Tesco 2009 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2009 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52 DIRECTORS’ REMUNERATION REPORT

Tesco PLC Annual Report and Financial Statements 2009

Directors’ remuneration report continued

Participation in the various elements is governed by the Remuneration

Committee and individual Executives are awarded incentives under the

elements which are most relevant to their sphere of responsibility.

If performance is lower than the maximum targets, incentive payments will

reduce accordingly and will be zero if threshold levels of performance are not

attained. The Committee has reviewed the performance conditions for each

of the incentive arrangements against the Group’s business strategy, its

growing global leadership, its position as one of the rising companies at the

top of the FTSE 100 and the intensely competitive sector in which it operates,

and has concluded that they provide a set of comprehensive and robust

measures of management’s effort and success in creating shareholder value.

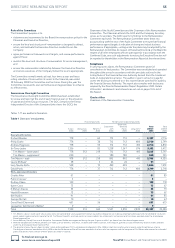

Share ownership guidelines

The Remuneration Committee believes that Executive Directors holding

shares aligns their interests with shareholders and demonstrates their

ongoing commitment to the business. Executive Directors are required to

build and maintain a shareholding with a value at least equal to their basic

salary. New appointees will typically be allowed three years to establish this

shareholding. Full participation in the long-term Performance Share Plan is

conditional upon this. All Executive Directors currently satisfy this requirement.

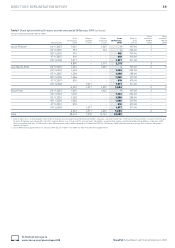

Shares held by Executive Directors

as at 28 February 2009

0 1,000,000 2,000,000 3,000,000 4,000,000 5,000,000 6,000,000 7,000,000 8,000,000

Ordinary shares SIP LTIP EIP PSP

Richard Brasher

Philip Clarke

Andrew Higginson

Tim Mason*

Laurie Mcllwee

Lucy Neville-Rolfe

David Potts

Sir Te rry Leahy

* Tim Mason sold 631,384 ordinary shares on 22 April 2009.

Includes ordinary shares and awards of shares and nil cost options made to Directors

which remain subject only to a holding period. Excludes unexercised vested executive

share options.

Funding of equity awards

Executive incentive arrangements are funded by a mix of newly issued

shares and shares purchased in the market. Where shares are newly issued

the Company complies with ABI dilution guidelines on their issue. The

current dilution usage of executive plans is c.4% of shares in issue.

Fixed remuneration

Basic pay

Basic pay is designed to attract and retain talented individuals. It needs to

reflect individual capability and any changes in responsibilities as the Group

faces new opportunities and challenges. As the Group continues to diversify

into new product areas and services, as well as expanding internationally,

it seeks to reflect this in the benchmarking that is used. We examine salary

levels at the major retailers, the leading FTSE companies and ensure

consideration is given to international competitors. We also take into account

pay conditions throughout the Group in deciding executive annual salary

increases. The average increase for senior management below Board level

last year was 5%, whereas for other staff the average increase was typically

around 4%. Basic salaries are typically increased with effect from 1 July

each year and the Remuneration Committee will be taking into account the

current economic climate in setting salaries for the coming year.

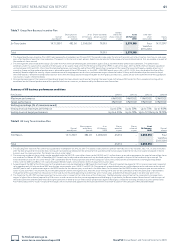

Basic salary 1 July 2008

Director £000

Richard Brasher 792

Philip Clarke 792

Andrew Higginson 792

Sir Terry Leahy 1,375

Tim Mason 792

Laurie McIlwee* 550

Lucy Neville-Rolfe 554

David Potts 792

* Salary on appointment 27 January 2009.

Pensions

Pension provision is central to our ability to foster loyalty and retain experience

which is why Tesco wants to ensure that the Tesco PLC Pension Scheme is a

highly valued benefit. All Executive Directors are members of the Tesco PLC

Pension Scheme which provides a pension of up to two-thirds of base salary

on retirement, normally at age 60, dependent on service. The Final Salary

Scheme is now closed to new entrants but has been replaced throughout

the organisation by a different defined-benefit pension scheme based on

career average earnings. Since April 2006, following implementation of the

regulations contained within the Finance Act 2004, Executive Directors have

been eligible to receive the maximum pension that can be provided from the

registered pension scheme. The balance of any pension entitlement for all

Executive Directors is delivered through an unapproved retirement benefits

scheme (SURBS). Except for Tim Mason, the SURBS is ‘secured’ by using a

fixed charge over a cash deposit in a designated account.

Over the last few years pension contributions by our Executive Directors

have been increasing progressively. In 2008/9 the level of contribution was

7% of salary which is in line with senior management’s contribution levels.

Contributions will rise over the next three years to 10% by 2011/12. Further

details of the pension benefits earned by the Directors can be found on

page 56.

All employee share schemes

The Executive Directors are eligible to participate in the Company’s all

employee share schemes on the same terms as UK employees.

Shares In Success. Shares in the Company are allocated to participants •

in the scheme up to HMRC approved limits (currently £3,000 per annum).

The amount of profit allocated to the scheme is determined by the

Board, taking account of Company performance.

Buy as You Earn. An HMRC approved share purchase scheme under •

which employees invest up to a limit of £110 on a four-weekly basis to

buy shares at the market value in Tesco PLC.

Save as You Earn. An HMRC approved savings-related share option •

scheme under which employees save up to a limit of £250 on a four-

weekly basis via a bank/building society with an option to buy shares in

Tesco PLC at the end of a three-year or five-year period at a discount of

up to 20% of the market value. There are no performance conditions

attached to SAYE options.

Other benefits

The Executive Directors are eligible for car benefits, life assurance,

disability and health insurance and staff discount.

2008/9 Performance measurement

Short-term performance 2008/9

Earnings per share

The reported underlying diluted Group EPS for 2008/9 was 28.92p,

an increase of 7% on last year.

Corporate objectives

The corporate objectives are based on our balanced scorecard, the

Steering Wheel. Corporate objectives for the awards made in respect

of the financial year 2008/9 included increasing sales from new space;

specific profit targets for international businesses and for retailing services;

like-for-like sales growth and the development of the non-food business;

focus on developing trading models internationally; enhancing talent