Tesco 1998 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 1998 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

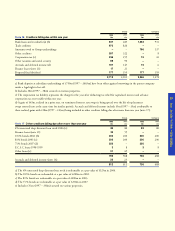

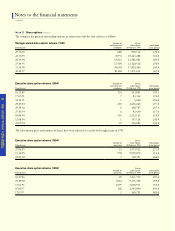

Note 31 Acquisitions

On 8 May 1997 the company acquired the Irish food retailing and related businesses of Associated British Foods plc for £643m.

The results of these businesses from this date to 28 February 1998 have been consolidated within the Group profit and loss account.

In the period from 15 September 1996 to 8 May 1997 they made a profit after taxation of £9m, and in the year to 14 September

1996 they made a profit after taxation of £38m with no minority interests.

The company also acquired a controlling interest in the Polish chain of stores called Madex and Minor on 10 March 1997 for £4m,

and retailing businesses in the UK, during the year, for £10m.

All of the Group’s acquisitions have been accounted for using acquisition accounting.

The acquisitions of the Irish businesses, the Polish chain and UK businesses have been consolidated into the Tesco Group balance

sheet as follows:

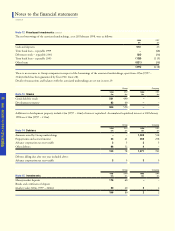

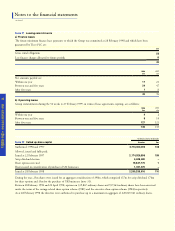

Note 30 Reconciliation of operating profit to net cash

inflow from operating activities

Operating profit

Depreciation

Increase in goods held for resale

(Increase)/decrease in development property

(Increase)/decrease in debtors

Increase in trade creditors

Increase in other creditors

(Increase)/decrease in working capital

Net cash inflow from operating activities

Continuing

£m

819

348

(6)

(108)

(40)

88

31

(35)

1,132

Discontinued

£m

(2)

10

–

–

4

9

3

16

24

1998 Total

£m

817

358

(6)

(108)

(36)

97

34

(19)

1,156

1997 Total

£m

774

317

(19)

44

(7)

74

36

128

1,219

Fixed assets

Stock

Debtors

Net cash

Loans

Creditors

Taxation

Shareholders’ funds

Goodwill

Total purchase consideration

Fair value

adjustments

£m

19

–

12

–

–

–

–

31

Balance sheet

at acquisition

Other

£m

10

2

–

–

–

(9)

–

3

Ireland

£m

304

64

21

65

(20)

(245)

(11)

178

Fair value

balance

sheet

£m

333

66

33

65

(20)

(254)

(11)

212

445

657

The fair value adjustments all relate to the Irish businesses and comprise £19m on the revaluation of the property portfolio and

£12m in respect of the recognition of pension surpluses.There were no material adjustments to achieve consistency of accounting

policies. Included within the Ireland acquisition balance sheet was £9m in respect of the Lifestyle businesses which were subsequently

sold (see note 32).This included fixed assets totalling £5m and stock totalling £4m.There were no fair value adjustments in respect

of these assets.

3 7