US Bank 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 US Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2004 ANNUAL REPORT AND FORM 10-K

FIVE STAR SERVICE IN ACTION

Table of contents

-

Page 1

FIVE STAR SERVICE IN ACTION 2 0 04 ANNUAL REPORT AND FORM 10- K -

Page 2

...At year-end 2004 U .S. BANCORP AT A GLANCE Ranking Asset size Deposits Total loans Earnings per share (diluted) Return on average assets Return on average equity Tangible common equity Efï¬ciency ratio Customers Primary banking region Bank branches ATMs NYSE symbol 6th largest ï¬nancial holding... -

Page 3

... at year-end 2004. U.S. Bancorp, the parent company of U.S. Bank, serves 13.1 million customers and operates 2,370 branch ofï¬ces in 24 states. U.S. Bancorp customers also access their accounts through 4,620 U.S. Bank ATM s, U.S. Bank Internet Banking and telephone banking. A network of specialized... -

Page 4

... Share (a) (In Dollars) 4,500 3,732.6 4,166.8 2.18 3,168.1 1.65 2,752.1 1.43 2,250 1.20 .60 1,478.8 .76 0 00 01 02 03 04 0 00 01 02 03 04 0 00 01 02 03 04 Return on Average Assets (In Percents) 2.4 24 Return on Average Equity (In Percents) 100 Dividend Payout Ratio (In Percents... -

Page 5

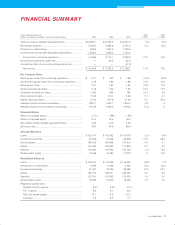

... 3.4% 29.2 9.1 9.1 10.9 12.3 Period End Balances Loans ...Allowance for credit losses ...Investment securities ...Assets ...Deposits ...Shareholders' equity ...Regulatory capital ratios Tangible common equity ...Tier 1 capital ...Total risk-based capital ...Leverage...6.4% 8.6 13.1 7.9 6.5% 9.1 13... -

Page 6

... in-store and traditional branch expansion program on page 13 of this report. We continue to support our pledge of guaranteed high levels of customer service. Investments in delivery and operational systems allowed us to unify systems, simplify procedures, streamline processes and increase the ease... -

Page 7

... always true. O ur Corporate Governance Guidelines, our Privacy Pledge, and our Code of Ethics and Business Conduct can all be found on our internet website at usbank.com. I urge you to visit the site. Jerry A. Grundhofer Chairm an and Chief Ex ecutive O fï¬cer U.S. Bancorp February 28, 2005 1.02... -

Page 8

FIVE STAR SERVICE IN ACTION THE VALUES OF FIVE STAR SERVICE Take Ownership Make it Personal Add Value to Every Interaction Make Customer Courtesy Common Share Knowledge SHE TAKES OWNERSHIP. 6 May Li, Manager Factoria Ofï¬ce, Bellevue, WA When Terrie Nixdorff needed help obtaining a debit card ... -

Page 9

Teshan Lewis, Account Coordinator Corporate Payment Systems, Minneapolis, MN Teshan Lewis went above and beyond to secure a Government Purchase Card for a staff member of the United States Air Force who was preparing for a short-notice deployment to Iraq. Teshan's personal commitment and persistence... -

Page 10

... Group, a diversiï¬ed private equity investment company. Pam adds value to every interaction by consistently ï¬nding the right specialized, competitive products and services designed to meet the needs of The Walnut Group's principals. Ann Vazquez, Manager Broker Dealer Division, St. Louis, MO... -

Page 11

... credit card portfolio conversion. Drawing on his vast knowledge of conversion processes, Andrew offered Umpqua ï¬,exible, efï¬cient and reliable options to guarantee their satisfaction. Andrew is pictured with Susie McEuin and Laura Schaeffer of Umpqua. HE SHARES HIS KNOWLEDGE. U.S. BANCORP... -

Page 12

... customers. 10 U.S. BANCORP KEY BUSINESS UNITS • Middle Market Commercial Banking • Commercial Real Estate • Corporate Banking • Correspondent Banking • Dealer Commercial Services • Equipment Leasing • Foreign Exchange • Government Banking • International Banking • Specialized... -

Page 13

... Payment Services • NOVA Information Systems, Inc. • Retail Payment Solutions (card services) • Transaction Services customers. Additionally, corporate payment products and merchant processing can provide valuable beneï¬ts to middle market and small business companies, and we are increasing... -

Page 14

... Street corporate trust business, and in June 2004 we completed the acquisition of N ational City's corporate trust division, a transaction that brought KEY BUSINESS UNITS • The Private Client Group • Corporate Trust Services • Institutional Trust & Custody • U.S. Bancorp Asset Management... -

Page 15

... San Francisco Minneapolis/ St. Paul Madison Cedar Rapids Milwaukee Omaha Salt Lake City Denver Des Moines Chicago Cleveland Dayton Columbus Cincinnati Kansas City St. Louis Louisville Nashville Las Vegas Los Angeles Phoenix San Diego Tucson U.S. Bank operates full-service in-store branches... -

Page 16

...from our corporate and purchasing cards into one easy-tomanage program. N O VA's new Electronic Check Service processing streamlines check acceptance and mitigates risk for our customers so they can accept checks as safely and easily as card payment alternatives. Gift card industry sales reached $45... -

Page 17

... experts in The Private Client Group. Retail Payment Solutions has increased penetration of personal and small business checking account customers with U.S. Bank-branded credit and debit cards by investing in sales and training opportunities with our expanded branch network. PRODUCT DEVELOPM ENT... -

Page 18

... our expertise in Commercial Real Estate ï¬nancing and capitalizing on an improving economy by opening new Commercial Real Estate ofï¬ces in Phoenix, Dallas and Washington, D.C. O ffering our clients greater investment choice, The Private Client Group launched M utual Fund O pen Architecture in... -

Page 19

...of our lines of business and learned how we expect our investments and initiatives to generate revenue growth and strengthen U.S. Bancorp. Now, we invite you to examine more closely management's discussion and analysis of our ongoing operations and U.S. Bancorp's ï¬nancial results for the year 2004... -

Page 20

... the banking industry due to rising interest rates and sluggish commercial loan growth, the Company experienced strong growth in its fee-based revenues, particularly in payment processing services. The Company generated fee-based revenue growth of 11.0 percent in 2004. By year-end, commercial loan... -

Page 21

...term debt Shareholders' equity Period End Balances Loans Allowance for credit losses Investment securities Assets Deposits Long-term debt Shareholders' equity Regulatory capital ratios Tangible common equity Tier 1 capital Total risk-based capital Leverage (a) Interest and rates are... -

Page 22

.... In 2004, average earning assets increased $7.3 billion (4.5 percent), compared with 2003, primarily due to growth in residential mortgages, retail loans and investment securities, partially offset by a decline in commercial loans and loans held for sale related to mortgage banking activities. The... -

Page 23

... for 2004, compared with 2003, was primarily driven by increases in residential mortgages, retail loans and investment securities, partially offset by a decline in commercial loans and loans held for sale related to mortgage banking activities. The decline in average commercial loans from a year ago... -

Page 24

... in Millions) Volume Yield/Rate Total Volume 2003 v 2002 Yield/Rate Total Increase (decrease) in Interest income Investment securities Loans held for sale Commercial loans Commercial real estate Residential mortgage Retail loans Total loans Other earning assets Total 254.3 (112.2) (110... -

Page 25

... noninterest-bearing deposits increased by 2.7 percent from a year ago, mortgage-related escrow balances and business-related noninterest-bearing deposits, including corporate banking, mortgage banking and government deposits, declined. Average interest-bearing deposits of $86.4 billion in 2004 were... -

Page 26

...) 2004 2003 2002 2004 v 2003 2003 v 2002 Credit and debit card revenue Corporate payment products revenue ATM processing services Merchant processing services Trust and investment management fees Deposit service charges Treasury management fees Commercial products revenue Mortgage banking... -

Page 27

...-wide shift of payments from paper-based to electronic and card-based transactions. During 2004, commercial products revenue increased $31.7 million (7.9 percent), primarily due to syndication fees and commercial leasing revenue. An increase in loan servicing revenues from a year ago contributed to... -

Page 28

...Not meaningful expansion of in-store branches, the expansion of the Company's merchant acquiring business in Europe and other initiatives. Stock-based compensation was higher due to lower employee stock-award forfeitures relative to prior years. Employee beneï¬ts increased primarily as a result of... -

Page 29

... .65% Discount rate Incremental beneï¬t (cost Percent of 2004 net income 4.0% 5.0% 7.0% 8.0% $(57.0) (.85)% $(30.9) (.46)% $- -% $35.4 .53% $73.5 1.09% Due to the complexity of forecasting pension plan activities, the accounting method utilized for pension plans, management's ability... -

Page 30

... in residential mortgages, retail loans and investment securities, partially offset by a decline in commercial loans and loans held for sale related to mortgage banking activities. The increase in average earning assets was principally funded by increases of $1.6 billion in interest-bearing deposits... -

Page 31

... services Commercial services and supplies Capital goods Agriculture Property management and development Paper and forestry products, mining and basic materials Consumer staples Health care Private investors Transportation Energy Information technology Other Total Loans Percent... -

Page 32

... commercial real estate loans increased by $125 million (.5 percent) in 2004, compared with 2003, primarily driven by growth in SBA commercial real estate mortgage loans. Table 9 provides a summary of 30 U.S. BANCORP commercial real estate by property type and geographical locations. The Company... -

Page 33

... growth in home equity lines, retail leasing, installment loans and credit card. Of the total retail loans and residential mortgages outstanding, approximately 87.4 percent are to customers located in the Company's primary banking regions. Loans Held for Sale At December 31, 2004, loans held for... -

Page 34

government banking deposits in the Wholesale Banking business line relative to a year ago. The decline also included certain product changes to migrate high-value customers with balances of $1.3 billion to the Company's Silver Elite interest checking product to further enhance customer retention. ... -

Page 35

... Company given the proï¬tability of certain business accounts and modest commercial loan growth and business customer decisions to utilize deposit liquidity during 2004. A portion of money market balances migrated to time deposits greater than $100,000 as interest rates increased for these products... -

Page 36

... for balance sheet hedging purposes, foreign exchange transactions, deposit overdrafts and interest rate swap contracts for customers, and settlement risk, including Automated Clearing House transactions, and the processing of credit card transactions for merchants. These activities are also... -

Page 37

...of its loan portfolio. As part of its normal business activities, it offers a broad array of traditional commercial lending products and specialized products such as asset-based lending, commercial lease ï¬nancing, agricultural credit, warehouse mortgage lending, commercial real estate, health care... -

Page 38

... of credit risk. Table 9 provides a summary of the signiï¬cant property types and geographic locations of commercial real estate loans outstanding at December 31, 2004 and 2003. At December 31, 2004, approximately 31.0 percent of the commercial real estate loan portfolio represented business owner... -

Page 39

... and development Total commercial real estate Residential mortgages Retail Credit card Retail leasing Other retail Total retail Total nonperforming loans Other real estate Other assets Total nonperforming assets Restructured loans accruing interest (b Accruing loans 90 days or more... -

Page 40

... real estate Residential mortgages Retail Credit card Retail leasing Other retail Total retail Total loans At December 31, 90 days or more past due including nonperforming loans 2004 2003 2002 2001 2000 Commercial Commercial real estate Residential mortgages (a Retail Total loans... -

Page 41

...commercial real estate Residential mortgages Retail Credit card Retail leasing Home equity and second mortgages Other retail Total retail Total loans (a (a) In accordance with guidance provided in the Interagency Guidance on Certain Loans Held for Sale, loans held with the intent to sell... -

Page 42

... the Company's consumer lending activities. USBCF specializes in serving channel-speciï¬c and alternative lending markets in residential mortgages, home equity and installment loan ï¬nancing. USBCF manages loans originated through a broker network, correspondent relationships and U.S. Bank branch... -

Page 43

...Total commercial real estate Residential mortgages Retail Credit card Retail leasing Home equity and second mortgages Other retail Total retail Total net charge-offs Provision for credit losses Losses from loan sales /transfers (a Acquisitions and other changes Balance at end of year 99... -

Page 44

... risks associated with commercial real estate and the mix of loans, including credit cards, loans originated through the consumer ï¬nance division and lower residential mortgages balances, and their relative credit risk was evaluated compared with other banks. Finally, the Company considered the... -

Page 45

... inherent loss rates for commercial real estate and traditional corporate lending. On a composite basis, inherent loss rates for commercial credit facilities increased slightly for most risk rating categories relative to a year ago. In addition to its risk rating process, the Company separately... -

Page 46

... year-end 2004, no vehicle-type concentration exceeded ï¬ve percent of the aggregate portfolio. Because retail residual valuations tend to be less volatile for longer-term leases, relative to the estimated residual at inception of the lease, the Company actively manages lease origination production... -

Page 47

... manage operational risks. Each business unit of the Company is required to develop, maintain and test these plans at least annually to ensure that recovery activities, if needed, can support mission critical functions including technology, networks and data centers supporting customer applications... -

Page 48

... rates, including asset management fees, mortgage banking and the impact from compensating deposit balances. The Company manages its interest rate risk position by holding assets on the balance sheet with desired interest rate risk characteristics, implementing certain pricing strategies for loans... -

Page 49

... mortgage banking operations, the Company enters into forward commitments to sell mortgage loans related to ï¬xed-rate mortgage loans held for sale and ï¬xed-rate mortgage loan commitments. The Company also acts as a seller and buyer of interest rate contracts and foreign exchange rate contracts... -

Page 50

... that transfer the credit risk related to interest rate swaps from the Company to an unafï¬liated third-party. The Company also provides credit protection to third-parties with risk participation agreements, for a fee, as part of a loan syndication transaction. At December 31, 2004, the Company had... -

Page 51

... Home Loan Banks (''FHLB'') that provide a source of funding through FHLB advances. The Company maintains a Grand Cayman branch for issuing eurodollar time deposits. The Company also issues commercial paper through its Canadian branch. In addition, the Company establishes relationships with dealers... -

Page 52

...not rely signiï¬cantly on off-balance sheet arrangements for liquidity or capital resources. The Company sponsors an off-balance sheet conduit to which it transferred high-grade investment securities, funded by the issuance of commercial paper. The conduit held assets of $5.7 billion at December 31... -

Page 53

... Company returned 109 percent of earnings in 2004. The Company continually assesses its business risks and capital position. The Company also manages its capital to exceed regulatory capital requirements for well-capitalized bank holding companies. To achieve these capital goals, the Company employs... -

Page 54

... (3.9 percent) from a year ago. The increase reï¬,ected growth in the majority of fee-based revenue categories, particularly in payment processing revenue. The expansion of the Company's merchant acquiring business in Europe, including the purchase of the remaining 50 percent shareholder interest... -

Page 55

...in credit and debit card revenue reï¬,ected increases in transaction volumes and other rate adjustments, partially offset by higher customer loyalty reward expenses. The corporate payment products revenue growth reï¬,ected growth in sales, card usage and rate changes. ATM processing services revenue... -

Page 56

... expansion of in-store branches, the expansion of the Company's merchant acquiring business in Europe and other initiatives. Stock-based compensation was higher due to lower forfeitures relative to prior years. Employee beneï¬ts increased year-over-year by $16.7 million (20.5 percent), primarily as... -

Page 57

... of 2004. The decline in mortgage-related deposits reï¬,ected lower production of mortgage banking businesses while the decline in government deposits was primarily due to a decision by the Federal government to pay fees for treasury management services rather than maintain compensating balances... -

Page 58

... rates. Partially offsetting these increases was the decline in average mortgage loans held for sale, reduced spreads on retail loans due to the competitive Table 22 Line of Business Financial Perfor mance Wholesale Banking Year Ended December 31 (Dollars in Millions) 2004 Percent 2003 Change 2004... -

Page 59

... the Company's decisions to retain adjustable-rate residential mortgages. Commercial real estate loan balances increased 6.3 percent while commercial loans decreased 5.4 percent in 2004, compared with 2003. The year-over-year decrease in average deposits (.6 percent) was due to a reduction in time... -

Page 60

... in credit card and debit card revenue (16.0 percent), corporate payment product revenues (12.6 percent), ATM processing services revenue private banking, ï¬nancial advisory, investment management and mutual fund servicing through ï¬ve businesses: Private Client Group, Corporate Trust, Asset... -

Page 61

... and employee beneï¬t costs for processing associated with increased credit and debit card transaction volumes, corporate payment products and merchant processing sales volumes, in addition to higher merchant acquiring costs resulting from the expansion of the merchant acquiring business in Europe... -

Page 62

... on the provision for credit losses, nonperforming assets and factors considered by the Company in assessing the credit quality of the loan portfolio and establishing the allowance for credit losses. Income taxes are assessed to each line of business at a standard tax rate with the residual tax... -

Page 63

... the overall level of the allowance for credit losses. The Company's determination of the allowance for commercial and commercial real estate loans is sensitive to the assigned credit risk ratings and inherent loss rates at December 31, 2004. In the event that 10 percent of loans within these... -

Page 64

...the end of the period covered by this report, the Company's disclosure controls and procedures were effective to ensure that information required to be disclosed by the Company in reports that it ï¬les or submits under the Exchange Act is recorded, processed, summarized and reported within the time... -

Page 65

(This page intentionally left blank) U.S. BANCORP 63 -

Page 66

... BANCORP CONSOLIDATED BALANCE SHEET At December 31 (Dollars in Millions) 2004 2003 Assets Cash and due from banks Investment securities Held-to-maturity (fair value $132 and $161, respectively Available-for-sale Loans held for sale Loans Commercial Commercial real estate Residential mortgages... -

Page 67

... Income Credit and debit card revenue Corporate payment products revenue ATM processing services Merchant processing services Trust and investment management fees Deposit service charges Treasury management fees Commercial products revenue Mortgage banking revenue Investment products fees... -

Page 68

... Common Shares Outstanding Common Stock Capital Surplus Retained Earnings Treasury Stock Other Comprehensive Income Total Shareholders' Equity Balance December 31, 2001 Net income Unrealized gain on securities available-for-sale******* Unrealized gain on derivatives Foreign currency translation... -

Page 69

... taxes Gain) loss on sales of securities and other assets, net Mortgage loans originated for sale in the secondary market, net of repayments Proceeds from sales of mortgage loans Stock-based compensation Other, net Net cash provided by (used in) operating activities 4,166.8 669.6 244.4 550... -

Page 70

... private banking, ï¬nancial advisory, investment management and mutual fund servicing to afï¬,uent individuals, businesses, institutions and mutual funds. Payment Services includes consumer and business credit cards, debit cards, corporate and purchasing card services, consumer lines of credit, ATM... -

Page 71

... with mortgage banking activities are considered derivatives and recorded on the balance sheet at fair value with changes in fair value recorded in income. All other unfunded loan commitments are generally related to providing credit facilities to customers of the bank and are not actively traded... -

Page 72

...the ordinary course of business, the Company enters into derivative transactions to manage its interest rate, foreign currency and prepayment risk and to accommodate the business requirements of its customers. All derivative instruments are recorded as either other assets, other liabilities or short... -

Page 73

... to projected cash ï¬,ows as of the measurement date for future beneï¬t payments. Periodic pension expense (or credits) includes service costs, interest costs based on the assumed discount rate, the expected return on plan assets based on an actuarially derived market-related value and amortization... -

Page 74

from banks, federal funds sold and securities purchased under agreements to resell. Stock-Based Compensation The Company grants stock awards including restricted stock and options to purchase common stock of the Company. Stock option grants are for a ï¬xed number of shares to employees and ... -

Page 75

... Cash Paid / (Received) Accounting Method (Dollars in Millions) Date Assets (a) Deposits Nova European acquisitions Corporate trust business of State Street Bank and Trust Company Bay View Bank branches The Leader Mortgage Company, LLC (a) Assets acquired do not include purchase accounting... -

Page 76

...Assets Cash and cash equivalents Trading securities Goodwill Other assets (a Total assets 382 656 306 1,025 $2,369 Liabilities Deposits Short-term borrowings Long-term debt Other liabilities (b Total liabilities (a) Includes customer margin account receivables, due from brokers /dealers... -

Page 77

... of customer accounts, printing and distribution of training materials and policy and procedure manuals, outside consulting fees, and other expenses related to systems conversions and the integration of acquired branches and operations. Asset write-downs and lease terminations represent lease... -

Page 78

...only activity in the USBM liability during 2004 was related to the payout of severance costs. In 2003, the integration of merchant processing platforms and business processes of U.S Bank National Association and NOVA, as well as systems conversions for the acquisitions of the State Street Corporate... -

Page 79

... from increases in interest rates since the purchase of the securities. The weighted average maturity of the available-for-sale investment securities was 4.45 years at December 31, 2004, compared with 5.12 years at December 31, 2003. The corresponding weighted average yields were 4.43 percent and... -

Page 80

... commercial real estate Residential mortgages Retail Credit card Retail leasing Home equity and second mortgages Other retail Revolving credit Installment Automobile Student Total other retail Total retail Total loans Loans are presented net of unearned interest and deferred fees... -

Page 81

... that were restructured at market interest rates and returned to an accruing status. Included in noninterest income, primarily in mortgage banking revenue, for the years ended December 31, 2004, 2003 and 2002, the Company had net gains on the sale of loans of $171.0 million, $162.9 million and $243... -

Page 82

... for revenues related to the conduit including fees for servicing, management, administration and accretion income from retained interests. The Company also has an asset-backed securitization to fund an unsecured small business credit product. The unsecured small business credit securitization trust... -

Page 83

... Indirect Automobile Loans Unsecured Small Business Receivables (a) Commercial Loans Investment Securities 2004 Proceeds from New sales and securitizations Collections used by trust to purchase new receivables in revolving securitizations **** Servicing and other fees received and cash flows on... -

Page 84

...301 Commercial real estate Commercial mortgages Construction and development ***** Total commercial real estate***** Residential mortgages Retail Credit card Retail leasing Other retail Total retail Total managed loans******** Investment securities Total managed assets Less Assets sold... -

Page 85

... prepayment speeds and better cash ï¬,ows than conventional mortgage loans. The Company's servicing portfolio consists of the distinct portfolios of Mortgage Revenue Bond Programs (''MRBP''), government-related mortgages and conventional mortgages. The MRBP division specializes in servicing loans... -

Page 86

... of goodwill for the years ended December 31, 2003 and 2004: Private Client, Trust and Asset Management (Dollars in Millions) Wholesale Banking Consumer Banking Payment Services Capital Markets Consolidated Company Balance at December 31, 2002 Goodwill acquired Other (a Balance at December... -

Page 87

... following table is a summary of short-term borrowings for the last three years: 2004 (Dollars in Millions) Amount Rate Amount 2003 Rate Amount 2002 Rate At year-end Federal funds purchased Securities sold under agreements to repurchase Commercial paper Treasury, tax and loan notes Other short... -

Page 88

...% due 2011 6.30% due 2014 4.95% due 2014 4.80% due 2015 Floating-rate subordinated notes 2.34% due 2014 Federal Home Loan Bank advances Bank notes Euro medium-term notes due 2004 Capitalized lease obligations, mortgage indebtedness and other Subtotal Total 100 70 100 300 300 400 500 300... -

Page 89

... (''Trust Preferred Securities'') to third-party investors and investing the proceeds from the sale of the Trust Preferred Securities solely in junior subordinated debt securities of the Company (the ''Debentures''). The Debentures held by the trusts, which total $2.6 billion, are the sole assets of... -

Page 90

... related to hedges on certain junior subordinated debentures, as well as prepaid issuance fees of $(3) million. (b) The variable-rate Trust Preferred Securities and Debentures reprice quarterly based on three-month LIBOR. Note 17 Shareholders' Equity At December 31, 2004 and 2003, the Company... -

Page 91

...Income included in shareholders' equity for the years ended December 31, is as follows: Transactions (Dollars in Millions) Pre-tax Tax-effect Net-of-tax Balances Net-of-tax 2004 Unrealized loss on securities available-for-sale Unrealized loss on derivatives Foreign currency translation adjustment... -

Page 92

... established investment policies and asset allocation strategies. Investment Policies and Asset Allocation In establishing its all employees based on years of service and employees' compensation while employed with the Company. Employees are fully vested after ï¬ve years of service. Under the plan... -

Page 93

... relative to assumed rates of return and asset allocation and LTROR information for a peer group in establishing its assumptions. Post-Retirement Medical Plans In addition to providing death beneï¬ts to certain retired employees through several retiree medical programs. The Company adopted one... -

Page 94

... at beginning of measurement period Service cost Interest cost Plan participants' contributions Actuarial (gain) loss Beneï¬t payments Curtailments Settlements Beneï¬t obligation transferred to Piper Jaffray Companies Beneï¬t obligation at end of measurement period (a)(b 1,801.1 58... -

Page 95

... future compensation Post-retirement medical plan actuarial computations Expected long-term return on plan assets Discount rate in determining beneï¬t obligations Health care cost trend rate (b) Prior to age 65 After age 65 Effect of one percent increase in health care cost trend rate Service... -

Page 96

...of shares of common stock or stock units that are subject to restriction on transfer. Most stock awards vest over three to ï¬ve years and are subject to forfeiture if certain vesting requirements are not met. Stock incentive plans of acquired companies are generally terminated at the merger closing... -

Page 97

...time employee stock options expire, are exercised or cancelled, the Company determines the tax beneï¬t associated with the stock award and under certain circumstances may be required to recognize an adjustment to tax expense. On an after-tax basis, stockbased compensation was $138.5 million in 2004... -

Page 98

... value adjustments on securities available-for-sale, derivative instruments in cash ï¬,ow hedges and certain tax beneï¬ts related to stock options are recorded directly to shareholders' equity as part of other comprehensive income. In preparing its tax returns, the Company is required to interpret... -

Page 99

... into derivative transactions to manage its interest rate, prepayment and foreign currency risks and to accommodate the business requirements of its customers. The Company does not enter into derivative transactions for speculative purposes. Refer to Note 1 ''Signiï¬cant Accounting Policies'' in... -

Page 100

... preferred securities. In addition, the Company uses forward commitments to sell residential mortgage loans to hedge its interest rate risk related to residential mortgage loans held for sale. The Company commits to sell the loans at speciï¬ed prices in a future period, typically within 90 days... -

Page 101

...850 34,425 $164,395 Derivative Positions Asset and liability management positions Interest rate swaps Forward commitments to sell residential mortgages Foreign exchange forward contracts Equity contracts Customer related positions Interest rate contracts Foreign exchange contracts 435 (4) (12... -

Page 102

...-party. The guarantees frequently support public and private borrowing arrangements, including commercial paper issuances, bond ï¬nancings and other similar transactions. The Company issues commercial letters of credit on behalf of customers to ensure payment or collection in connection with trade... -

Page 103

...consider the potential risk of default. At December 31, 2004, the value of future delivery airline tickets purchased was approximately $1.9 billion, and the Company held collateral of $191.9 million in escrow deposits and letters of credit related to airline customer transactions. U.S. BANCORP 101 -

Page 104

...obligation related to these speciï¬ed matters is capped at $17.5 million and can be terminated by the Company if there is a change in control event for Piper Jaffray Companies. Through December 31, 2004, the Company has paid approximately $3.3 million to Piper Jaffray Companies under this agreement... -

Page 105

... 25 U.S. Bancor p (Parent Company) Condensed Balance Sheet December 31 (Dollars in Millions) 2004 2003 Assets Deposits with subsidiary banks, principally interest-bearing Available-for-sale securities Investments in bank and bank holding company subsidiaries Investments in nonbank subsidiaries... -

Page 106

... stock Cash dividends paid Net cash provided by (used in) ï¬nancing activities Change in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year Transfer of funds (dividends, loans or advances) from bank subsidiaries to the Company... -

Page 107

... balance sheets of U.S. Bancorp as of December 31, 2004 and 2003, and the related consolidated statements of income, shareholders' equity, and cash ï¬,ows for each of the two years in the period ended December 31, 2004. These ï¬nancial statements are the responsibility of the Company's management... -

Page 108

... reliability of the ï¬nancial statements, management is responsible for establishing and maintaining an adequate system of internal control over ï¬nancial reporting as deï¬ned by Rules 13a-15(f) and 15d-15(f) under the Securities Exchange Act of 1934. The Company's system of internal controls is... -

Page 109

...(United States), the consolidated balance sheets of U.S. Bancorp as of December 31, 2004 and 2003, and the related consolidated statements of income, shareholders' equity, and cash ï¬,ows for each of the two years in the period ended December 31, 2004 and our report dated February 18, 2005 expressed... -

Page 110

... BANCORP CONSOLIDATED BALANCE SHEET - FIVE-YEAR SUMMARY December 31 (Dollars in Millions) 2004 2003 2002 2001 2000 % Change 2004 v 2003 Assets Cash and due from banks Held-to-maturity securities Available-for-sale securities Loans held for sale Loans Less allowance for loan losses Net loans... -

Page 111

... Income Credit and debit card revenue Corporate payment products revenue ATM processing services Merchant processing services Trust and investment management fees Deposit service charges Treasury management fees Commercial products revenue Mortgage banking revenue Investment products fees... -

Page 112

...Credit and debit card revenue Corporate payment products revenue ATM processing services Merchant processing services Trust and investment management fees ********** Deposit service charges Treasury management fees Commercial products revenue Mortgage banking revenue Investment products fees... -

Page 113

... ï¬led on Form 10-Q with the Securities and Exchange Commission have been retroactively restated to give effect to the spin-off of Piper Jaffray Companies on December 31, 2003, and the adoption of the fair value method of accounting for stock-based compensation. The accounting change was adopted... -

Page 114

... SHEET AND Year Ended December 31 Average Balances 2004 Yields and Rates Average Balances 2003 Yields and Rates (Dollars in Millions) Interest Interest Assets Investment securities Loans held for sale Loans (b) Commercial Commercial real estate Residential mortgages Retail Total loans... -

Page 115

RELATED YIELDS AND RATES (a) 2002 Average Balances Yields and Rates Average Balances 2001 Yields and Rates Average Balances 2000 Yields and Rates 2004 v 2003 % Change Average Balances ...4.3 5.5 (16.7) .3 2.1% 6.46% 1.81 4.65% 4.63% 7.67% 3.21 4.46% 4.43% 8.63% 4.25 4.38% 4.32% U.S. BANCORP 113 -

Page 116

... 20549 Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the ï¬scal year ended December 31, 2004 Commission File Number 1-6880 U.S. Bancorp Incorporated in the State of Delaware IRS Employer Identiï¬cation #41-0255900 Address: 800 Nicollet Mall Minneapolis... -

Page 117

... mutual funds. Banking and investment services are provided through a network of 2,370 banking ofï¬ces principally operating in 24 states in the Midwest and West. The Company operates a network of 4,620 branded ATMs and provides 24-hour, seven day a week telephone customer service. Mortgage banking... -

Page 118

...part-time employee actively employed by U.S. Bancorp on the grant date, other than individuals eligible to participate in any of the Company's executive 116 U.S. BANCORP stock incentive plans or in U.S. Bancorp Piper Jaffray Inc.'s annual option plan. As of December 31, 2004, options to purchase an... -

Page 119

... at any time. Website Access to SEC Reports U.S. Bancorp's internet required annual Chief Executive Ofï¬cer certiï¬cation to the New York Stock Exchange. Governance Documents Our Corporate Governance Guidelines, Code of Ethics and Business Conduct and Board of Directors committee charters are... -

Page 120

... ended September 30, 2004. 10.23 Form of Executive Ofï¬cer Stock Option Agreement with annual vesting under U.S. Bancorp 2001 Stock Incentive Plan. Filed as Exhibit 10.2 to Form 10-Q for the quarterly period ended September 30, 2004. 10.24 Form of Executive Ofï¬cer Restricted Stock Award Agreement... -

Page 121

... quarterly period ended September 30, 2004. 10.32 Employment Agreement with Edward Grzedzinski. Filed as Exhibit 10.22 to Form 10-K for the year ended December 31, 2002. 10.33 Information Regarding the 2005 Compensation of the Non-Employee Members of the Board of Directors of U.S. Bancorp. Statement... -

Page 122

...Bancorp By: Jerry A. Grundhofer Chairman and Chief Executive Ofï¬cer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed...nancial ofï¬cer) Terrance R. Dolan Executive Vice President and Controller (principal accounting ofï¬cer) Linda L. Ahlers Director ... -

Page 123

...SECURITIES EXCHANGE ACT OF 1934 I, Jerry A. Grundhofer, Chief Executive Ofï¬cer of U.S. Bancorp, a Delaware corporation, certify that: (1) I have reviewed this Annual Report on Form 10-K of U.S. Bancorp; (2) Based on my knowledge, this report does not contain any untrue statement of a material fact... -

Page 124

... SECURITIES EXCHANGE ACT OF 1934 I, David M. Moffett, Chief Financial Ofï¬cer of U.S. Bancorp, a Delaware corporation, certify that: (1) I have reviewed this Annual Report on Form 10-K of U.S. Bancorp; (2) Based on my knowledge, this report does not contain any untrue statement of a material fact... -

Page 125

... Bancorp, a Delaware corporation (the ''Company''), do hereby certify that: (1) The Annual Report on Form 10-K for the ï¬scal year ended December 31, 2004 (the ''Form 10-K'') of the Company fully complies with the requirements of section 13(a) or 15(d) of the Securities Exchange Act of 1934; and... -

Page 126

... From the time of the merger of Firstar Corporation and U.S. Bancorp in February 2001 until October 2004, Mr. Davis served as Vice Chairman of U.S. Bancorp. From the time of the merger, Mr. Davis was responsible for Consumer Banking, including Retail Payment Solutions (card services), and he assumed... -

Page 127

... Inc. St. Louis, Missouri John J. Stollenwerk2,3 President and Chief Executive Ofï¬cer Allen-Edmonds Shoe Corporation Port Washington, Wisconsin 1. 2. 3. 4. 5. 6. Executive Committee Compensation Committee Audit Committee Community Outreach and Fair Lending Committee Governance Committee Credit and... -

Page 128

..., annual reports and other documents ï¬led with the Securities and Exchange Commission, access our home page on the internet at usbank.com, click on About U.S. Bancorp, then Investor/Shareholder Information. Mail. At your request, we will mail to you our quarterly earnings, news releases, quarterly... -

Page 129

U.S. Bancorp 800 N icollet M all M inneapolis, M N 55402 usbank.com