TD Bank 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 TD Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Adifferent kind

of bank

151st Annual Report 2006

Table of contents

-

Page 1

A different kind of bank 151st Annual Report 2006 -

Page 2

... of bank ORGANIC GROWTH driving shareholder value today and for the future BEST RETURN FOR RISK UNDER-TAKEN Best-in-class Canadian retail operations A top 10 bank in North America by market capitalization Wholesale bank delivering high return on capital invested Focused U.S. growth strategy 14... -

Page 3

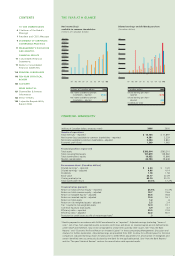

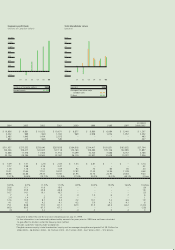

...) Financial position at year end Total assets Total risk-weighted assets Total shareholders' equity Market capitalization Per common share2 (Canadian dollars) Diluted earnings3 - reported Diluted earnings - adjusted Dividends Book value Closing market price Total shareholder return Financial ratios... -

Page 4

... stock dividend paid on July 31, 1999. As the information is not reasonably determinable, amounts for years prior to 1999 have not been calculated to give effect to dilution under the treasury stock method. Includes customers' liability under acceptances. Tangible common equity is total shareholders... -

Page 5

..., TD Waterhouse Private Trust client TD named one of Canada's best brands The Globe and Mail #1 in overall customer service & customer satisfaction Synovate survey JD Power & Associates Leading web bank with more than South Asian Festival, 2006 4.5 million online customers Supporting events... -

Page 6

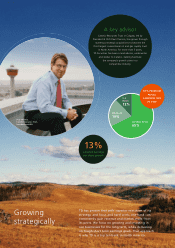

...per share growth Growing strategically TD has proven that with superior execution of its strategy, and focus and hard work, one bank can consistently gain revenue and market share from its peers. We focus on growing and investing in our businesses for the long term, while delivering on tough short... -

Page 7

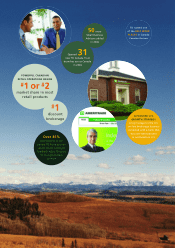

more Small Business Advisors added in 2006 50 TD named one of the BEST WORK PLACES in Canada Canadian Business Opened new TD Canada Trust branches across Canada in 2006 31 POWERFUL CANADIAN RETAIL OPERATIONS ENGINE #1 or #2 #1 discount brokerage A FOCUSED U.S. GROWTH STRATEGY A top 3 player ... -

Page 8

... through TD Book Week new state-of-the-art Automated Banking Machines installed across Canada, offering five language choices, greater security features, audio guidance and more. TD SECURITIES closing in on being a top 3 dealer in Canada Surveyed over 400,000 $61 million invested in training and... -

Page 9

...to support Azores' export business to Asia, which has led to a five-fold increase in sales since 2004. 100 + TD employees helped prepare skilled new immigrants to find work in their fields through the Mentoring Partnership program. customer internet bank in Canada Rated by Global Finance TD MUTUAL... -

Page 10

... Chairman of the Board's Message 2006 was another outstanding year for TD Bank Financial Group - one that saw the Bank build value for our shareholders, deliver exceptional service to our customers, and invest in our businesses and the future. In 2006, the Board also refined TD's director... -

Page 11

... top three dealer in Canada. We seized the number one position in equity block trading and fixed income trading, and we're a top three advisor in mergers and acquisitions. We also reached a major milestone this year, completing our exit of the global structured products businesses. This means we now... -

Page 12

... competitive pay, benefits and performance-based compensation - Invest in training and development • Improve the employee engagement score year-over-year Community • Promoting children's health and education • Protecting and preserve the environment • Volunteering time for social services... -

Page 13

... throughout the year. The 2006 report will be released and available on our web site in February 2007 - www.td.com/community. • • • • • We have a strong, independent Chairman with a clear leadership mandate in corporate governance. The Board oversees management, considers and... -

Page 14

...of the Board Petro-Canada Calgary, Alberta Irene R. Miller Chief Executive Officer Akim, Inc. New York, New York William R. Ryan Chairman and Chief Executive Officer** TD Banknorth Inc. Portland, Maine Vice Chair and Group Head, U.S. Personal and Commercial Banking The Toronto-Dominion Bank Toronto... -

Page 15

... Sheet Review Credit Portfolio Quality Capital Position Off-balance Sheet Arrangements Financial Instruments RISK FACTORS AND MANAGEMENT 24 26 30 33 36 40 Business Focus Canadian Personal and Commercial Banking U.S. Personal and Commercial Banking Wholesale Banking Wealth Management Corporate... -

Page 16

... in 2006. Each of our businesses contributed to shareholder value. CORPORATE OVERVIEW TD Bank Financial Group (the Bank) is one of the largest financial services providers in North America, offering comprehensive retail and commercial banking, wealth management and wholesale banking products and... -

Page 17

... balance sheet restructuring charge in TD Banknorth. 8 Equity in net income of associated company excludes the following items of note: 2006 - $28 million amortization of intangibles. 9 See additional information in Table 3. 102006 - one-time adjustment for the impact of TD Ameritrade earnings... -

Page 18

... of intangibles TD Ameritrade (included in equity in net income of associated company) Other Amortization of intangibles, net of income taxes1 1 Amortization of intangibles is included in the Corporate segment. ECONOMIC PROFIT AND RETURN ON INVESTED CAPITAL The Bank utilizes economic profit as... -

Page 19

... its investment in TD Ameritrade using the equity method of accounting. The fiscal periods of the Bank and TD Ameritrade are not coterminus. The Bank's equity share of TD Ameritrade's results from the acquisition date to September 30, 2006, has been reported in the Bank's results for the fiscal year... -

Page 20

... 24, 2006, the Bank sold its U.S. brokerage business, TD Waterhouse U.S.A., to Ameritrade in exchange for a minority stake in TD Ameritrade. The investment in TD Ameritrade is accounted for using the equity method, and the Bank's share of net income is reported on the single line "Equity in net... -

Page 21

...and trading-related assets, the net interest margin was up slightly, compared with 2005. This was a result of overall margin improvements in Canadian Personal and Commercial Banking, particularly on deposits, which benefited from a higher interest rate environment in the first half of the year. This... -

Page 22

...Credit card Business and government Total loans Total earning assets Interest-bearing liabilities Deposits Personal Banks Business and government Total deposits Subordinated notes and debentures Obligations related to securities sold short and under repurchase agreements Preferred shares and capital... -

Page 23

...Canadian dollars) 2006 Investment and securities services: Discount brokerage Securities and full service brokerage Mutual funds Credit fees Net investment securities gains Trading income (loss) Service charges Loan securitizations Card services Insurance, net of claims Trust fees Other Total $ 544... -

Page 24

.... Wholesale Banking benefited from the exit of its structured products portfolios and higher overall revenue. Wealth Management improved due to the sale of TD Waterhouse U.S.A. and also experienced growth in revenue in excess of expenses in the domestic business. U.S. Personal and Commercial Banking... -

Page 25

... Pension and other employee benefits Total salaries and employee benefits Occupancy Rent Depreciation Property tax Other Total occupancy Equipment Rent Depreciation Other Total equipment Amortization of intangible assets Restructuring costs Marketing and business development Brokerage-related fees... -

Page 26

... statements reported the pre-tax and tax results of TD Waterhouse U.S.A. separately. TD Ameritrade results are now reported as equity in net income of associated company, net of income taxes; tax expense of $84 million for the year is not part of the tax rate reconciliation. The Government of Canada... -

Page 27

... the same quarter last year, a $138 million tax expense relating to TD Waterhouse U.S.A. was recorded to reorganize the TD Waterhouse U.S.A. group of companies which preceded the transaction with Ameritrade. See the Bank's fourth quarter 2006 News Release, dated December 8, 2006, for a discussion of... -

Page 28

... branches located across Canada. TD Commercial Banking serves the needs of medium-sized Canadian businesses, customizing a broad range of products and services to meet their financing, investment, cash management, international trade and day-today banking needs. Under the TD Insurance and TD Meloche... -

Page 29

... spending being supported by a 30-year low unemployment rate and solid wage gains. Business investment advanced quickly, reflecting solid corporate profit growth and declining costs for imported machinery and equipment when priced in Canadian dollars. The main factor holding back economic growth was... -

Page 30

... 260 $6,220 Insurance, net of claims Real estate secured lending Business banking Consumer lending Personal deposits Other 1 Total 1 2 Other revenue includes internal commissions on sales of mutual funds and other Wealth Management products, fees for foreign exchange, safety deposit box rentals... -

Page 31

... the acquisition of VFC in April 2006. • Increased sales and service capacity through investments in infrastructure, process improvements and opening of 31 new branches. • Captured the #1 market share position in personal term deposits and #2 position in Small Business Lending for loans -

Page 32

.... Business Banking • Small Business Banking & Merchant Services - Customer focus drove 5% growth in net new deposit accounts and new borrowers in 2006. • Commercial Banking - The continuation of a favourable credit environment and investment in customer-facing resources and the sales footprint... -

Page 33

... to a U.S.-led economic downturn. Revenue growth will benefit from continued investments in marketing, simplified front-line processes, employee expertise to continue to build upon sales capacity, productivity improvements and new branch investments made in the last few years. PCL rates are expected... -

Page 34

... estate lending Consumer lending (including home equity loans) Commercial lending Treasury/corporate Insurance Wealth management Chequing and banking fees Less: unallocated interest expense Total 1 Residential mortgages Consumer loans Business and government loans Investment securities Other assets... -

Page 35

... institutions, including savings banks, finance companies, credit unions and other providers of financial services, such as money market mutual funds, brokerage firms, consumer finance companies and insurance companies. TD Banknorth is one of the largest financial institutions located in the... -

Page 36

... of deposit products to individuals, businesses and governments, including chequing, savings, money-market, term investment, merchant services and cash management products designed to meet the needs of the customer. The Community Banking gross revenues which comprise the majority of TD Banknorth... -

Page 37

...05 06 $34 (billions of Canadian dollars) Risk-weighted assets 30 20 10 0 04 05 06 Revenues ( millions of Canadian dollars) 2006 $ 287 1,621 363 $ 2,271 2005 $ 266 1,467 255 $1,988 2004 $ 303 1,594 299 $2,196 Corporate banking Investment banking and capital markets Equity investments Total... -

Page 38

... BUSINESS STRATEGY Become a top 3 dealer in Canada: - Protect the #1 market share rankings in equity block and fixed income trading and #2 market share ranking in fixed-income underwriting. - Increase share of equity underwriting and merger & acquisitions industry revenues. - Prudently extend credit... -

Page 39

...from correspondent banking deposits and higher lending volumes. ECONOMIC OUTLOOK Economic conditions are expected to support stable demand for capital market and investment services in 2007. • Corporate borrowing will likely be affected by lower business confidence. However, business investment is... -

Page 40

...of mutual funds, the Bank manages assets on behalf of individuals, pension funds, corporations, institutions, endowments and foundations. These assets are not reported on the Bank's Consolidated Balance Sheet. Assets under administration: Assets owned by customers where the Bank provides services of... -

Page 41

... position in industry ranking and has been number two in net sales in long-term mutual funds for four years in a row with $3.3 billion in net fund sales. • The discount brokerage operation introduced an active trader platform in Canada to target its frequent trading customers. • The investment... -

Page 42

... MANAGEMENT CANADA AND THE U.S. 2006 $410 180 $590 2005 $ 324 108 $ 432 2004 $252 100 $352 (millions of Canadian dollars) Canadian Wealth TD Ameritrade / TD Waterhouse U.S.A. Net income KEY PRODUCT GROUPS TD Waterhouse Discount Brokerage • A leader in self-directed investing, serving customers... -

Page 43

... assets and products. • Maintain the momentum in mutual funds by increasing fund sales in our retail branch and external channels. • Aggressively target the active trader client segment within discount brokerage, by capitalizing on our new technology platform and tailored pricing. • Ameritrade... -

Page 44

... comprises audit, compliance, corporate and public affairs, economics, enterprise technology solutions (information technology), finance, human resources, legal, marketing, office of the ombudsman, real estate, risk management and security. Banking is an increasingly complex and challenging business... -

Page 45

...brokerage fees due to a decline in commissions per trade, lower average trades per day and the impact of foreign exchange in TD Waterhouse U.S.A. The improvement in trading income was largely a result of an increase in trading revenue within the Wholesale Banking credit and equity trading businesses... -

Page 46

... business deposits and real estate secured lending. Volume growth was partly offset by lower margins. Also contributing to higher revenue were growth in banking and credit card service and transaction fees and insurance revenue growth through improved claims experience and new sales. The acquisition... -

Page 47

... the Bank's total assets and total liabilities decreased by $5 billion and $7 billion, respectively. Subsequent to the sale, the Bank continued to manage certain deposits related to TD Ameritrade clients and retained these deposits on its Consolidated Balance Sheet. These deposits grew over the year... -

Page 48

... certain non-trading derivatives are recorded on the Consolidated Balance Sheet. GROUP FINANCIAL CONDITION LOAN PORTFOLIO Overall in 2006 the Bank's credit quality remained stable as a result of buoyant economic conditions in North America, established business and risk management strategies and... -

Page 49

... Transportation Utilities All other loans Total business and government Total Canada United States Residential mortgages Consumer instalment and other personal Total residential and personal Real estate development Residential Real estate services Total real estate Agriculture Apparel and textile... -

Page 50

... Total Other International Total Percentage change over previous year Canada United States Other International Total 119,571 7.5% 4.8 7.4 7.0% 5.2% 366.6 1.3 22.3% 5.0% (20.7) 21.5 (3.8)% As shown in Table 23, the largest business and government sector concentrations in Canada are real estate... -

Page 51

... manufacturing Telecommunications Transportation Utilities All other loans Total business and government Total Canada United States Real estate development Commercial and industrial Residential Shopping Centres Real Estate Services Total real estate Apparel and textile Automotive Cable Chemical... -

Page 52

... for personal credit portfolios are based on delinquency and type of security. Specific allowances for credit losses are established to reduce the book value of loans to estimated realizable amounts in the normal course of business. Specific allowances for the wholesale and commercial portfolios... -

Page 53

... provision Sectoral provision (net of transfer to specifics) Total Provision for credit losses as a % of net average loans Canada Residential mortgages Personal Business and other Total Canada United States Other International General provision Sectoral provision Total 1 2 (.01)% .66 .14 .32 .17... -

Page 54

... Transportation Utilities All other loans Total business and government Total Canada United States Consumer instalment and other personal Total residential and personal Real estate development Commercial and industrial Residential Real estate services Total real estate Cable Chemical Construction... -

Page 55

... rating agency and regulatory capital measures, economic capital refers solely to common equity capital. Since losses flow through the Consolidated Statement of Income, the Bank ensures it has sufficient common equity to absorb worst-case losses. The Bank makes business decisions based on the return... -

Page 56

... senior debt rating to AA. Both Standard & Poor's (S&P) and Moody's Investors Service (Moody's) modified their outlooks for the Bank's rating to positive from stable during the year. As at October, 2006, the Bank's long-term ratings were: Fitch (AA-), Moody's (Aa3), DBRS (AA) and S&P (A+). CAPITAL... -

Page 57

... involving SPEs. SECURITIZATION OF BANK-ORIGINATED ASSETS The Bank securitizes residential mortgages, personal loans, credit card loans and commercial mortgages to enhance our liquidity position, to diversify sources of funding and to optimize the management of the balance sheet. Details of these... -

Page 58

... $273 million in 2005. Co-ownership Structures The Bank securitizes real estate secured personal loans, credit card loans and commercial mortgages through a co-ownership structure. Through this structure, ownership interests in a homogenous pool are sold to SPEs. The ownership interest entitles the... -

Page 59

... services and other financial products to the VIEs in exchange for market rate compensation. GUARANTEES In the normal course of business, we enter into various guarantee contracts to support our clients. These guarantees, with the exception of related premiums, are kept off-balance sheet... -

Page 60

... to, cash resources, investment and trading securities, loans and derivatives while financial liabilities include deposits, obligations related to securities sold short, obligations related to securities sold under repurchase agreements, derivative instruments and subordinated debt. The Bank uses... -

Page 61

... new products and services, achieving market acceptance of its products and services, and/or developing and maintaining loyal customers. Acquisitions and Strategic Plans The Bank regularly explores opportunities to acquire other financial services companies or parts of their businesses directly... -

Page 62

... Risk Officer.2 • Responsible for the oversight of the Bank's non-trading market risk, consolidated liquidity and funding position and consolidated capital position including foreign exchange capital hedging. Domestic Shared Services Committee • Chaired by the Vice Chair, Corporate Operations... -

Page 63

...any significant audit and risk issues at TD Ameritrade. The following pages describe the key risks the Bank faces and how they are managed. The President and Chief Executive Officer reports to the Board on the implementation of Bank strategies, identifying business risks within those strategies and... -

Page 64

... the scoring techniques and standards used in extending personal credit. COUNTRY RISK Unanticipated economic or political changes in a foreign country could affect cross-border payments for goods and services, loans, dividends, trade-related finance, as well as repatriation of the Bank's capital in... -

Page 65

... and Capital Committee is chaired by the Senior Vice President, Trading Risk Management and includes members of senior management from Wholesale Banking and Audit. They meet regularly to conduct a review of the market risk profile of our trading businesses, approve changes to risk policies, review... -

Page 66

... liability management market risk policies and compliance with approved risk limits. HOW WE MANAGE OUR ASSET AND LIABILITY POSITIONS When Bank products are issued, risks are measured using a fully hedged option-adjusted transfer-pricing framework that allows treasury and balance sheet management to... -

Page 67

...lag in changing product prices in response to changes in wholesale rates may have an impact on margins earned. • The general level of interest rates will impact the return the Bank generates on its modeled maturity profile for core deposits and the investment profile for its net equity position as... -

Page 68

... time period. In 2006, the Bank securitized and sold $3.0 billion of mortgages and $3.5 billion of lines of credit. In addition, the Bank issued $3.7 billion of other medium and long-term funding, $2.3 billion of subordinated debt and $0.4 billion of preferred shares. Insurance Risk Insurance risk... -

Page 69

... Managing the operational risk exposures related to our use of technology and information is of significant importance to the Bank. Technology and information is used in virtually all aspects of our business and operations including creating and supporting new markets, competitive products... -

Page 70

... risk of non-compliance. Their assessments are also reviewed by the Compliance department to evaluate the effectiveness of the business unit controls. Once the annual review process is completed, senior management of the business unit certify in writing whether they are in compliance with applicable... -

Page 71

...The fair value of exchange-traded financial instruments is based on quoted market prices, adjusted for daily margin settlements, where applicable. Note 17 to the Bank's Consolidated Financial Statements provides disclosures of the estimated fair value of all financial instruments at October 31, 2006... -

Page 72

... fair value of investment securities in Note 2 to the Consolidated Financial Statements. Valuation of publicly traded securities is determined by using quoted market prices, which fluctuate from one reporting period to another. Valuation of private equity investments requires management's judgement... -

Page 73

... value based on expected future cash flows. This accounting policy impacts all of the Bank's business segments. See Note 5 of the Consolidated Financial Statements for additional disclosures regarding goodwill and intangible assets. ACCOUNTING FOR PENSIONS AND POST-RETIREMENT BENEFITS Pension... -

Page 74

... on the applicable criteria. Management's assessment of the effectiveness of internal control over financial reporting has been audited by its independent auditors, Ernst & Young LLP, a registered public accounting firm that has also audited the Consolidated Financial Statements of the Bank for the... -

Page 75

..., Canada December 7, 2006 Colleen M. Johnston Executive Vice President and Chief Financial Officer INDEPENDENT AUDITORS' REPORT TO SHAREHOLDERS We have audited the Consolidated Balance Sheet of The Toronto-Dominion Bank as at October 31, 2006 and the Consolidated Statements of Income, Changes in... -

Page 76

...31, 2006 and the consolidated statements of income, changes in shareholders' equity and cash flows for the year ended October 31, 2006 of the Toronto-Dominion Bank and our report dated December 7, 2006 expressed an unqualified opinion thereon. Ernst & Young LLP Chartered Accountants Toronto, Canada... -

Page 77

...banks Securities (Note 2) Trading Investment Securities purchased under reverse repurchase agreements Loans (Note 3) Residential mortgages Consumer instalment and other personal Credit card Business and government Allowance for credit losses Loans (net of allowance for credit losses) Other Customers... -

Page 78

... investment securities gains (Note 2) Trading income (loss) (Note 22) Service charges Loan securitizations (Note 4) Card services Insurance, net of claims (Note 23) Trust fees Other Total revenues Provision for (reversal of) credit losses (Note 3) Non-interest expenses Salaries and employee benefits... -

Page 79

... beginning of year Net income Common dividends Preferred dividends Termination of equity-based compensation plan Premium paid on repurchase of common shares Other Balance at end of year Total shareholders' equity The accompanying Notes are an integral part of these Consolidated Financial Statements... -

Page 80

... activities Change in deposits Securities sold under repurchase agreements Securities sold short Issue of subordinated notes and debentures Repayment of subordinated notes and debentures Subordinated notes and debentures (acquired) sold in Wholesale Banking Liability for preferred shares and capital... -

Page 81

... Share Capital Stock-based Compensation Employee Future Benefits Income Taxes Fair Value of Financial Instruments Interest Rate Risk Derivative Financial Instruments Contingent Liabilities, Commitments and Guarantees Concentration of Credit Risk Trading-related Income Insurance Segmented Information... -

Page 82

...may be sold in response to changes in such investment objectives arising from changing market conditions. Investment securities include investments in the merchant banking portfolio that are not publicly traded and are generally held for longer terms than most other securities. Equity securities are... -

Page 83

... (millions of Canadian dollars) Within 1 year 1 to 3 years 3 to 5 years 5 to 10 years Remaining term to maturity1 Over 10 years With no specific maturity 2006 Total 2005 Total Investment securities Government and government-insured securities Canada Mortgage-backed securities Provinces $ 5,815 579... -

Page 84

..., or a loan that is guaranteed or insured by the Government of Canada, the provincial governments in Canada or an agency controlled by anyone of these governments. A deposit with a bank is considered impaired when a payment is contractually past due 21 days. A Government of Canada guaranteed loan is... -

Page 85

...-offs related to restructured loans (2005 - nil; 2004 - $7 million). Includes foreign exchange rate changes, net of losses on loan sales. NOTE 4 LOAN SECURITIZATIONS the retained interests based on their relative fair values at the date of transfer. To obtain fair value, quoted market prices are... -

Page 86

... Bank's Consolidated Statement of Income. Securitization Gains and Income on Retained Interests (millions of Canadian dollars) Residential mortgage loans Personal loans Credit Commercial card mortgage loans loans 2006 Residential mortgage loans Personal loans Credit card loans Commercial mortgage... -

Page 87

...term deposit, loan and mutual fund intangibles resulting from acquisitions. Intangible assets are amortized over five to 18 years, proportionate to the expected economic benefit. Other Intangibles (millions of Canadian dollars) All intangible assets are assessed for impairment at least annually and... -

Page 88

... sheet management strategies. The Bank does not retain effective control over the assets sold. Assets sold during the year under such arrangements amounted to $1 billion (2005 - $1 billion). The Bank enters into total return swaps with the sale counterparties in respect of the assets sold. Market... -

Page 89

... liabilities on the Consolidated Balance Sheet is $350 million due to TD Capital Trust ll. Term Deposits (millions of Canadian dollars) Within 1 year 1 to 2 years 2 to 3 years 3 to 4 years 4 to 5 years Over 5 years 2006 Total 2005 Total Personal Banks Business and government Total $20,188 11... -

Page 90

... for reporting purposes. Liabilities (millions of Canadian dollars) 2006 2005 Preferred Shares Preferred shares issued by the Bank (thousands of shares): Class A - 16 Series I Class A - 14,000 Series M Class A - 8,000 Series N Preferred shares issued by TD Mortgage Investment Corporation... -

Page 91

...into common shares of the Bank, determined by dividing $1,000 plus the declared and unpaid interest to the date of exchange by the greater of $1.00 and 95% of the average trading price of such common shares at that time. By giving at least two business days of notice prior to the date of exchange to... -

Page 92

... the Bank, the common shares may be issued from the Bank's treasury at an average market price based on the last five trading days before the date of the dividend payment, with a discount of between 0% to 5% at the Bank's discretion, or from the open market at market price. During the year, a total... -

Page 93

... award is earned by the plan participant. Changes in the value of restricted share units and deferred share units are recorded, net of the effects of related hedges, in the Consolidated Statement of Income. For the year ended October 31, 2006, the Bank recognized compensation expense, net of the... -

Page 94

... employee stock purchase plan that is available to employees with one year of service. N O T E 15 EMPLOYEE FUTURE BENEFITS The Bank also provides certain post-retirement benefits, postemployment benefits, compensated absence and termination benefits for its employees (non-pension employee benefits... -

Page 95

... the projected benefit method pro-rated on service and management's best estimates of investment returns on the plan's assets, compensation increases, retirement ages of employees and estimated health care costs. The discount rate used to value liabilities is based on long-term corporate AA bond... -

Page 96

...of period Service cost - benefits earned Interest cost on projected benefit obligation Members' contributions Benefits paid Actuarial (gains) losses Change in actuarial assumptions Plan amendments Projected benefit obligation at end of period Change in plan assets Plan assets at fair market value at... -

Page 97

... benefit obligation at end of period Plan assets at fair market value at end of period Prepaid pension expense Pension expense TD Banknorth Pension Plan TD Banknorth has a noncontributory defined benefit retirement plan covering most permanent, full-time employees. Supplemental retirement plans... -

Page 98

... CT Defined Benefit Pension Plan, $34 million to the TD Banknorth Defined Benefit Pension Plan, $12 million to the Bank's supplemental employee retirement plans and $11 million for the principal non-pension post-retirement benefit plans. Future contribution amounts may change upon the Bank's review... -

Page 99

... taxes at Canadian statutory income tax rate Increase (decrease) resulting from: Dividends received Rate differentials on international operations Items related to dilution gains and losses Future federal and provincial tax rate changes Federal large corporations tax Other - net Provision for income... -

Page 100

... INSTRUMENTS fixed-rate performing loans, estimated fair value is determined by discounting the expected future cash flows related to these loans at market interest rates for loans with similar credit risks. The fair value of loans is not adjusted for the value of any credit protection the Bank has... -

Page 101

... rate contracts Forward rate agreements Swaps Options written Options purchased Total interest rate contracts Foreign exchange contracts Forward contracts Cross-currency interest rate swaps Total foreign exchange contracts Credit derivatives Other contracts2 Fair value - non-trading Total fair value... -

Page 102

...Cash resources and other Effective yield Investment securities Effective yield Trading securities Securities purchased under resale agreements Effective yield Loans Effective yield Other Total assets Liabilities and shareholders' equity Deposits Effective yield Obligations related to securities sold... -

Page 103

...the spot market and sold in the forward market, or vice-versa. Cross-currency interest rate swaps are transactions in which counterparties exchange principal and interest flows in different currencies over a period of time. These contracts are used to manage both currency and interest rate exposures... -

Page 104

... of Canadian dollars) Trading 2006 2005 Notional principal Interest rate contracts Futures Forward rate agreements Swaps Options written Options purchased Total interest rate contracts Foreign exchange contracts Futures Forward contracts Swaps Cross-currency interest rate swaps Options written... -

Page 105

...-RELATED RISKS Market Risk Derivative instruments, in the absence of any compensating upfront cash payments, generally have no market value at inception. They obtain value, positive or negative, as relevant interest rates, foreign exchange rates, equity, commodity or credit prices or indices change... -

Page 106

...assurances that the Bank will make payments in the event that a customer cannot meet its obligations to third parties and they carry the same credit risk, recourse and collateral security requirements as loans extended to customers. Documentary and commercial letters of credit are instruments issued... -

Page 107

...). GUARANTEES A guarantee is defined to be a contract that contingently requires the Bank to make payments to a third party based on (i) changes in an underlying interest rate, foreign exchange rate, equity or commodity instrument, index or other variable, that is related to an asset, a liability... -

Page 108

... the Consolidated Statement of Income. 2006 $ (65) 797 $732 2005 $457 147 $604 2004 $1,037 (153) $ 884 Net interest income Other income Total trading-related income By product Interest rate and credit portfolios Foreign exchange portfolios Equity and other portfolios Total trading-related income... -

Page 109

... and provides financial products and services to personal, small business, insurance, and commercial customers. The U.S. Personal and Commercial Banking segment provides commercial banking, insurance agency, wealth management, merchant services, mortgage banking and other financial services in the... -

Page 110

...dollars) or assets. This location frequently corresponds with the location of the legal entity through which the business is conducted and the location of the customer. 2006 Canada United States Other international Total 2005 Canada United States Other international Total 2004 Canada United States... -

Page 111

... assumed Deposits Obligations related to securities sold under repurchase agreements Other liabilities Future tax liability on intangible assets Subordinated notes, debentures and other debt 28,919 1,430 198 189 670 $31,406 Less cash used in share repurchase program by TD Banknorth Fair value of... -

Page 112

... its investment in TD Ameritrade using the equity method of accounting. The fiscal periods of the Bank and TD Ameritrade are not coterminus. The Bank's equity share of TD Ameritrade's results from the acquisition date to September 30, 2006, has been reported in the Bank's results for the fiscal year... -

Page 113

...relation to the Bank's equity investment in TD Ameritrade, the Bank designated five of twelve members to TD Ameritrade's Board of Directors. A description of significant transactions of the Bank and its affiliates with TD Ameritrade is set forth below. Money Market Deposit Account Agreement The Bank... -

Page 114

... based on Canadian GAAP Employee future benefitsa Securitizationsb Available-for-sale securitiesc Derivative instruments and hedging activitiesd Guaranteese Liabilities and equityf Amortization of intangible assetsg Asset retirement obligations Other Income taxes and net change in income taxes due... -

Page 115

... dollars) Canadian GAAP Adjustments 2006 U.S. GAAP Canadian GAAP Adjustments 2005 U.S. GAAP Assets Cash resources and other Securities Trading Investment c,g Securities purchased under reverse repurchase agreements Loans (net) Investment in TD Ameritrade Trading derivatives' market revaluationd... -

Page 116

...plan, option holders could elect to receive cash for the options equal to their intrinsic value, being the excess of the market value of the share over the option exercise price at the date of exercise. In accounting for stock options with this feature, U.S. GAAP requires expensing the annual change... -

Page 117

.... The Bank is in the process of assessing the impact of this guidance on the Bank's Consolidated Financial Statements. Defined Benefit Pension and Other Postretirement Plans Effective November 1, 2007, the Bank will be required to adopt the FASB guidance on accounting for defined benefit pension and... -

Page 118

... TD Asset Management USA Inc. TD Capital Canadian Private Equity Partners Ltd. TD Capital Funds Management Ltd. TD Capital Group Limited TD Capital Trust TD Investment Services Inc. TD Life Insurance Company TD Mortgage Corporation The Canada Trust Company TD Pacific Mortgage Corporation TD Mortgage... -

Page 119

...States and Other International (millions of Canadian dollars) United States TD Banknorth Inc. (56.98%) TD Banknorth, National Association Northgroup Asset Management Company TD Bank USA, National Association TD Discount Brokerage Acquisition LLC TD AMERITRADE Holding Corporation (7.35%) TD Discount... -

Page 120

... dollars) 1 2006 Assets Cash resources and other Securities Securities purchased under reverse repurchase agreements Loans (net of allowance for credit losses) Other Total Liabilities Deposits Other Subordinated notes and debentures Liabilities for preferred shares and capital trust securities... -

Page 121

... the Bank for the applicable period, except as noted. Certain comparative amounts have been restated to conform to the presentation adopted in the current period. For 2004, does not include the impact of future tax increase of $17 million reported in the report to shareholders for the quarter ended... -

Page 122

... market price Closing market price to book value Closing market price appreciation Total shareholder return Return on total common equity Return on risk-weighted assets Efficiency ratio Net interest rate margin Common dividend payout ratio Dividend yield3 Price earnings ratio4 Net impaired loans... -

Page 123

...-one stock dividend paid on July 31, 1999. As the information is not reasonably determinable, amounts for years prior to 1999 have not been calculated to give effect to dilution under the treasury stock method. Dividends paid during the year divided by average of high and low common share prices for... -

Page 124

... securities to investors to fund the purchase of loans. Swaps: Contracts that involve the exchange of fixed and floating interest rate payment obligations and/or currencies on a notional principal for a specified period of time. Total Market Return: The change in market price plus dividends paid... -

Page 125

...in U.S. funds by contacting the Bank's transfer agent. Dividends will be exchanged into U.S. funds at the Bank of Canada noon rate on the fifth business day after record date, or as otherwise advised by the Bank. Dividend information for 2007 is available at www.td.com under Investor Relations/Share... -

Page 126

...Kilburn TD Life Group Suzanne E. Poole Pacific Region Retail Distribution Lisa A. Reikman Commercial National Accounts Bruce M. Shirreff Core, Term, and Real Estate Secured Lending Products Ian B. Struthers Ontario District Commercial Banking Paul I. Verwymeren Commercial Credit Risk Management Paul... -

Page 127

...TD Asset Management WEALTH MANAGEMENT William H. Hatanaka Group Head Wealth Management Chairman and Chief Executive Officer TD Waterhouse Canada Inc. John G. See Executive Vice President Discount Brokerage and Financial Planning Wealth Management Senior Vice Presidents: William R. Fulton Private... -

Page 128

... live and work. We believe our actions in 2006 clearly demonstrate this commitment. To learn more about what TD and its employees did this year to give back to its communities and contribute to Canada's social, economic and environmental well-being, watch for our 2006 Corporate Responsibility Report... -

Page 129

... future TD is strategically positioned to build for the future. This is demonstrated in the way we support our customers' plans for the road ahead and invest in our businesses and people. That's also why we're committed to helping make a lasting difference in the communities where we live and work... -

Page 130

... customers in four key businesses operating in a number of locations in key financial centres around the globe: Canadian Personal and Commercial Banking including TD Canada Trust; Wealth Management including TD Waterhouse and an investment in TD Ameritrade; Wholesale Banking, including TD Securities...