Sunoco 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 Sunoco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Sunoco, Inc.

2008 Annual Report

and Form 10-K

Table of contents

-

Page 1

Sunoco, Inc. 2008 Annual Report and Form 10-K -

Page 2

... products manufactured or sold, rates of return, income, cash flow, earnings growth, capital spending, costs and plans could differ materially due to, for example, changes in market conditions, changes in refining, chemicals or marketing margins, crude oil and feedstock supply, changes in operating... -

Page 3

... benefit of certain capital projects completed in 2007, we optimized refinery operations to produce a mix of products that better reflected market demand. In 2008, we made and sold more higher-value distillate fuel and less gasoline and residual fuel than in previous years. Non-refining businesses... -

Page 4

... Refining and Supply, we expect to complete a capital project at our Philadelphia refinery that will improve our ability to upgrade heating oil into ultra-low sulfur diesel fuel. Sunoco Logistics Partners L.P. is expected to benefit from a recent $185 million acquisition of pipeline and terminaling... -

Page 5

... No.) 1735 Market Street, Suite LL, Philadelphia, PA (Address of principal executive offices) 19103-7583 (Zip Code) Registrant's telephone number, including area code (215) 977-3000 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which... -

Page 6

-

Page 7

...and Corporate Governance ...Executive Compensation ...Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters ...Certain Relationships and Related Transactions, and Director Independence ...Principal Accounting Fees and Services ...99 100 100 100 100 Market for... -

Page 8

-

Page 9

... refineries in Marcus Hook, Philadelphia, Westville (also known as Eagle Point) and Toledo produce principally fuels and commodity petrochemicals while the refinery in Tulsa emphasizes lubricants production with related fuels production being sold in the wholesale market. Sunoco intends to sell or... -

Page 10

...) at the Marcus Hook, Philadelphia, Eagle Point and Toledo refineries, and sells these products to other Sunoco business units and to wholesale and industrial customers. This business also manufactures petroleum and lubricant products at the Tulsa refinery. The Company's refinery operations are... -

Page 11

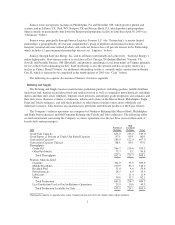

...Throughputs: Crude Oil ...Other Feedstocks ...Total Throughputs ...Products Manufactured: Gasoline ...Middle Distillates ...Residual Fuel ...Petrochemicals ...Lubricants ...Other ...Total Production ...Less Production Used as Fuel in Refinery Operations ...Total Production Available for Sale ... 655... -

Page 12

... such crude oils were processed. The Philadelphia, Marcus Hook and Eagle Point refineries process crude oils supplied from foreign sources. The Toledo refinery processes domestic and Canadian crude oils as well as crude oils supplied from other foreign sources. The Tulsa refinery processes domestic... -

Page 13

... gasoline hydrotreaters at the Marcus Hook, Philadelphia, Eagle Point and Toledo refineries. In addition, higher operating costs are being incurred as the low-sulfur fuels are produced. Another rule was adopted in May 2004 which is phasing in limits on the allowable sulfur content in off-road diesel... -

Page 14

...option to purchase steam from that facility or, alternatively, it obtains steam from Refining and Supply's four auxiliary boilers located on land adjacent to the power plant that are operated by FPL on its behalf. Retail Marketing The Retail Marketing business consists of the retail sale of gasoline... -

Page 15

...Retail Marketing's outlets at December 31, 2008 were 53 outlets on turnpikes and expressways in Pennsylvania, New Jersey, New York, Maryland and Delaware. Of these outlets, 37 were Company-operated sites providing gasoline, diesel fuel and convenience store merchandise. Distributor outlets are sites... -

Page 16

... of the commodity petrochemicals produced by Refining and Supply at the Marcus Hook, Philadelphia, Eagle Point and Toledo refineries.) During 2003, Sunoco formed a limited partnership with Equistar Chemicals, L.P. ("Equistar") involving Equistar's ethylene facility in LaPorte, TX. Equistar is... -

Page 17

... of phenol annually at a price based on the market value of cumene feedstock plus an amount approximating other phenol production costs. During January 2009, Sunoco decided that it will permanently shut down its Bayport, TX polypropylene plant which has become uneconomic to operate and in 2008 also... -

Page 18

... Sunoco's Tulsa and Toledo refineries) or to local trade points. In November 2008, the Partnership purchased a refined products pipeline system, refined products terminal facilities and certain other related assets located in Texas and Louisiana from affiliates of Exxon Mobil Corporation for... -

Page 19

... also include an LPG terminal near Detroit, MI, a crude oil terminal complex adjacent to Sunoco's Philadelphia refinery, ship and barge docks adjacent to Sunoco's Eagle Point refinery and a refined products terminal adjacent to Sunoco's Marcus Hook refinery. During 2008, 2007 and 2006, throughput at... -

Page 20

...supply these facilities without any significant disruption in coke production. Substantially all coke sales from the Indiana Harbor and Jewell plants and 50 percent of the production from the Haverhill plant (once it becomes fully operational) are made pursuant to long-term contracts with affiliates... -

Page 21

... facility. The flue gas produced at Haverhill during the cokemaking process is used to generate low-cost steam that is sold to the adjacent chemical manufacturing complex owned and operated by Sunoco's Chemicals business and electricity for sale into the regional power market. The cogeneration plant... -

Page 22

... oil companies, with foreign refiners that import products into the United States and with producers and marketers in other industries supplying alternative forms of energy and fuels to satisfy the requirements of the Company's industrial, commercial and individual consumers. Some of Sunoco... -

Page 23

... factors may vary among product lines, in general, Sunoco's competitive position is primarily based on raw material costs, selling prices, product quality, manufacturing technology, access to new markets, proximity to the market and customer service and support. Sunoco's competitors can be expected... -

Page 24

... in our marketing areas and as a result of various logistical factors. In many cases, it is very difficult to increase refined product and chemical prices quickly enough to recover increases in the costs of products being sold. We may experience significant changes in our results of operations also... -

Page 25

... global economic and political environment can lead to volatility in the costs and availability of energy and raw materials, and in the prices for refined products and chemicals. This may place downward pressure on our results of operations. This is particularly true of developments in and relating... -

Page 26

...of operations. Weakness in general economic, financial and business conditions can lead to a decline in the demand for the refined products and chemicals that we sell. Such weakness can also lead to lower demand for transportation and storage services provided by us. In addition, the global economic... -

Page 27

... rule which is phasing in limits on the allowable sulfur content in off-road diesel fuel that began in June 2007. This rule largely relates to operations at our Tulsa refinery. National Ambient Air Quality Standards: National Ambient Air Quality Standards for ozone and fine particles promulgated... -

Page 28

... service stations operated by fully integrated major oil companies and other well-recognized national or regional retail outlets, often selling gasoline or merchandise at aggressively competitive prices. Our chemicals business competes with local, regional, national and international companies... -

Page 29

.... These operations also face competition from trucks for incremental and marginal volumes in areas served by the Partnership's pipelines. The Partnership's refined product terminals compete with terminals owned by integrated petroleum companies, refining and marketing companies, independent terminal... -

Page 30

... the financial services sector and the re-pricing of credit risk in the broadly syndicated market, among other things. These events have negatively affected general economic conditions. In particular, the cost of raising money in the debt and equity capital markets has increased substantially while... -

Page 31

... and adversely affect our business, financial condition, liquidity or ability to raise capital, and results of operations. We currently maintain investment grade ratings by Fitch, Moody's and S&P. (Ratings from credit agencies are not recommendations to buy, sell or hold our securities. Each rating... -

Page 32

... employees. We have made contributions to the plans each year over the past several years to improve their funded status, and we expect to make additional contributions to the plans in the future as well. As a result of the poor performance of the financial markets during 2008, the projected benefit... -

Page 33

... our employees are covered by many collective bargaining agreements with various terms and dates of expiration. In February 2009, we reached an agreement on a three-year contract with the hourly workers at our Toledo refinery. Negotiations continue at our Marcus Hook and Philadelphia refineries and... -

Page 34

...with NJDEP. (See also the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2007.) In 2005 and 2004, Sunoco, Inc. (R&M) received Notices of Violation from Philadelphia Air Management Services ("AMS"), an agency of the City of Philadelphia, that alleged violations of certain... -

Page 35

... ended December 31, 2007.) In November 2007 and February 2008, Sunoco Logistics Partners L.P. received notices of administrative fines from the Delaware County Regional Water Control Authority ("DELCORA") totaling approximately $600 thousand relating to alleged non-compliance with monthly average... -

Page 36

...State of New York (State of New York v. LVF Realty, et al.) seeking to recover approximately $57 thousand in investigation costs incurred by the state at a service station located in Inwood, NY, plus interest and penalties. Sunoco owned the property from the 1940s until 1985 and supplied gasoline to... -

Page 37

... March 2005 and President and Chief Executive Officer of Shell Oil Products U.S. from June 2003 until January 2005. Ms. Elsenhans was appointed Chairman of the Board of Sunoco Partners LLC, a subsidiary of Sunoco, Inc. and the general partner of Sunoco Logistics Partners L.P. in October 2008 and had... -

Page 38

... of Sunoco Logistics Partners L.P. limited partnership units totaling $14 and $90 million in 2008 and 2007, respectively, after-tax gains related to income tax matters totaling $26, $18 and $18 million in 2008, 2005 and 2004, respectively, an after-tax loss associated with a phenol supply contract... -

Page 39

... fuel specifications related to sulfur reductions in gasoline and diesel products, strong premiums for ethanol-blended gasoline, generally tight industry refined product inventory levels on a days-supply basis and strong global refined product demand coupled with refinery maintenance/capital... -

Page 40

... the Tier II low-sulfur gasoline and on-road diesel fuel requirements. • • In the Retail Marketing business: • Continued to execute a Retail Portfolio Management program in 2008 designed to enhance overall return on capital employed in the business. Under this program, Sunoco is selectively... -

Page 41

... cogeneration power plant located at the Company's Haverhill, OH site; Began operations in 2007 at a new 1.7 million tons-per-year cokemaking facility in Vitória, Brazil. SunCoke Energy has a $41 million preferred stock investment in this facility and receives fees for operating the plant as... -

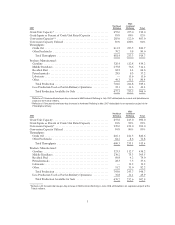

Page 42

...tax) 2008 2007 2006 Refining and Supply ...Retail Marketing ...Chemicals ...Logistics ...Coke ...Corporate and Other: Corporate expenses ...Net financing expenses and other ...Asset write-downs and other matters ...Income tax matters ...Issuance of Sunoco Logistics Partners L.P. limited partnership... -

Page 43

...wholesale and industrial customers. Refining operations are comprised of Northeast Refining (the Marcus Hook, Philadelphia and Eagle Point refineries) and MidContinent Refining (the Toledo and Tulsa refineries). Sunoco intends to sell the Tulsa refinery or convert it to a terminal by the end of 2009... -

Page 44

...the Philadelphia refinery and the turnaround work at the Tulsa refinery as well as increased operating costs to produce low-sulfur fuels. Retail Marketing The Retail Marketing business sells gasoline and middle distillates at retail and operates convenience stores in 26 states, primarily on the East... -

Page 45

.... Chemicals The Chemicals business manufactures phenol and related products at chemical plants in Philadelphia, PA and Haverhill, OH; and polypropylene at facilities in LaPorte, TX, Neal, WV, Bayport, TX and Marcus Hook, PA. The Chemicals business also distributes and markets these products. Sunoco... -

Page 46

...in the event of nonperformance, Sunoco has oversight, performance and other contractual rights under the partnership agreement. Logistics The Logistics business operates refined product and crude oil pipelines and terminals and conducts crude oil acquisition and marketing activities primarily in the... -

Page 47

... 2008, the Partnership purchased a refined products pipeline system, refined products terminal facilities and certain other related assets located in Texas and Louisiana from affiliates of Exxon Mobil Corporation for $185 million. In March 2006, the Partnership purchased two separate crude oil... -

Page 48

... nonconventional fuel tax credits. With the completion of the preferential return periods, the third-party investor's share of net income is now recognized as minority interest expense by the Coke business. With respect to the Jewell operation, beginning in 2008, the price of coke from this facility... -

Page 49

... Matters-During 2008, Sunoco recorded a $95 million after-tax provision to write down Refining and Supply's Tulsa refinery, which it intends to sell or convert to a terminal by the end of 2009; recorded a $35 million after-tax provision to write down Chemicals' Bayport, TX polypropylene plant that... -

Page 50

... percent increases in 2008 and 2007, respectively, were primarily due to higher crude oil and refined product acquisition costs resulting largely from price increases and higher crude oil costs in connection with the crude oil gathering and marketing activities of the Company's Logistics operations... -

Page 51

... Honeywell International Inc. in 2006 in connection with a phenol supply contract dispute, partially offset by lower net income. Increases in crude oil prices typically increase cash generation as the payment terms on Sunoco's crude oil purchases are generally longer than the terms on product sales... -

Page 52

... facility, certain subsidiaries of the Company will sell their accounts receivable from time to time to SRC. In turn, SRC may sell undivided ownership interests in such receivables to commercial paper conduits in exchange for cash or letters of credit. The Company has agreed to continue servicing... -

Page 53

... based upon the number of Company-operated convenience stores and the level of purchases. †Represents fixed and determinable obligations to secure wastewater treatment services at the Toledo refinery and coal handling services at the Indiana Harbor cokemaking facility. Sunoco's operating leases... -

Page 54

... at the Philadelphia refinery to increase ultra-low-sulfur-diesel fuel production capability, $100 million related to growth opportunities in the Logistics business, including amounts attributable to projects to increase crude oil storage capacity at the Partnership's Nederland terminal and to... -

Page 55

... at the Philadelphia refinery to increase ultra-low-sulfur-diesel fuel production capability, $35 million for other refinery upgrade projects, $94 million related to growth opportunities in the Logistics business, $165 million towards the expansion of the Haverhill, OH cokemaking facility and the... -

Page 56

...included a new 24 thousand barrels-per-day hydrotreating unit, sulfur recovery unit and tail gas treater. In 2008, Sunoco elected not to proceed with this project. Sunoco intends to sell the Tulsa refinery or convert it to a terminal by the end of 2009. National Ambient Air Quality Standards ("NAAQS... -

Page 57

...which target specific industries such as petroleum refining or chemical or coke manufacturing could adversely affect the Company's ability to conduct its business and also may reduce demand for its products. MTBE Litigation Information regarding certain MTBE litigation in which Sunoco is a defendant... -

Page 58

... However, increasingly in 2008, Sunoco has satisfied its ethanol purchase commitments utilizing contracts based on spot-market prices. To reduce the margin risk created by the purchases utilizing fixed-price contracts, the Company enters into derivative contracts to sell gasoline at a fixed price to... -

Page 59

... the determination of expense and benefit obligations for Sunoco's postretirement health care benefit plans. The discount rates used to determine the present value of future pension payments and medical costs are based on a portfolio of high-quality (AA rated) corporate bonds with maturities that... -

Page 60

...the 15-year period ended December 31, 2008, the compounded annual investment return on Sunoco's pension plan assets was a positive return of 6.3 percent. The asset allocation for Sunoco's pension plans at December 31, 2008 and 2007 and the target allocation of plan assets for 2009, by asset category... -

Page 61

...assets being reviewed for impairment. Sunoco had asset impairments totaling $155 and $8 million after tax during 2008 and 2007, respectively. The impairments in 2008 related to the Tulsa refinery, which the Company intends to sell or convert to a terminal by the end of 2009; a polypropylene plant in... -

Page 62

marketing properties held for sale in the Company's Retail Portfolio Management program. The impairment in 2007 related to the permanent shutdown of a previously idled phenol line at the Company's Haverhill, OH plant. For a further discussion of these asset impairments, see Note 2 to the ... -

Page 63

... number of risks and uncertainties. Important factors that could cause actual results to differ materially from the forward-looking statements include, without limitation Changes in refining, marketing and chemical margins; Changes in coal and coke prices; Variation in crude oil and petroleum-based... -

Page 64

... product specifications; Availability and pricing of ethanol and related RINs (Renewable Identification Numbers) used to demonstrate compliance with the renewable fuels standard for credits and trading; Political and economic conditions in the markets in which the Company, its suppliers or customers... -

Page 65

...Statements of Income ...Consolidated Balance Sheets ...Consolidated Statements of Cash Flows ...Consolidated Statements of Comprehensive Income and Shareholders' Equity ...Notes to Consolidated Financial Statements ...Quarterly Financial and Stock Market Information ...58 59 60 61 62 63 64 65 98 57 -

Page 66

... independent registered public accounting firm, has issued an audit report on the effectiveness of the Company's internal control over financial reporting as of December 31, 2008, which appears on page 59. Lynn L. Elsenhans Chairman, Chief Executive Officer and President Terence P. Delaney Interim... -

Page 67

... with the standards of the Public Company Accounting Oversight Board (United States), the 2008 consolidated financial statements of Sunoco, Inc. and subsidiaries and our report dated February 24, 2009 expressed an unqualified opinion thereon. Philadelphia, Pennsylvania February 24, 2009 59 -

Page 68

... changed its method for accounting for uncertain income tax positions in 2007. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), Sunoco, Inc. and subsidiaries' internal control over financial reporting as of December 31, 2008... -

Page 69

...taxes) ...Interest income ...Gain related to issuance of Sunoco Logistics Partners L.P. limited partnership units (Note 15) ...Other income, net (Notes 2 and 3) ...Costs and Expenses Cost of products sold and operating expenses ...Consumer excise taxes ...Selling, general and administrative expenses... -

Page 70

...400,000,000 shares; Issued, 2008-281,141,020 shares; Issued, 2007-281,079,728 shares ...Capital in excess of par value ...Retained earnings ...Accumulated other comprehensive loss ...Common stock held in treasury, at cost 2008-164,263,232 shares; 2007-163,472,983 shares ...Total shareholders' equity... -

Page 71

... interest share of Sunoco Logistics Partners L.P. income ...Payments in excess of expense for retirement plans ...Changes in working capital pertaining to operating activities: Accounts and notes receivable ...Inventories ...Accounts payable and accrued liabilities ...Taxes payable ...Other ...Net... -

Page 72

... gain on available-for-sale securities (net of related tax benefit of $5) ...Cash dividend payments ...Purchases for treasury ...Issued under management incentive plans ...Net increase in equity related to unissued shares under management incentive plans ...Other ...Total ...At December 31, 2008... -

Page 73

... and beverages at its convenience stores, operates common carrier pipelines and provides terminalling services through a publicly traded limited partnership and provides a variety of car care services at its retail gasoline outlets. Revenues related to the sale of products are recognized when title... -

Page 74

... of cost or market. The cost of crude oil and petroleum and chemical product inventories is determined using the last-in, first-out method ("LIFO"). The cost of materials, supplies and other inventories is determined using principally the average-cost method. Depreciation and Retirements Plants and... -

Page 75

... investor's share of net income generated by the Company's cokemaking operations is recorded as a noncash increase in minority interest expense in the Coke segment and is included in selling, general and administrative expenses in the consolidated statements of income. Cash payments, representing... -

Page 76

...issuance. Stock-Based Compensation Stock-based payment transactions are recorded utilizing a fair-value-based method of accounting. In addition, the Company uses a non-substantive vesting period approach for stock-based payment awards granted prior to December 2008 that vest when an employee becomes... -

Page 77

... master limited partnership through which Sunoco conducts a substantial portion of its logistics operations, purchased a refined products pipeline system, refined products terminal facilities and certain other related assets located in Texas and Louisiana from affiliates of Exxon Mobil Corporation... -

Page 78

... Company's invested capital in Company-owned or leased retail sites. Most of the sites were converted to contract dealers or distributors thereby retaining most of the gasoline sales volume attributable to the divested sites within the Sunoco branded business. During 2008, 2007 and 2006, net gains... -

Page 79

...write off the affected production line. Sunoco also sold its Neville Island, PA terminal facility and recorded a loss on the divestment and established accruals for enhanced pension benefits associated with employee terminations and for other exit costs. In addition, the Company settled certain MTBE... -

Page 80

... liability ... $ 138 (859) $(721) $ 130 (1,027) $ (897) Net cash payments for income taxes were $234, $397 and $528 million in 2008, 2007 and 2006, respectively. During 2008, Sunoco recorded a $16 million after-tax gain related primarily to tax credits claimed on amended federal income tax returns... -

Page 81

... significantly increase or decrease in the next twelve months. 5. Earnings Per Share Data The following table sets forth the reconciliation of the weighted-average number of common shares used to compute basic earnings per share ("EPS") to those used to compute diluted EPS (in millions): 2008 2007... -

Page 82

... of the following components (in millions of dollars): December 31 2008 2007 Crude oil ...Petroleum and chemical products ...Materials, supplies and other ... $303 327 191 $821 $ 341 647 162 $1,150 The current replacement cost of all inventories valued at LIFO exceeded their carrying value by... -

Page 83

... $3,534 837 1,015 1,101 552 $7,039 Refining and supply ...Retail marketing ...Chemicals ...Logistics ...Coke ... $ 6,088 1,507 1,420 1,658 793 $11,466 9. Retirement Benefit Plans Defined Benefit Pension Plans and Postretirement Health Care Plans Sunoco has both funded and unfunded noncontributory... -

Page 84

... years ended December 31, 2008 and 2007 (in millions of dollars): Defined Benefit Plans 2008 2007 Postretirement Benefit Plans 2008 2007 Reclassifications to earnings of: Actuarial loss amortization ...Prior service cost (benefit) amortization ...Settlement losses ...Retirement benefit plan funded... -

Page 85

... Plans 2007 Unfunded Plans Postretirement Benefit Plans 2008 2007 Benefit obligations at beginning of year* ...Service cost ...Interest cost ...Actuarial losses (gains) ...Plan amendments ...Benefits paid ...Premiums paid by participants ...Special termination benefits ...Benefit obligations at end... -

Page 86

... 31, 2008 and 2007 (in millions of dollars): Defined Benefit Plans 2008 Funded Plans Unfunded Plans Funded Plans 2007 Unfunded Plans Postretirement Benefit Plans 2008 2007 Cumulative amounts not yet recognized in net income: Prior service costs (benefits) ...Actuarial losses ...Accumulated other... -

Page 87

... 2008 2007 Goodwill ...Propylene supply contract ...Dealer and distributor contracts and other intangible assets ...Prepaid retirement costs ...Restricted cash ...Other ... $ 95 87 54 - 18 89 $343 $126 99 59 122 68 100 $574 During 2003, Sunoco formed a limited partnership with Equistar Chemicals... -

Page 88

... each quarter ended after March 31, 2004). At December 31, 2008, the Company's tangible net worth was $3.1 billion and its targeted tangible net worth was $1.9 billion. The Facility also requires that Sunoco's ratio of consolidated net indebtedness, including borrowings of Sunoco Logistics Partners... -

Page 89

... facility, certain subsidiaries of the Company will sell their accounts receivable from time to time to SRC. In turn, SRC may sell undivided ownership interests in such receivables to commercial paper conduits in exchange for cash or letters of credit. The Company has agreed to continue servicing... -

Page 90

... options. The time charter leases typically require a fixed-price payment or a fixed-price minimum and a variable component based on spotmarket rates. In the table above, the variable component of the lease payments has been estimated utilizing the average spot-market prices for the year 2008... -

Page 91

Over the years, Sunoco has sold thousands of retail gasoline outlets as well as refineries, terminals, coal mines, oil and gas properties and various other assets. In connection with these sales, the Company has indemnified the purchasers for potential environmental and other contingent liabilities ... -

Page 92

...): Refineries Retail Sites Chemicals Facilities Pipelines and Terminals Hazardous Waste Sites Other Total At December 31, 2005 ...Accruals ...Payments ...Other ...At December 31, 2006 ...Accruals ...Payments ...Other ...At December 31, 2007 ...Accruals ...Payments ...Other ...At December 31, 2008... -

Page 93

.... At some smaller or less impacted facilities and some previously divested terminals, the focus is on remediating discrete interior areas to attain regulatory closure. Sunoco owns or operates certain retail gasoline outlets where releases of petroleum products have occurred. Federal and state laws... -

Page 94

... 2007, Sunoco, along with other refiners, entered into a settlement in principle which covers 53 MTBE cases. The settlement required a cash payment by the group of settling refiner defendants of approximately $422 million (which included attorneys' fees) plus an agreement in the future to fund costs... -

Page 95

... Internal Revenue Service review. Although the Company believes the possibility is remote that it will be required to do so, at December 31, 2008, the maximum potential payment under these tax indemnifications would have been approximately $180 million. Logistics Operations In 2006, Sunoco Logistics... -

Page 96

...shares of Sunoco common stock at any time prior to maturity at a conversion price of $20.41 per share and are redeemable at the option of the Company. At December 31, 2008, there were 353,602 shares of common stock reserved for this potential conversion (Note 12). The Company increased the quarterly... -

Page 97

... life. The Company uses historical share prices, for a period equivalent to the options' expected life, to estimate the expected volatility of the Company's share price. The fair value of the stock options has been based on the following weighted-average assumptions: 2008 2007 2006 Expected life... -

Page 98

... Sunoco common shares at the end of the period) with any change in fair value recognized as an increase or decrease in income. For service-based awards to be settled in common stock, the grant-date fair value is based on the closing price of the Company's shares on the date of grant. For performance... -

Page 99

... performance-based awards to reflect actual performance. The adjustments are required since the original grants of these awards were at 100 percent of the targeted amounts. ***Cash payments for vested awards are made in the first quarter of the following year. †Includes 195,800 awards attributable... -

Page 100

...the total compensation cost related to nonvested awards not yet recognized reflect the Company's estimates of performance factors pertaining to performance-based common stock unit awards. In addition, equity-based compensation expense attributable to Sunoco Logistics Partners L.P. for 2008, 2007 and... -

Page 101

...wholesale and industrial customers. Refinery operations are comprised of Northeast Refining (the Marcus Hook, Philadelphia and Eagle Point refineries) and MidContinent Refining (the Toledo and Tulsa refineries). Sunoco intends to sell the Tulsa refinery or convert it to a terminal by the end of 2009... -

Page 102

The Chemicals segment manufactures phenol and related products at chemical plants in Philadelphia, PA and Haverhill, OH; and polypropylene at facilities in LaPorte, TX, Neal, WV, Bayport, TX and Marcus Hook, PA. This segment also distributes and markets these products. Sunoco intends to permanently ... -

Page 103

... and Supply Retail Marketing Corporate and Other Chemicals Logistics Coke Consolidated 2008 Sales and other operating revenue (including consumer excise taxes): Unaffiliated customers ...$26,663 $16,097 Intersegment ...$13,875 $- Pretax segment income (loss) ...Income tax (expense) benefit... -

Page 104

... and Supply Retail Marketing Corporate and Other Consolidated Chemicals Logistics Coke 2007 Sales and other operating revenue (including consumer excise taxes): Unaffiliated customers ...$21,149 $14,333 Intersegment ...$12,078 $- Pretax segment income (loss) ...Income tax (expense) benefit... -

Page 105

...of dollars): 2008 2007 2006 Gasoline: Wholesale ...Retail ...Middle distillates ...Residual fuel ...Petrochemicals ...Lubricants ...Other refined products ...Convenience store merchandise ...Other products and services ...Resales of purchased crude oil ...Coke and coal operations ...Consumer excise... -

Page 106

... Stock Prices) 2008 First Quarter Second Quarter Third Quarter Fourth Quarter First Quarter 2007 Second Quarter Third Quarter Fourth Quarter Sales and other operating revenue (including consumer excise taxes) ...$12,796 Gross profit* ...$122 Net income (loss) ...$(59) Net income (loss) per share... -

Page 107

... the fourth quarter of 2008 that have materially affected, or are reasonably likely to materially affect, the Company's internal control over financial reporting. ITEM 9B. OTHER INFORMATION None. PART III ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE The information on directors... -

Page 108

... "Executive Compensation," including the sections entitled "Compensation Discussion and Analysis," "Summary Compensation Table," "Grants of Plan-Based Awards in 2008," "Outstanding Equity Awards at Fiscal Year-End 2008," "Option Exercises and Stock Vested in 2008," "Pension Benefits," "Nonqualified... -

Page 109

... II. -Form of Stock Option Agreement under the Sunoco, Inc. Long-Term Performance Enhancement Plan II. -Sunoco, Inc. Directors' Deferred Compensation Plan I, as amended and restated effective September 4, 2008 (incorporated by reference to Exhibit 10.1 of the Company's Quarterly Report on Form 10... -

Page 110

...by reference to Exhibit 10.9 of the Company's Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2008 filed August 7, 2008, File No. 1-6841). -Sunoco, Inc. Special Executive Severance Plan, as amended and restated effective November 1, 2007 (incorporated by reference to Exhibit 10... -

Page 111

...-Sunoco, Inc. Executive Compensation Summary Sheet. -Omnibus Agreement, dated as of February 8, 2002, among Sunoco, Inc., Sunoco, Inc. (R&M), Sun Pipe Line Company of Delaware, Atlantic Petroleum Corporation, Sunoco Texas Pipe Line Company, Sun Pipe Line Services (Out) LLC, Sunoco Logistics Partners... -

Page 112

.... -Consent of Independent Registered Public Accounting Firm. -Power of Attorney executed by certain officers and directors of Sunoco, Inc. -Certified copy of the resolution authorizing certain officers to sign on behalf of Sunoco, Inc. -Certification Pursuant to Exchange Act Rule 13a-14(a) or Rule... -

Page 113

... of Period Charged to Costs and Expenses Charged To Other Accounts Deductions Balance at End of Period For the year ended December 31, 2008: Deducted from asset in balance sheet-allowance for doubtful accounts and notes receivable ...For the year ended December 31, 2007: Deducted from asset in... -

Page 114

... on its behalf by the undersigned, thereunto duly authorized. SUNOCO, INC. By /s/ TERENCE P. DELANEY Terence P. Delaney Interim Chief Financial Officer Date February 24, 2009 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by or on behalf of the... -

Page 115

... and report financial information; and Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. b) Lynn L. Elsenhans Chairman, Chief Executive Officer and President February 24, 2009... -

Page 116

..., summarize and report financial information; and Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. b) Terence P. Delaney Interim Chief Financial Officer February 24, 2009 108 -

Page 117

... I, Lynn L. Elsenhans, Chief Executive Officer and President of Sunoco, Inc., certify that the Annual Report on Form 10-K for the fiscal year ended December 31, 2008 fully complies with the requirements of section 13(a) or 15(d) of the Securities Exchange Act of 1934 and that the information... -

Page 118

... shares, this graph compares Sunoco's cumulative total return (i.e., based on common stock price and dividends), plotted on an annual basis, with Sunoco's new and former performance peer groups' cumulative total returns and the S&P 500 Stock Index (a performance indicator of the overall stock market... -

Page 119

...Health, Environment and Safety Review and CERES Report is available at our website or by writing the Company. CustomerFirst For customer service inquiries, write the Company or call 1-800-SUNOCO1. Certifications The Certifications of Lynn L. Elsenhans, Chairman, Chief Executive Officer and President... -

Page 120

Sunoco, Inc., 1735 Market Street, Suite LL, Philadelphia, PA 19103-7583 Printed on recycled paper