Stein Mart 2014 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2014 Stein Mart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

The comparable store sales increase was driven by increases in average units per transaction and average unit retail prices, partially offset

by a decrease in the number of transactions. The total net sales increase of 2.5% is less than the comparable store sales increase of

3.7% as a result of the 53rd week in 2012 which had sales of $15.8 million.

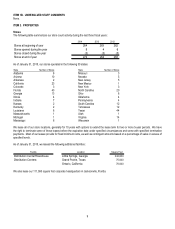

Gross Profit. The following table compares gross profit for fiscal 2013 to fiscal 2012 (dollar amounts in thousands):

2013 2012 Increase

Gross

p

rofit 367,353$ 342,630$ 24,723$

Percentage of net sales 29.1% 27.8% 1.3%

Gross profit as a percent of sales for 2013 increased from 2012 primarily due to the $10.0 million impact of the change in accounting

estimate to refine our estimation of the buying and distribution costs allocated to inventories as well as higher markup.

Selling, General and Administrative Expenses. The following table compares SG&A for fiscal 2013 to fiscal 2012 (dollar amounts in

thousands):

2013 2012 Increase

Selling, general and administrative expenses 326,520$ 306,407$ 20,113$

Percentage of net sales 25.9% 24.9% 1.0%

SG&A increased primarily due to the $15.0 million impact of the change in accounting estimate to refine our estimation of buying and

distribution costs allocated to inventories. In addition to the impact of the change in accounting estimate, the increase in SG&A also

resulted from $3.9 million increase in depreciation expense, $2.5 million supply chain and e-commerce start-up costs, $2.1 million

decrease in breakage income on unused gift cards and merchandise return cards, and higher compensation costs. Depreciation expense

increased as a result of investments in capital expenditures. The decrease in breakage income on unused gift cards and merchandise

return cards was primarily the result of an update in our breakage assumptions during the second quarter of 2012. These increases were

partially offset by $2.1 million lower investigation and related fees as well as lower healthcare costs resulting from favorable claims

experience.

Income Taxes. The following table compares income tax expense for fiscal 2013 to fiscal 2012 (dollar amounts in thousands):

2013 2012 Increase

Income tax ex

p

ense 15

,

013$10

,

971$4

,

042$

Effective tax rate ("ETR") 37.0% 30.5% 6.5%

Income tax expense for 2012 was favorably impacted by non-taxable income related to the elimination of post-retirement life insurance

benefit of $6.4 million.

Liquidity and Capital Resources

Our primary source of liquidity is the sale of merchandise inventories. Capital requirements and working capital needs are funded through

a combination of internally generated funds, available cash, credit terms from vendors, and our $250 million senior secured revolving credit

facility available pursuant to the second amended and restated credit agreement with Wells Fargo Bank, N.A. (the New Credit

Agreement), and our $25 million Equipment Term Loan. Working capital is used to support store inventories and capital investments for

system improvements, new store openings and to maintain existing stores. Historically, our working capital needs are lowest after our

heavy spring selling in March and April and holiday selling in late December and early January. They are highest as we begin paying for

our heavy spring, fall, and holiday receipts in late February, October and at the end of November, respectively.

As of January 31, 2015, we had $65.3 million in cash and cash equivalents and $93.4 million of borrowing availability under our prior $100

million senior secured revolving credit facility (the Prior Credit Agreement) with Wells Fargo Bank, N.A. The Prior Credit Agreement

provided for a $100 million senior secured revolving credit facility which could be increased to $150 million and had a maturity date of

February 28, 2017. The amount available for borrowing was based on 90% of eligible credit card receivables and inventories less

reserves, as defined in the Prior Credit Agreement. The amount available for borrowing represented the capped borrowing base of $100

million reduced by outstanding letters of credit of $6.6 million. We did not use our $100 million revolving credit facility in 2014 or 2013,

other than for outstanding letters of credit. On February 3, 2015, we entered into the $275 million Credit Facilities. The Credit Facilities

replace the Companys former $100 million senior secured revolving credit facility. See Note 13 of the Notes to the Consolidated Financial

Statements for further discussion.

As of February 26, 2015, we had drawn down $185 million of the funds available under the Credit Facilities in part to fund our special cash

dividend of $5.00 per share of our common stock which was paid on February 27, 2015. We believe that we will continue to generate