong, and we repurchased

93.8 million shares during 2004.

INVESTING FOR GROWTH AND SERVICE

We are investing more in our core businesses to drive

revenue growth. Our investments and expertise in new

technology have delivered a new generation of electronic

options for customers—check imaging, processing,

payments, account management, collections and other

service delivery systems. Of particular note is the expansion

of our merchant processing capabilities in Europe; there

are further details of that expansion on page 16 of this

report. And, we continue to invest in our branch offi ce

network in higher-growth markets. There are further

details of our in-store and traditional branch expansion

program on page 13 of this report.

We continue to support our pledge of guaranteed high

levels of customer service. Investments in delivery and

operational systems allowed us to unify systems, simplify

procedures, streamline processes and increase the ease

of numerous customer transactions and communications.

These investments improved customer service and

increased customer satisfaction and loyalty, contributing

signifi cantly to our ability to attract and retain customers.

We have also improved hiring and training practices,

and service quality is an integral part of our employees’

performance evaluation and incentive programs.

RATING AGENCIES VIEW

U.S. BANK FAVORABLY

We are pleased that on January 18, 2005, Moody’s rating

agency upgraded U.S. Bank’s ratings. Long-term senior

debt at the holding company, U.S. Bancorp, was upgraded

to Aa2 from Aa3 while long-term senior ratings of its

subsidiary bank, U.S. Bank National Association,

were

upgraded to Aa1 from Aa2.

The main driver behind the

2004 was a year that it all came together for U.S. Bancorp.

Service quality levels have never been higher. Financial results

are strong and lead the industry in key measurements. All lines

of business are contributing to revenue and growth.

4 U.S. BANCORP