Tesco 2001 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2001 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2TESCO PLC

OPERATING AND FINANCIAL REVIEW

This operating and financial review analyses the

performance of Tesco in the financial year ended

24 February 2001. It also explains other aspects of the

Group’s results and operations including taxation and

treasury management.

Group performance

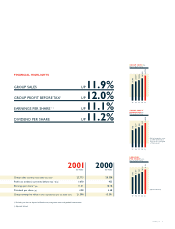

Group sales including VAT increased by 11.9% to £22,773m

(2000 – £20,358m).

Group profit on ordinary activities before tax (excluding the

net loss on disposal of fixed assets, integration costs and goodwill

amortisation) increased by 12.0% to £1,070m.

Group capital expenditure was £1,944m (2000 – £1,488m)

including £200m for the re-purchase of UK stores previously part

of sale and leaseback agreements. UK capital expenditure was

£1,206m, including £705m on new stores and £175m on extensions

and refits. Total international capital expenditure was £738m

including £390m in Asia. In the year ahead we see Group capital

expenditure increasing slightly to £2.0bn, including £200m of further

store buy-backs.

Group net debt in the year increased by £744m to £2,804m

(2000 – £2,060m), with gearing increasing to 52% (2000 – 43%).

Group interest and taxation

Net interest payable was £125m (2000 – £99m). Additional

borrowings to fund our investment plans resulted in this increase.

Corporation tax has been charged at an effective rate of

27.3% (2000 – 27.8%). Prior to accounting for the net loss on

disposal of fixed assets, integration costs and goodwill amor-

tisation, our underlying tax rate was 26.9% (2000 – 27.4%).

Shareholder returns and dividends

Adjusted diluted earnings per share (excluding the net loss on

disposal of fixed assets, integration costs and goodwill amortisation)

increased by 11.1% to 11.31p (2000 – 10.18p).

The Board has proposed a final dividend of 3.50p (2000 –

3.14p) giving a total dividend for the year of 4.98p (2000 – 4.48p).

This represents an increase of 11.2% and maintains dividend cover

at 2.27 times.

Shareholders’ funds, before minority interests, increased by £587m.

This was due to retained profits of £427m and new shares issued less

expenses of £162m, offset by losses on foreign currency translation of

£2m. As a result, return on shareholders’ funds was 21.1%.

Total shareholder return, which is measured as the percentage

change in the share price plus the dividend, has been 28.5% over

the last five years, compared to the market average of 12.5% and

has been 19.2% over the last three years, compared to the market

average of 5.3%. In the last year, total shareholder return in Tesco

was 62.2% compared to the market average of (0.2)%.

2001 2000 Change

Group summary £m £m %

Group sales

(including value added tax) 22,773 20,358 11.9

Group operating profit

(prior to integration costs

and goodwill amortisation) 1,174 1,043 12.6

Profit on ordinary activities before tax†1,070 955 12.0

Adjusted diluted earnings per share†11.31p 10.18p 11.1

Dividend per share 4.98p 4.48p 11.2

†Excluding net loss on disposal of fixed assets, integration costs and goodwill

amortisation

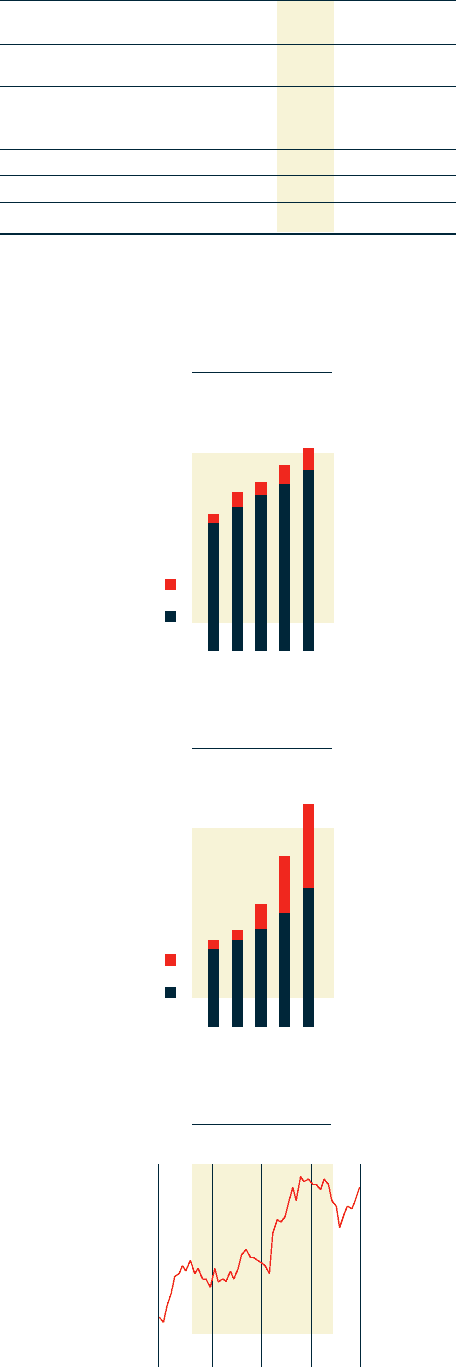

97 98 99 00

14,984

17,447*

18,546

20,358

01

22,773

GROUP

PERFORMANCE £m

*52 weeks pro forma

14,024

15,799*

17,070

18,331

19,880

Group sales

UK retail sales

97 98 99 00

841

1,067

1,488

01

1,944

CAPITAL

EXPENDITURE £m

682

757

848

989

1,206

Group

UK

758

Feb 01Dec 00Oct 00Jun 00Mar 00

169.0

271.0

TESCO SHARE

PRICE Pence