Sunoco 2008 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2008 Sunoco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

To Our Shareholders:

Despite challenging market conditions and significant volatility in commodity prices, Sunoco’s

financial performance in 2008 was strong. The Company earned $874 million before special items*, with

earnings per share of $7.46, up 7.5 percent from 2007.

Rising crude oil prices in the midst of a weakening global economy led to income before special items

in the first half of 2008 that was just above breakeven levels. However, in the second half of the year,

commodity prices fell from their record levels in July and hurricane-related refinery outages reduced

industry supply. Sunoco’s operations performed well during this period and the second half of 2008 proved

profitable for all of our businesses.

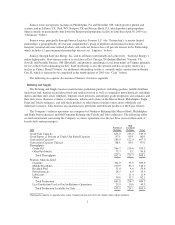

Refining business captures market opportunities

While 2008 clearly highlighted the volatility of the refining market, the $515 million earned by

Refining and Supply also demonstrated the improving flexibility of our refinery operations and commercial

activities, as well as our nimbleness in responding to market demand.

We expanded our ability to process lower-cost crude oil feedstocks and reduced our purchases of

certain higher-premium West African grades. As a result, we significantly reduced our crude oil acquisition

costs compared to market benchmarks, particularly in the second half of the year.

In addition, by realizing the benefit of certain capital projects completed in 2007, we optimized

refinery operations to produce a mix of products that better reflected market demand. In 2008, we made and

sold more higher-value distillate fuel and less gasoline and residual fuel than in previous years.

Non-refining businesses deliver strong results

Market volatility in 2008 also highlighted the value of our diversified business portfolio. In the

aggregate, our non-refining businesses contributed a record $427 million to earnings.

Retail Marketing earned a record $201 million as retail margins expanded in the second half of the

year. Despite lower industry demand for gasoline and diesel fuel, Sunoco’s strong branded presence

continued to serve us well in the marketplace.

The $36 million earned by Chemicals in 2008 represented an improvement from last year. However,

the markets for both polypropylene and phenol products continue to be challenging.

Logistics earned $85 million due to a record contribution from Sunoco Logistics Partners L.P. (NYSE:

SXL), which continued to effectively execute its growth strategy. During 2008, SXL provided $76 million

in cash distributions to Sunoco, up more than 20 percent from 2007.

SunCoke Energy earned a record $105 million in 2008. During the year, we began operations at our

second cokemaking facility in Haverhill, Ohio and began construction on a new facility in Granite City,

Illinois that is expected to be completed in 2009.

Safe, reliable and environmentally sound operations

Our financial success has always been built upon a foundation of safe, reliable and environmentally

sound operations. Outstanding performance in these areas continues to be a core value and top priority.

*Net income amounted to $776 million for 2008 and $891 million for 2007, which includes a net charge for special items of $98

million for 2008 and a net gain for special items of $58 million for 2007.