Tesco 2001 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2001 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36 TESCO PLC

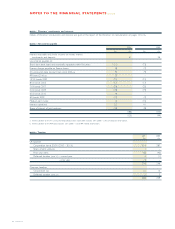

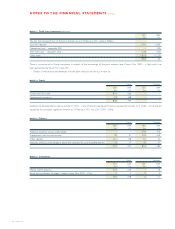

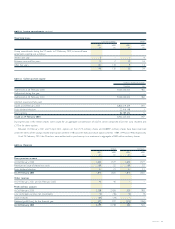

NOTE 24 Reserves continued

Other reserves comprise a merger reserve arising on the acquisition of Hillards plc in 1987.

In accordance with section 230 of the Companies Act 1985 a profit and loss account for Tesco PLC, whose result for the year is shown

above, has not been presented in these accounts.

The cumulative goodwill written off against the reserves of the Group as at 24 February 2001 amounted to £718m (2000 – £718m).

During the year, the qualifying share ownership trust (QUEST) subscribed for 50 million shares from the company. The amount of £64m shown

above represents contributions to the QUEST from subsidiary undertakings.

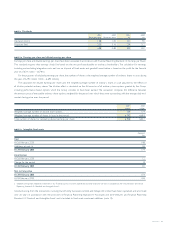

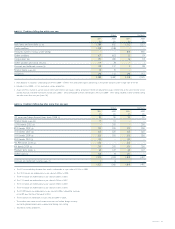

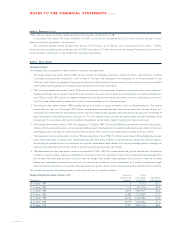

NOTE 25 Share options

Company schemes

The company had six principal share option schemes in operation during the year:

i The savings-related share option scheme (1981) permits the grant to employees of options in respect of ordinary shares linked to a building

society/bank save-as-you-earn contract for a term of three or five years with contributions from employees of an amount between £5 and

£250 per month. Options are capable of being exercised at the end of the three and five year period at a subscription price not less than 80%

of the middle market quotation of an ordinary share immediately prior to the date of grant.

ii The Irish savings-related share option scheme (2000) permits the grant to Irish employees of options in respect of ordinary shares linked to a

building society/bank save-as-you-earn contract for a term of three or five years with contributions from employees of an amount between £10

and £250 per month (£IR). Options are capable of being exercised at the end of the three and five year period at a subscription price not less

than 75% of the middle market quotation of an ordinary share immediately prior to the date of grant.

iii The executive share option scheme (1984) permitted the grant of options in respect of ordinary shares to selected executives. The scheme

expired after ten years on 9 November 1994. Options were generally exercisable between three and ten years from the date of grant at a

subscription price determined by the Board but not less than the middle market quotation within the period of 30 days prior to the date of

grant. Some options have been granted at a discount of 15% of the standard option price but the option holder may take advantage of that

discount only if, in accordance with investor protection ABI guidelines, certain targets related to earnings per share are achieved.

iv The executive share option scheme (1994) was adopted on 17 October 1994. The principal difference between this scheme and the previous

scheme is that the exercise of options will normally be conditional upon the achievement of a specified performance target related to the annual

percentage growth in earnings per share over any three year period. There will be no discounted options granted under this scheme.

v The unapproved executive share option scheme (1996) was adopted on 7 June 1996. This scheme was introduced following legislative changes

which limited the number of options which could be granted under the previous scheme. As with the previous scheme, the exercise of options

will normally be conditional upon the achievement of a specified performance target related to the annual percentage growth in earnings per

share over any three year period. There will be no discounted options granted under this scheme.

vi The international executive share option scheme was adopted on 20 May 1994. This scheme permits the grant to selected non-UK executives

of options to acquire ordinary shares on substantially the same basis as their UK counterparts. Options are normally exercisable between three

and ten years from their grant at a price of not less than the average of the middle market quotations for the ordinary shares for the three

dealing days immediately preceding their grant and will normally be conditional on the achievement of a specified performance target

determined by the Remuneration Committee when the options are granted. There will be no discounted options granted under this scheme.

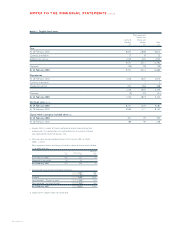

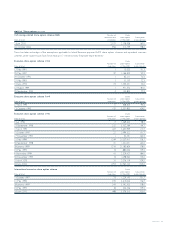

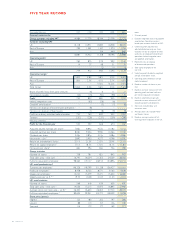

The company has granted outstanding options in connection with the six schemes as follows:

Savings-related share option scheme (1981)Number of Shares

executives and under option Subscription

Date of grant employees 24 Feb 2001 prices (pence)

26 October 1994 6 10,053 61.7

27 October 1995 1,716 3,951,926 83.3

31 October 1996 10,819 26,875,977 83.0

30 October 1997 14,483 25,573,687 121.7

29 October 1998 46,118 57,609,785 136.0

28 October 1999 49,704 43,909,582 151.0

26 October 2000 67,307 48,322,256 198.0

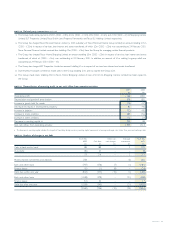

NOTES TO THE FINANCIAL STATEMENTS continued