Sunbeam 2003 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2003 Sunbeam annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

page 2

D

Dear Fellow Shareholders:

In my letter to shareholders last year, I stated that we entered

2003 with a solid platform of businesses and considerable

momentum for growth. I am delighted to report that your

company succeeded in meeting or beating its major objectives

for the year, both operationally and financially.

We reported record financial performance in 2003 with

revenues surpassing the $500 million mark and cash flow

from operations exceeding $70 million. At the same time,

shareholder value continued to expand as evidenced by a

72% increase in our share price, which was achieved on the

heels of strong our performance in 2002.

Our strategy over the last two years has been to focus on

building a portfolio of market-leading, niche branded

consumer products that produce EBITDA margins in excess

of 15%. While the nature of our products might appear to be

diverse, as illustrated by the front cover of this annual report,

they are remarkably similar and cohesive from an operating

perspective. Typically our products are “basic” in nature with

a consumable element, are used in and around the home

and can be shipped in a coordinated manner through our

well-established, complementary distribution channels. Our

goal is to build on our existing portfolio of brands and

products by introducing line extensions or new products that

can best serve the needs of our customers.

As a result of our efforts in the last two and a half years, Jarden

has become a highly regarded leader in the consumer products

market. We continue to work on expanding the depth and

breadth of our product offerings to increase organic growth

in revenue and earnings.

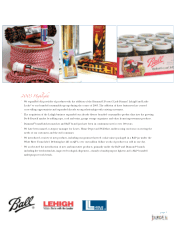

In 2003, we completed two significant acquisitions, as well as

two tuck-in transactions, adding over $250 million in annualized

incremental revenue to the group. In the branded consumables

segment, Diamond Brands provided Jarden with market leading

positions in wooden matches, toothpicks, clothespins and boxed

retail plastic cutlery. The Lehigh acquisition expanded our

retail distribution to the do-it-yourself market, while establishing

us as the largest provider of rope, cord and twine used by con-

sumers in the United States. Equally important as the valuations

on which we were able to buy these businesses, the acquisitions

have been successfully integrated into the group and we are

actively pursuing opportunities to maximize their growth within

the Jarden family.

As part of our ongoing commitment to manage our balance

sheet in what we consider to be a conservative manner during

this period of rapid expansion, we completed a primary equity

offering that netted the company $112 million of new capital

for acquisitions and general corporate purposes. In addition,

we continued to tap the debt markets on an opportunistic basis

during 2003 to build our long-term credit base. This included

the issuance of an additional $32 million of ten year notes and

$280 million of senior secured loans. The strong credit markets

in general, and receptiveness to Jarden in particular, allowed us

to close these financings at favorable rates. Furthermore, the 3

for 2 stock split completed in November increased liquidity in

the market for Jarden’s common stock at a time of heightened

investor interest.

On the operating front, I am pleased to report that we continued

to strengthen our management ranks during 2003, following

our mantra that, “Our best assets go home every night.”

“We believe our portfolio of well-recognized consumer brands has

enormous development potential. The morale within your company is high;

we have a clear strategy, a successful operating business and

a motivated and enthusiastic management team.”

CHAIRMAN’S LETTER