Texas Instruments 2013 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2013 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TEXAS INSTRUMENTS 2013 ANNUAL REPORT • 13

ANNUAL

REPORT

Other

Gain on technology transfer

During the second quarter of 2013, we entered into an agreement to transfer wireless connectivity technology to a customer. This

technology was associated with the former Wireless business, and we recognized a gain of $315 million on this transfer.

Gain on transfer of Japan substitutional pension

During the third quarter of 2012, we transferred the obligations and assets of the substitutional portion of our Japan pension plan to the

government of Japan, resulting in a net gain of $144 million. See Note 11 for additional details.

4. Losses associated with the 2011 earthquake in Japan

In March 2011, a magnitude 9.0 earthquake struck near our semiconductor manufacturing facilities in Japan. Our manufacturing site in

Miho suffered substantial damage. We maintain earthquake insurance policies in Japan for limited coverage for property damage and

business interruption losses.

In 2011, we incurred cumulative gross operating losses of $101 million related to the earthquake and associated events in Japan.

These losses related to property damage, the underutilization expense we incurred from having our manufacturing assets only partially

loaded and costs associated with recovery teams assembled from across the world. Gross operating losses did not comprehend any lost

revenue.

These losses were offset by $36 million in cumulative insurance proceeds related to property damage claims, of which $13 million

was received in 2012 and $23 million was received in 2011. Almost all of these costs and proceeds are included in COR in our

Consolidated statements of income and are recorded in Other.

In addition, we recognized $172 million in cumulative insurance proceeds through December 31, 2012, of which $135 million was

received in 2012 and $37 million was received in 2011, related to business interruption claims. These proceeds are recorded as revenue

in our Consolidated statements of income and in Other.

In the third quarter of 2012, we completed discussions with our insurers and their advisors. All claims related to these events have

been settled and the proceeds received.

5. Stock-based compensation

We have stock options outstanding to participants under various long-term incentive plans. We also have assumed stock options that

were granted by companies that we later acquired. Unless the options are acquisition-related replacement options, the option price

per share may not be less than 100 percent of the fair market value of our common stock on the date of the grant. Substantially all the

options have a ten-year term and vest ratably over four years. Our options generally continue to vest after the option recipient retires.

We also have RSUs outstanding under long-term incentive plans. Each RSU represents the right to receive one share of TI common

stock on the vesting date, which is generally four years after the date of grant. Upon vesting, the shares are issued without payment by

the grantee. Beginning with 2013 grants, RSUs generally continue to vest after the recipient retires. Holders of most RSUs receive an

annual cash payment equal to the dividends paid on our common stock.

We have options and RSUs outstanding to non-employee directors under various director compensation plans. The plans generally

provide for annual grants of stock options and RSUs, a one-time grant of RSUs to each new non-employee director and the issuance of

TI common stock upon the distribution of stock units credited to deferred compensation accounts established for such directors.

We also have an employee stock purchase plan under which options are offered to all eligible employees in amounts based on a

percentage of the employee’s compensation, subject to a cap. Under the plan, the option price per share is 85 percent of the fair market

value on the exercise date, and options have a three-month term.

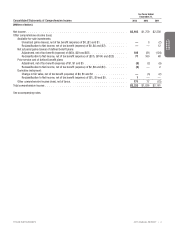

Total stock-based compensation expense recognized was as follows:

For Years Ended

December 31,

2013 2012 2011

Stock-based compensation expense recognized in:

COR . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 49 $ 48 $ 40

R&D . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 67 71 58

SG&A . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 160 127 121

Acquisition charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11 17 50

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $287 $263 $269