True Value 2015 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2015 True Value annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4 TRUE VALUE 2015 ANNUAL REPORT

NET MARGIN

INVESTMENTS

THREE-YEAR PERIOD OF SIGNIFICANT

INVESTMENT TO ACCELERATE PERFORMANCE

2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

3-YEAR INITIAL

SIGNIFICANT

INVESTMENT

PROJECTED

Despite a tough spring season, total gross

billings came in at $2,033,196,000, growing by

2.0 percent over last year on a comparable 52-

week basis. As we had planned, our net margin

was down, largely due to the considerable

investments we’re making.

We continued to keep our commitment to pay

a consistent cash dividend to our members.

This year’s cash dividend is comparable

to last year, and we expect to continue this

level of cash returns during this period of

heavy reinvestment.

The best is still ahead

When we first presented this plan to you,

we said it would not be a large binder that

collects dust on a shelf. This strategic plan is a

roadmap for action, and we are taking action.

Bold action. That’s what it takes to drive

transformation.

The results are starting to come. Many of our

investments are already gaining traction. With

your help and continued commitment, we are

building on that momentum to create the kind

of company that we will all be proud to be a

part of.

Sincerely,

John R. Hartmann

President and Chief Executive Ocer

Brent A. Burger

Chairman of the Board

TRUE VALUE 2015 ANNUAL REPORT 5

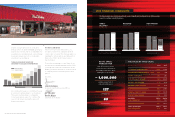

We have begun to generate momentum in a year of significant investment in our future, and we

expect to continue to build from here.

THE VALUE OF TRUE VALUE

($ IN MILLIONS) 2014 2015

PATRONAGE DIVIDEND/CASH $20.5 $19.0

PATRONAGE DIVIDEND/NOTES & STOCK $20.6 0.0

INTEREST ON NOTES $6.2

$6.1

PROMOTIONAL DISCOUNTS $35.1 $36.0

DATING & ANTICIPATION $17.1

$17. 9

REUNION SPIFFS/RACKING $7. 5

$7. 8

MARKETING REIMBURSEMENTS $10.9

$10.3

GROWTH CREDITS & LOANS $33.7

$41.0

PROMOTIONAL FREIGHT $3.6

$5.8

SU BTOTAL $155.2 $143.9

% OF PURCHASES 8.2% 7.5%

STRATEGIC INVESTMENT $13.2 $23.2

TOTAL INVESTMENT $168.4 $167.1

% OF PURCHASES 8.9% 8.8%

GROSS

BILLINGS*

$ IN MILLIONS

$1,900.0

2013

$2,014.8

2014 2015

$2,033.2

$1,411.5

2013

$1,495.0

2014 2015

$1 ,497.2

2015 FINANCIAL HIGHLIGHTS

With DTV, new stores and

conversions, we’re doing more

than adding retail space. We’re

making the co-op stronger.

RETAIL SPACE:

MORE/BETTER

Added square feet of

relevant retail space

~ 1,000,000

* Note: fiscal 2014 figures are based on a 53 week year,

fiscal 2013 and 2015 figures are based on 52 week years

New Stores

127

Conversions

63

†Including 2014 Strategy Cost

‡Including 2015 Strategy Cost

$41.1†

$19.0‡

$13.2

million

cost

$23.2

million

cost

REVENUE*

$ IN MILLIONS

NET MARGIN

$ IN MILLIONS

2015

2013 2014

$55.3