TD Bank 2006 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2006 TD Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TD BANK FINANCIAL GROUP ANNUAL REPORT 2006 To Our Shareholders

TO OUR SHAREHOLDERS

Chairman of the Board’s

Message

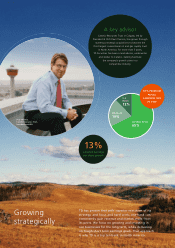

2006 was another outstanding year for TD Bank

Financial Group – one that saw the Bank build

value for our shareholders, deliver exceptional

service to our customers, and invest in our

businesses and the future.

The Bank’s strong financial performance led TD’s Board to

increase the total dividend per share to $1.78, an increase of

12.7% over last year. In 2006, TD’s total shareholder return

was 20.3%. Over the past three years, we have increased the

dividend 6 times for a total increase of 50%, and the Bank’s

total shareholder return has increased 62.3%, a testament to

TD’searnings strength.

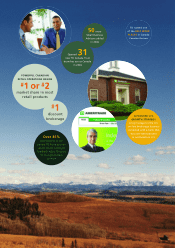

FOCUS ON THE FUTURE

TD continued to invest for the futurein 2006, in part, through

aU.S. growth strategy in TD Banknorth and TD Ameritrade.

Reflecting the importance of these investments, our directors

worked closely with the management teams of TD Bank Financial

Group, TD Banknorth and TD Ameritrade, providing strategic

counsel and advice. The Board remains confident that TD’s

management is executing on a two-pronged U.S. growth

platform that will enhance shareholder value for the long term.

LEADING THE WAYIN GOVERNANCE

TD has made many governance enhancements in recent years

that have ensured that both the Boardand management goals

are aligned and focused on their responsibilities to shareholders.

I’m pleased to report that in 2006, TD was recognized for having

one of Canada’s top boards by The Globe and Mail’s Corporate

Governance Rankings. TD was also the recipient of the 2006

Best Governance Award from Investor Relations (IR) Magazine

in Canada. This external recognition is the result of the

commitment that our directors and senior executives have

made to leadership in corporate governance.

I’m also proud to recognize that the Bank attained Sarbanes

Oxley (SOX) 404 certification this year,which strengthens the

financial controls we have throughout TD. This certification

involved a tremendous amount of work by TD employees, our

auditors, and with the oversight of the Board’sAudit Committee.

In 2006, the Board also refined TD’s director evaluation

processes, further improving how directors receive feedback.

This work refines our framework for providing constructive

input, improving directors’ individual skills and how the Board

functions as a whole.

The Board believes TD success is based on a culture of

integrity which starts with the principle “tone at the top“.

Setting the tone is not about doing one specific thing; it involves

acombination of policies, procedures and behavioral leadership

that spreads throughout an organization. For example, an

important first step in building a culture is developing a Code

of Conduct and Ethics that resonates with employees. In

2006, the TD Board played a role in setting the right tone by

overseeing the update of these standards of integrity, honesty

and professionalism.

THE RIGHT BALANCE OF OVERSIGHT

AND STRATEGIC COUNSEL

As your Chairman, I’m more focused than ever on running the

Board in a way that delivers the most strategic value to TD

and our shareholders. In the past few years, all boards have

spent tremendous energy on the compliance and due diligence

functions, sometimes at the expense of time devoted to the

advisory assistance that boards can provide to management.

While the oversight functions are being fully carried out, the

TD Board placed additional emphasis on engaging our directors

in strategic discussions to ensurethat the Bank benefited from

their collective experience.

CHANGES TO THE BOARD

The Board was delighted to welcome Irene Miller as a director

this year. Irene brings a U.S. perspective to the table that I have

no doubt will benefit our organization and our shareholders in

the years ahead. Also on behalf of the Board, I’d like to thank

Mickey Cohen, who retired as a director in 2006, for his out-

standing service to TD. His contributions over the years as Lead

Director,Chair of our Corporate Governance Committee, and a

member of the Management Resources and Risk Committees

were invaluable.

OUR PEOPLE ARE THE DIFFERENCE

On behalf of the Board, I would like to sincerely thank Ed Clark,

his management team and all employees across TD for another

tremendous year. The results TD produced in 2006 don’t happen

without the dedication of an exceptional group of people who

work hardevery day to make us a better financial institution.

John M. Thompson

Chairman of the Board of Directors

6