Tesco 1998 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 1998 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 6

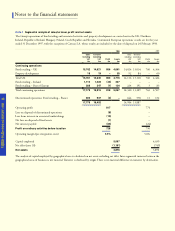

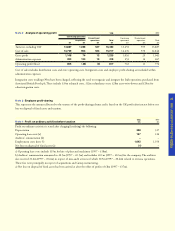

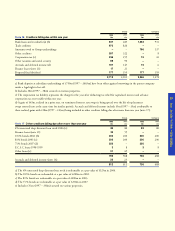

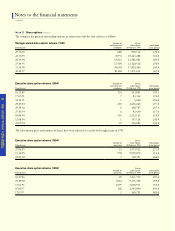

Note 11 Tangible fixed assets

Cost

At 22 February 1997

Currency translation

Additions at cost (a)

Purchase of subsidiary undertakings

Disposals (b)

At 28 February 1998

Depreciation

At 22 February 1997

Currency translation

Charge for period

Purchase of subsidiary undertakings

Disposals (b)

At 28 February 1998

Net book value (c) (d)

At 28 February 1998

At 22 February 1997

Capital work in progress included above (e)

At 28 February 1998

At 22 February 1997

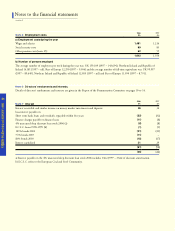

a) Includes £20m (1997 – £16m) in respect of interest capitalised net of tax relief of £8m (1997 – £7m) principally relating to land

and building assets.

b) Fully depreciated assets not in use in the business totalling £181m have been removed from fixed assets in the year.

c) Net book value includes capitalised interest, net of tax relief, at 28 February 1998 of £278m (1997 – £268m). Plant, equipment,

fixtures and fittings and vehicles subject to finance leases included in net book value is:

Plant equipment

fixtures and

fittings and

vehicles

£m

1,948

(38)

312

291

2,513

(345)

2,168

1,210

(10)

209

168

1,577

(292)

1,285

883

738

17

31

Land and

buildings

£m

5,697

(46)

529

239

6,419

(252)

6,167

609

(18)

149

29

769

(30)

739

5,428

5,088

118

108

Total

£m

7,645

(84)

841

530

8,932

(597)

8,335

1,819

(28)

358

197

2,346

(322)

2,024

6,311

5,826

135

139

At 22 February 1997

Movement in the period

At 28 February 1998

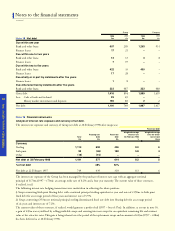

d) The net book value of land and buildings comprises:

Depreciation

£m

155

(6)

149

Cost

£m

202

(23)

179

Net book

value

£m

47

(17)

30

Freehold

Long leasehold – 50 years or more

Short leasehold – less than 50 years

At 28 February 1998

e) Capital work in progress does not include land.

1998

£m

4,628

508

292

5,428

1997

£m

4,245

544

299

5,088

Notes to the financial statements

c o n t i n u e d

f)Net book value is stated after charging £28m in respect of integration costs incurred on acquisition of the Irish businesses.