Texas Instruments 2013 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2013 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TEXAS INSTRUMENTS 2013 ANNUAL REPORT • 7

ANNUAL

REPORT

NOTES TO FINANCIAL STATEMENTS

1. Description of business and significant accounting policies and practices

Business

At Texas Instruments (TI), we design and make semiconductors that we sell to electronics designers and manufacturers all over the

world. We have two reportable segments, which are established along major categories of products as follows:

• Analog – consists of the following major product lines: High Volume Analog & Logic (HVAL), Power Management (Power), High

Performance Analog (HPA) and Silicon Valley Analog (SVA). SVA consists primarily of products that we acquired through our

purchase of National Semiconductor Corporation (National) in 2011.

• Embedded Processing – consists of the following major product lines: Processors, Microcontrollers and Connectivity.

We report the results of our remaining business activities in Other. As a result of our decision to exit certain product lines, Other

also includes our baseband products and our OMAP™ applications processors and connectivity products sold into smartphones and

consumer tablets. These products, which we refer to as “legacy wireless products,” were part of our former Wireless segment. The

Wireless segment was eliminated effective January 1, 2013. To conform to this revised reporting structure, we filed a Form 8-K on

May 3, 2013, to recast prior period segment information presented in our Form 10-K for the year ended December 31, 2012. See Note

16 for additional information on our business segments.

Basis of presentation

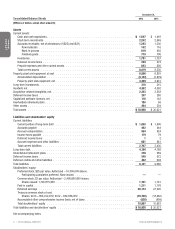

The consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States

(U.S. GAAP). The basis of these financial statements is comparable for all periods presented herein.

The consolidated financial statements include the accounts of all subsidiaries. All intercompany balances and transactions have

been eliminated in consolidation. All dollar amounts in the financial statements and tables in these notes, except per-share amounts,

are stated in millions of U.S. dollars unless otherwise indicated. We have reclassified certain amounts in the prior periods’ financial

statements to conform to the 2013 presentation. The preparation of financial statements requires the use of estimates from which final

results may vary.

In September 2011, we completed the acquisition of National. We accounted for this transaction under Accounting Standards

Codification (ASC) 805 – Business Combinations, and the consolidated financial statements include the results of operations of National

from the date of acquisition. See Note 2 for more information.

Revenue recognition

We recognize revenue from direct sales of our products to our customers, including shipping fees, when title and risk of loss pass to

the customer, which usually occurs upon shipment or delivery, depending upon the terms of the sales order; when persuasive evidence

of an arrangement exists; when sales amounts are fixed or determinable; and when collectability is reasonably assured. Revenue from

sales of our products that are subject to inventory consignment agreements is recognized consistent with the principles discussed

above, but delivery occurs when the customer pulls product from consignment inventory that we store at designated locations.

Estimates of product returns for quality reasons and of price allowances, which are based on historical experience, product shipment

analysis and customer contractual arrangements, are recorded when revenue is recognized. Allowances include volume-based

incentives and special pricing arrangements. In addition, we record allowances for accounts receivable that we estimate may not

be collected.

We recognize revenue from direct sales of our products to our distributors, net of allowances, consistent with the principles

discussed above. Title transfers to the distributors at delivery or when the products are pulled from consignment inventory, and payment

is due on our standard commercial terms; payment terms are not contingent upon resale of the products. We calculate credit allowances

based on historical data, current economic conditions and contractual terms. For instance, we sell to distributors at standard published

prices, but we may grant them price adjustment credits in response to individual competitive opportunities they may have. To estimate

allowances, we use statistical percentages of revenue, determined quarterly, based upon recent historical adjustment trends. We also

provide allowances for certain growth-based incentives.

We provide distributors an allowance to scrap certain slow-selling or obsolete products in their inventory, estimated as a negotiated

fixed percentage of each distributor’s purchases from us. In addition, if we publish a new price for a product that is lower than that

paid by distributors for the same product still remaining in each distributor’s on-hand inventory, we may credit them for the difference

between those prices. The allowance for this type of credit is based on the identified product price difference applied to our estimate

of each distributor’s on-hand inventory of that product. We believe we can reasonably and reliably estimate allowances for credits to

distributors in a timely manner.