Texas Instruments 2012 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2012 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL

REPORT

TEXAS INSTRUMENTS12 • 2012 ANNUAL REPORT

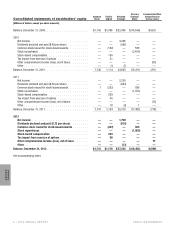

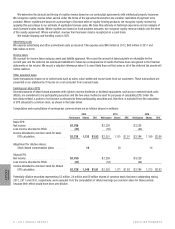

3. Restructuring charges/other

Restructuring charges/other is comprised of the following components:

For Years Ended

December 31,

2012 2011 2010

Restructuring charges by action:

Restructuring charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 261 $ — $ —

Goodwill impairment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 90 — —

2012 Wireless action . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 351 — —

2011 action . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 49 112 —

2008/2009 actions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . —— 33

Other:

Gain on transfer of Japan substitutional pension . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (144) — —

Gain on divested product line . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . —— (144)

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8— —

Restructuring charges/other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 264 $112 $ (111)

Restructuring charges/other recognized by segment are as follows:

For Years Ended

December 31,

2012 2011 2010

Analog . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $ — $ 13

Embedded Processing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . —— 6

Wireless . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 351 — 10

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (87) 112 (140)

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 264 $112 $ (111)

Restructuring charges

Restructuring charges may consist of voluntary or involuntary severance-related charges, asset-related charges and other costs to

exit activities. We recognize voluntary termination benefits when the employee accepts the offered benefit arrangement. We recognize

involuntary severance-related charges depending on whether the termination benefits are provided under an ongoing benefit

arrangement or under a one-time benefit arrangement. If the former, we recognize the charges once they are probable and the amounts

are estimable. If the latter, we recognize the charges once the benefits have been communicated to employees.

Restructuring activities associated with assets are recorded as an adjustment to the basis of the asset, not as a liability. When we

commit to a plan to abandon a long-lived asset before the end of its previously estimated useful life, we accelerate the recognition of

depreciation to reflect the use of the asset over its shortened useful life. When an asset is held to be sold, we write down the carrying

value to its net realizable value and cease depreciation. Restructuring actions may be viewed as an impairment indicator requiring

testing of the recoverability of intangible assets, including goodwill.

2012 Wireless action

In November 2012, we announced an action concerning our Wireless business that, when complete, is expected to reduce annualized

expenses by about $450 million and will focus our investments on embedded markets with greater potential for sustainable growth.

About 1,700 jobs worldwide are expected to be eliminated. The total restructuring charges related to this action will be about

$360 million, of which about $245 million will be for severance and related benefits. We recognized $351 million of these costs in the

fourth quarter of 2012 consisting of: $245 million for severance and benefit costs and other non-cash items of $3 million of accelerated

depreciation of the affected facilities’ assets, $13 million for other exit costs and $90 million for the non-tax deductible impairment of

goodwill. See Note 10 for additional information on the goodwill impairment charge. We estimate that this action will be substantially

complete by the end of 2013. As of December 31, 2012, $4 million has been paid to terminated employees for severance and benefits

related to this action.