Tesco 1998 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 1998 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 5

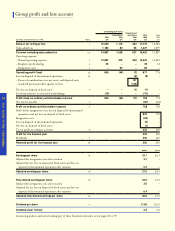

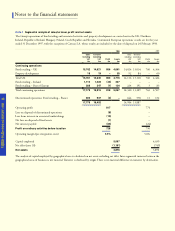

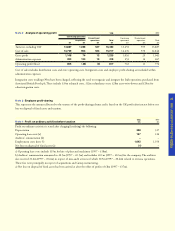

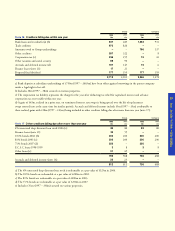

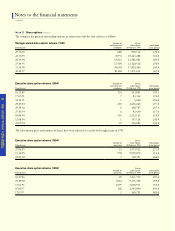

Note 8 Taxation

UK taxation:

Corporation tax at 31.2% (1997 – 33.0%)

Share of associated undertakings’ tax

Prior year items

Deferred taxation (see note 20) – current year

– prior year

Overseas tax

There was no material tax charge/credit arising from the disposal of the discontinued operations or the disposal of fixed assets. The tax

credit on the integration costs was £16m.

1998

£m

251

(5)

(20)

(3)

(8)

215

8

223

1997

£m

254

–

(25)

(2)

–

227

3

230

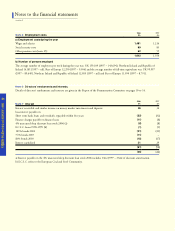

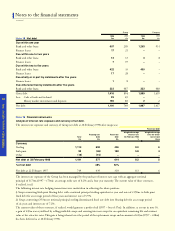

Note 9 Dividends

Declared interim – 3.55p per share (1997 – 3.25p)

Proposed final – 8.05p per share (1997 – 7.10p)

Note 10 Earnings per share and fully diluted earnings per share

a) Earnings per share and fully diluted earnings per share, excluding integration costs and net loss on disposal of fixed assets, have been

calculated in addition to the disclosures required by SSAP3 as amended by FRS3 since, in the opinion of the directors, this will allow

shareholders to identify the underlying results of the trading operations of the business.

b) The calculation for earnings per share, including and excluding integration costs and net loss on disposal of fixed assets, is based on

the profit on ordinary activities after taxation and after minority interests divided by the weighted average number of ordinary shares

in issue during the year of 2,184m (1997 – 2,162m).

c) The calculation for fully diluted earnings per share, including and excluding integration costs and net loss on disposal of fixed assets,

is based on the profit on ordinary activities after taxation and after adding the interest income, net of corporation tax, which would

have arisen had all the various ordinary share options granted under the company’s schemes been exercised on the first day of the

financial year, or at the date granted if later, and the proceeds invested in 21⁄2% consolidated stock on that day.

The amount so derived has been divided by the number of ordinary shares in issue at the beginning of the year together with the

weighted average number of ordinary shares assumed to have been issued as indicated above.

1998

£m

78

177

255

1997

£m

70

155

225