Tesco 2009 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2009 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

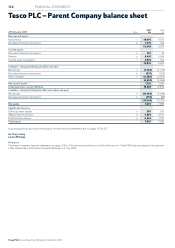

132 FINANCIAL STATEMENTS

Tesco PLC Annual Report and Financial Statements 2009

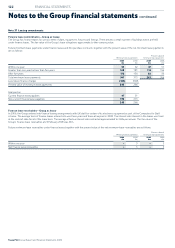

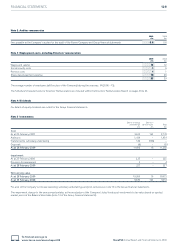

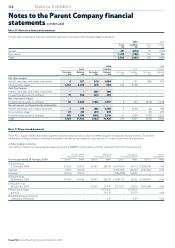

Note 10 Derivative financial instruments

The fair value of derivative financial instruments has been disclosed in the Company’s Balance Sheet as:

2009 2008

Asset Liability Asset Liability

£m £m £m £m

Current 291 (373) 76 (413)

Non-current 1,473 (194) 216 (86)

Total 1,764 (567) 292 (499)

2009 2008

Asset Liability Asset Liability

Fair value Notional Fair value Notional Fair value Notional Fair value Notional

£m £m £m £m £m £m £m £m

Fair value hedges

Interest rate swaps and similar instruments 6 257 (31) 1,000 2 125 (80) 657

Cross currency swaps 1,444 4,293 (41) 996 252 2,788 – –

Cash flow hedges

Interest rate swaps and similar instruments – – (66) 400 – – – –

Forward foreign currency contracts 19 656 (23) 283 – – – –

Net investment hedges

Forward foreign currency contracts 92 2,623 (194) 2,767 2 289 (218) 2,328

Derivatives not in a formal hedge relationship

Interest rate swaps and similar instruments 1 774 (30) 3,280 5 3,638 (2) 189

Cross currency swaps 20 219 (47) 639 – – (2) 204

Forward foreign currency contracts 182 2,632 (135) 2,561 31 1,589 (197) 2,625

Total 1,764 11,454 (567) 11,926 292 8,429 (499) 6,003

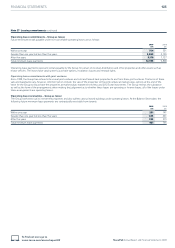

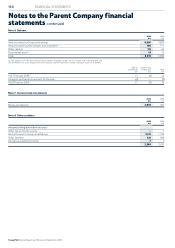

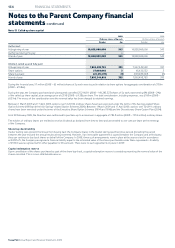

Note 11 Share-based payments

Tesco PLC’s equity-settled share-based payment schemes comprise various share schemes designed to reward Executive Directors. For further

information on these schemes, including the valuation models and assumptions used, see note 27 to the Group financial statements.

a) Share option schemes

The number of options and weighted average exercise price (WAEP) of share option schemes relating to Tesco PLC employees are:

Savings-related Approved Unapproved Nil cost

share option scheme share option scheme share option scheme share options

For the year ended 28 February 2009 Options WAEP Options WAEP Options WAEP Options WAEP

Outstanding at

23 February 2008 37,652 269.29 53,381 280.99 12,191,979 303.75 10,838,238 0.00

Granted 7,539 311.00 – – 2,615,968 427.00 3,591,855 0.00

Exercised (8,125) 195.00 – – (126,832) 164.00 – –

Outstanding at

28 February 2009 37,066 294.06 53,381 280.99 14,681,115 326.92 14,430,093 0.00

Exercisable as at

28 February 2009 – – 43,965 272.93 7,511,677 258.10 2,050,588 0.00

Exercise price range 197.50 to 173.00 to

(pence) – – – 312.75 – 312.75 – 0.00

Weighted average remaining

contractual life (years) – – – 5.47 – 4.29 – 5.82

Notes to the Parent Company financial

statements continued