Tesco 2014 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2014 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

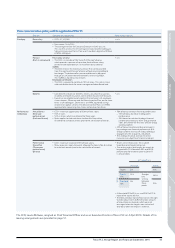

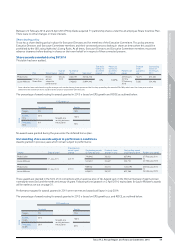

How do performance measures link to strategy?

The balance of short-term performance measures is illustrated in the chart below:

Short-term performance

Performance measure Link to strategy

Profitability (50% of short-term)

• Trading profit

The profit measure incentivises the delivery of our strategy by encouraging the creation of shareholder value through

bottom-line financial results. Trading profit is used as it is widely understood throughout the business, and does not

include property profits. This reflects our fundamentally different approach to space going forward.

Strategic financial performance

(26% of short-term)

• Group internet sales (10%)

• UK like-for-like sales (8%)

• Group working capital (8%)

The selected strategic financial measures allow for the Company to more specifically incentivise the delivery of key

elements of our strategy.

Establishing multichannel leadership is an important and exciting dimension of our strategy and continues to be a key

focus for 2014/15.

Another key priority for 2014/15 is delivering on our commitments to continue to invest in a strong UK business.

A focus on improving like-for-like performance will support this.

A working capital metric is included to focus Executives on the effective management of stock, cash and suppliers.

Strategic non-financial performance

(24% of short-term)

• Group customer service (8%)

• Group colleague engagement (8%)

• Group CO2 reduction (8%)

At Tesco we believe that a focus on the enablers of business performance will help us build a much more successful,

sustainable business for the long term which will ultimately yield financial returns for all stakeholders.

The Committee therefore decided it remained important to focus the annual bonus framework on:

• Improving our service to our customers.

• Improving the engagement of all of our colleagues – if our colleagues smile, our customers smile too.

• Being a business that puts back into our community.

Group customer service and Group colleague engagement is objectively measured through our management Steering

Wheel which ensures that we manage in a balanced way across our business.

Bonus targets are considered by the Board to be commercially sensitive as they would give away details of our budgeting to our

competitors. We therefore do not publish the details of targets. However, targets are considered to be measurable and appropriately

stretching. If they are achieved the Committee considers that value will have been added for shareholders.

The Committee will provide an explanation of the rationale for the level of any bonus paid in the 2014/15 Directors’ Remuneration

Report including details of where performance fell within the target range to ensure transparency for shareholders regarding the level

of reward paid in the context of performance delivered. The Committee will disclose performance targets when they are no longer

considered to be commercially sensitive.

Long-term performance

Performance measure Link to strategy

Earnings per share and return on capital

employed (matrix)

The ultimate goal of our strategy is to provide long-term sustainable returns for all of our shareholders. Tesco believes

that the best way to deliver enhanced value is to grow earnings over the long term while maintaining a sustainable level

of return on capital employed – in other words to keep growing the size of the business in an efficient way.

2014 Performance Share Plan awards will continue to be subject to performance against a matrix of stretching earnings

growth targets and sustainable return on capital performance. The Committee believes that this combination of EPS

growth and ROCE performance is strongly aligned with our strategic objectives and also reflects the drivers of

long-term shareholder value.

Performance targets are outlined in the table on page 43 and are unchanged from the 2013 awards.

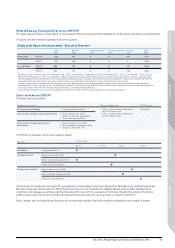

Balance of measures for short-term bonus (%)

50%

26%

24%

Profitability

Strategic financial

Strategic non-financial

44 Tesco PLC Annual Report and Financial Statements 2014

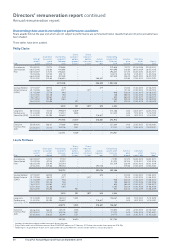

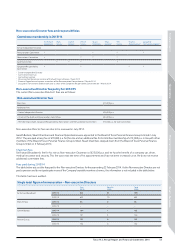

Directors’ remuneration report continued

Annual remuneration report