Tesco 2001 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2001 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.22 TESCO PLC

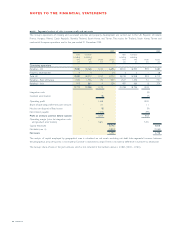

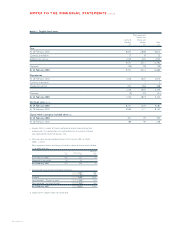

Basis of financial statements

These financial statements have been prepared under the historical

cost convention, in accordance with applicable accounting standards

and the Companies Act 1985.

The Group has adopted Financial Reporting Standard 18,

‘Accounting Policies’, during the year.

Basis of consolidation

The Group profit and loss account and balance sheet consist of the

financial statements of the parent company, its subsidiary

undertakings and the Group’s share of interests in joint ventures.

The accounts of the parent company’s subsidiary undertakings

are prepared to dates around 24 February 2001 apart from Global

T.H., Tesco Polska Sp. z o.o., Tesco Stores C

˘R a.s., Tesco Stores SR

a.s., Samsung Tesco Co. Limited, Tesco Taiwan Co. Limited and

Ek-Chai Distribution System Co. Ltd which prepared accounts to

31 December 2000. In the opinion of the Directors it is necessary

for the above named subsidiaries to prepare accounts to a date

earlier than the rest of the Group to enable the timely publication of

the Group financial statements.

The Group’s interests in joint ventures are accounted for using

the gross equity method. As a result of a change in its financial

year end, the share of interests of joint ventures for the year to

24 February 2001 includes the results of the Tesco Personal Finance

Group for the ten months to 31 December 2000.

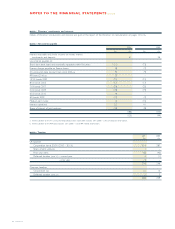

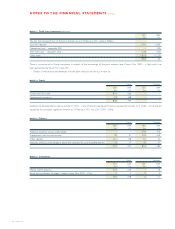

Stocks

Stocks comprise goods held for resale and properties held for, or in

the course of, development and are valued at the lower of cost and

net realisable value. Stocks in stores are calculated at retail prices and

reduced by appropriate margins to the lower of cost and net

realisable value.

Money market deposits

Money market deposits are stated at cost. All income from these

investments is included in the profit and loss account as interest

receivable and similar income.

Fixed assets and depreciation

Fixed assets are carried at cost and include amounts in respect of

interest paid on funds specifically related to the financing of assets in

the course of construction.

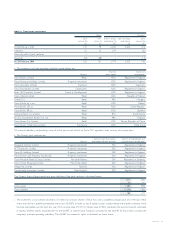

Depreciation is provided on a straight-line basis over the

anticipated useful economic lives of the assets. Following a review of

the useful economic lives and the residual values of a number of

classes of tangible fixed assets, these have been revised.

The principal changes have been to:

• Increase the period over which land premia is amortised from

25 years to 40 years.

• Provide additional depreciation where a decision has been made

to replace a store, to write it down to its net realiseable value

over its remaining useful economic life.

The net effect of these changes has not materially impacted the

results for the year.

The following rates applied for the year ended 24 February 2001:

• Land premia paid in excess of the alternative use value – at 2.5%

of cost.

• Freehold and leasehold buildings with greater than 40 years

unexpired – at 2.5% of cost.

• Leasehold properties with less than 40 years unexpired are

amortised by equal annual instalments over the unexpired

period of the lease.

• Plant, equipment, fixtures and fittings and motor vehicles – at

rates varying from 10% to 33%.

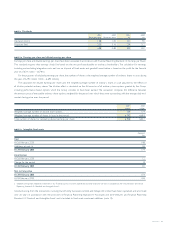

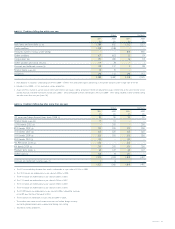

Goodwill

Goodwill arising from transactions entered into after 1 March 1998

is capitalised and amortised on a straight-line basis over its useful

economic life, up to a maximum of 20 years.

All goodwill from transactions entered into prior to 1 March

1998 has been written off to reserves.

Impairment of fixed assets and goodwill

Fixed assets and goodwill are subject to review for impairment in

accordance with Financial Reporting Standard 11, ‘Impairment of

Fixed Assets and Goodwill’. Any impairment is recognised in the

profit and loss account in the year in which it occurs.

ACCOUNTING POLICIES