Texas Instruments 2012 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2012 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TEXAS INSTRUMENTS 2012 ANNUAL REPORT • 5

ANNUAL

REPORT

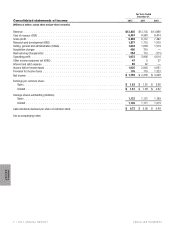

For Years Ended

December 31,

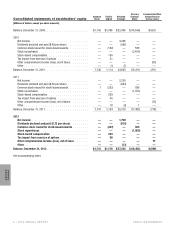

Consolidated statements of cash flows 2012 2011 2010

[Millions of dollars]

Cash flows from operating activities:

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,759 $ 2,236 $ 3,228

Adjustments to net income:

Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 957 904 865

Amortization of acquisition-related intangibles . . . . . . . . . . . . . . . . . . . . . . . . . 342 111 48

Stock-based compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 263 269 190

Gain on sales of assets and divestiture . . . . . . . . . . . . . . . . . . . . . . . . . . . . . —(5) (144)

Deferred income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65 (119) (188)

Gain on transfer of Japan substitutional pension . . . . . . . . . . . . . . . . . . . . . . . . (144) — —

Increase (decrease) from changes in:

Accounts receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 311 112 (231)

Inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5(17) (304)

Prepaid expenses and other current assets . . . . . . . . . . . . . . . . . . . . . . . . . . . 227 (29) (8)

Accounts payable and accrued expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . 99 2 57

Accrued compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (82) (77) 246

Income taxes payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (229) (85) (19)

Changes in funded status of retirement plans . . . . . . . . . . . . . . . . . . . . . . . . . . . (198) (7) 26

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39 (39) 54

Cash flows from operating activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,414 3,256 3,820

Cash flows from investing activities:

Additions to property, plant and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (495) (816) (1,199)

Proceeds from insurance recovery, asset sales and divestiture . . . . . . . . . . . . . . . . . . . —16 148

Purchases of short-term investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2,802) (3,653) (2,510)

Proceeds from short-term investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,198 3,555 2,564

Purchases of long-term investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1) (6) (8)

Proceeds from long-term investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 61 157 147

Business acquisitions, net of cash acquired . . . . . . . . . . . . . . . . . . . . . . . . . . . . —(5,425) (199)

Cash flows from investing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,039) (6,172) (1,057)

Cash flows from financing activities:

Proceeds from issuance of long-term debt and commercial paper borrowings . . . . . . . . . . . 1,492 4,697 —

Repayment of debt and commercial paper borrowings . . . . . . . . . . . . . . . . . . . . . . . (1,375) (200) —

Dividends paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (819) (644) (592)

Stock repurchases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,800) (1,973) (2,454)

Proceeds from common stock transactions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 523 690 407

Excess tax benefit from share-based payments . . . . . . . . . . . . . . . . . . . . . . . . . . 38 31 13

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (10) (12) —

Cash flows from financing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,951) 2,589 (2,626)

Net change in cash and cash equivalents. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 424 (327) 137

Cash and cash equivalents at beginning of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . 992 1,319 1,182

Cash and cash equivalents at end of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,416 $ 992 $ 1,319

See accompanying notes.