Stein Mart 2014 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2014 Stein Mart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

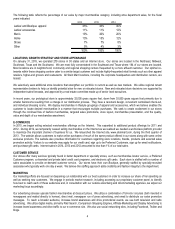

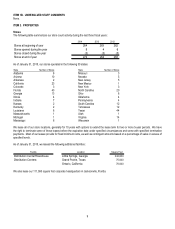

ITEM 6. SELECTED CONSOLIDATED FINANCIAL DATA (Dollars in Thousands, Except Per Share and Per Square Foot Data)

Consolidated Statement of Operations Data:

2014 2013 2012 (1) 2011 2010

Net sales 1,317,677$ 1,263,571$ 1,232,366$ 1,177,951$ 1,201,081$

Cost of merchandise sold 930,941 896,218 889,736 858,335 868,415

Gross profit 386,736 367,353 342,630 319,616 332,666

Selling, general and administrative expenses 342,027 326,520 306,407 287,184 277,330

Operating income 44,709 40,833 36,223 32,432 55,336

Interest expense, net 266 265 225 286 338

Income before income taxes 44,443 40,568 35,998 32,146 54,998

Income tax expense (benefit) 17,537 15,013 10,971 12,215 (1,688)

Net income 26,906$ 25,555$ 25,027$ 19,931$ 56,686$

Basic income per share 0.60$0.58$0.57$ 0.45$1.28$

Diluted income per share 0.59$0.57$0.57$ 0.44$1.26$

Cash dividends paid per share 0.275$0.15$ 1.00$-$ 0.50$

Consolidated Operatin

g

Data:

Stores open at end of period 270 264 263 262 264

Sales per store including gross shoe department (2)(4) 5,217$ 5,085$ 4,949$ 4,793$ 4,813$

Sales per store including net shoe department (3)(4) 4,911$ 4,783$ 4,652$ 4,500$ 4,537$

Sales per square foot including gross shoe department (2)(4) 177$173$167$161$161$

Comparable store net sales increase (decrease) (5) 3.3% 3.7% 2.7% (1.1)% (1.8)%

Consolidated Balance Sheet Data:

Working capital 174,533$ 160,958$ 136,352$ 172,898$ 171,038$

Total assets 553,091 524,258 491,709 479,583 442,023

Capital lease obligations/long-term - - - 1,480 -

Total shareholdersequity 284,938 264,401 234,034 249,671 237,481

(1) 2012 is a 53-week year; all others are 52-week years.

(2) These sales per store and sales per square foot amounts include gross shoe department sales, which are reported net in our net sales. Sales per store is calculated by

dividing (a) total sales including shoe department gross sales for stores open at the end of the year, excluding stores open for less than 12-months by (b) the number of

stores open at the end of such period, exclusive of stores open for less than 12 months. Sales per square foot includes shoe department gross sales and selling space

and excludes administrative, receiving and storage areas. Internet sales are excluded from the calculation.

(3) These sales per store amounts include shoe department commissions, which are included in our net sales. Sales per store is calculated by dividing (a) total sales

including shoe department net sales for stores open at the end of the year, excluding stores open for less than 12-months by (b) the number of stores open at the end of

such period, exclusive of stores open for less than 12 months. Internet sales are excluded from the calculation.

(4) Sales per store and sales per square foot for 2012 has been adjusted to exclude the 53rd week.

(5) Comparable store sales information for a period reflects stores open throughout that period and for the same 52-week period in the prior year and Internet sales, except

for the year 2012. Comparable store net sales increase for 2012 compares sales for the 52 weeks ended January 26, 2013 to the 52 weeks ended January 28, 2012.

Comparable store sales does not include leased department commissions.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with our audited Consolidated Financial Statements and notes thereto included

elsewhere in this Form 10-K. The following discussion and analysis contains forward-looking statements which involve risks and

uncertainties, and our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain

factors, including those set forth in the table of contents.

Overview

We are a national retailer offering the fashion merchandise, service and presentation of a better department or specialty store at prices

comparable to off-price retail chains. Our focused assortment of merchandise features current season moderate to better fashion apparel

for women and men, as well as accessories, shoes and home fashions.

2014 Highlights

Comparable store sales for 2014 increased 3.3 percent compared to 2013 and total sales increased 4.3 percent. Net income for 2014 was

$26.9 million or $0.59 per diluted share compared to $25.6 million or $0.57 per diluted share for 2013.

Cash and cash equivalents at year-end 2014 was $65.3 million compared to $66.9 million at year-end 2013. Our 2014 balance sheet

reflects our increased investment in inventories, capital expenditures of $40 million and payment of one quarterly dividend at $0.05 per