Tesco 1998 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 1998 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 0

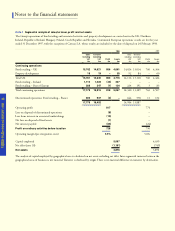

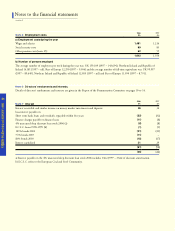

Basis of financial statements

The financial statements have been prepared in accordance with

applicable accounting standards, under the historical cost

c o n v ention, and are in accordance with the Companies Act 19 8 5 .

Basis of consolidation

The Group profit and loss account and balance sheet consist of

the financial statements of the parent company and its subsidiary

undertakings, all of which are prepared to or around 28 February

1998 apart from Global T.H., Tesco Polska Sp. z o.o., Tesco

Stores C

˘Ra.s. and Tesco Stores SR a.s. which had 31 December

1997 year ends.The results of Catteau S.A. have been included

to 24 February 1998, its date of disposal. In the opinion of the

directors it is necessary for the Continental European companies

to prepare financial statements to an accounting date earlier than

the rest of the Group to enable the timely publication of the

Group financial statements.

Any excess or deficiency of purchase consideration in relation to

the fair value of attributable net assets of subsidiary undertakings

at the date of acquisition is adjusted in reserves.

The Group’s share of associated undertakings’ profits or losses is

included in the Group profit and loss account and added to the

cost of investments in the balance sheet. The accounting policies

of associated undertakings are adjusted on consolidation to

achieve consistent Group accounting policies.

Stocks

Stocks comprise goods held for resale and development pro p e rt i e s ,

and are valued at the lower of cost and net realisable value.

Stocks in stores are calculated at retail prices and reduced by

appropriate margins to the lower of cost and net realisable value.

Money market investments

Money market investments are stated at cost. All income from

these investments is included in the profit and loss account as

interest receivable and similar income.

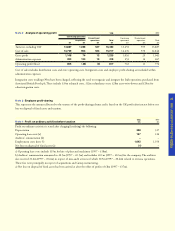

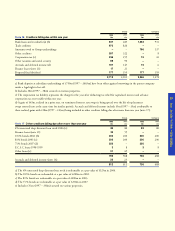

Fixed assets and depreciation

Fixed assets include amounts in respect of interest paid, net of

taxation, on funds specifically related to the financing of assets in

the course of construction.

Depreciation is provided on an equal annual instalment basis

over the anticipated useful working lives of the assets, after they

have been brought into use, at the following rates:

Land premiums paid in excess of the alternative use value

on acquisition – at 4% of cost.

Freehold and leasehold buildings with greater than 40 years

unexpired – at 2.5% of cost.

Leasehold properties with less than 40 years unexpired are

amortised by equal annual instalments over the unexpired

period of the lease.

Plant, equipment, fixtures and fittings and motor vehicles –

at rates varying from 10% to 33%.

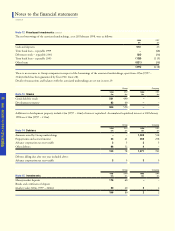

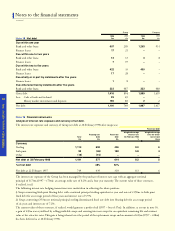

Leasing

Plant, equipment and fixtures and fittings which are the subject

of finance leases are dealt with in the financial statements as

tangible assets and equivalent liabilities at what would otherwise

have been the cost of outright purchase.

Rentals are apportioned between reductions of the respective

liabilities and finance charges, the latter being calculated by

reference to the rates of interest implicit in the leases.The finance

charges are dealt with under interest payable in the profit and

loss account.

Leased assets are depreciated in accordance with the depreciation

accounting policy over the anticipated working lives of the assets

which generally correspond to the primary rental periods.

The cost of operating leases in respect of land and buildings and

other assets is expensed as incurred.

Accounting policies