Stein Mart 2014 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2014 Stein Mart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10

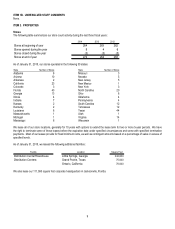

As of January 31, 2015, the current terms of our 270 stores (assuming we exercise all lease renewal options) were as follows:

Number of Leases

Years Lease Term Expire Expiring

2015 2

2016-2019 10

2020-2024 45

2025-2029 74

2030 and later 139

ITEM 3. LEGAL PROCEEDINGS

On July 24, 2013, the Securities and Exchange Commission (the SEC) informed us that it was conducting an investigation of the

Company and made a request for voluntary production of documents and information. The request is focused on our restatement of 2012

and prior financial statements and our 2013 change in auditors. We are cooperating fully with the SEC in this matter. We have recognized

$4.1 million and $1.9 million of expenses related to the SEC investigation during 2014 and 2013, net of expected insurance recoveries,

respectively. A protracted investigation could impose substantial costs and distractions, regardless of its outcome. There can be no

assurance that any final resolution of this investigation will not have a material and adverse effect on the Companys financial condition and

results of operations.

In addition, we are involved in various routine legal proceedings incidental to the conduct of our business. Management, based upon the

advice of outside legal counsel, does not believe that these routine legal proceedings will have a material adverse effect on our financial

condition, results of operations or cash flows.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF

EQUITY SECURITIES

Market Price and Related Matters

Our common stock trades on The NASDAQ Global Select Market (NASDAQ) under the trading symbol SMRT. On March 20, 2015,

there were 847 shareholders of record. The following table sets forth the high and low sales prices of our common stock per NASDAQ and

our quarterly cash dividends per common share for each quarter in the years ended January 31, 2015 and February 1, 2014:

2014 2013

High Low Dividend High Low Dividend

First Quarter $14.78 $11.53 $0.050 $8.92 $7.44 $0.00

Second Quarter 14.36 11.56 0.075 15.21 8.85 0.05

Third Quarter 13.91 11.25 0.075 15.50 11.95 0.05

Fourth Quarter 15.45 12.85 0.075 16.17 12.32 0.05

Dividends

In 2014, we paid a quarterly dividend of $0.05 per common share on April 18, 2014 and a quarterly dividend of $0.075 per common share

on July 18, 2014, October 17, 2014 and January 16, 2015. In 2013, we paid a quarterly dividend of $0.05 per common share on July 19,

2013, October 18, 2013 and January 17, 2014.

On February 4, 2015, the Company announced that its Board of Directors declared a special cash dividend of $5.00 per common share

which was paid on February 27, 2015. The payment made in connection with this dividend was approximately $226 million. See Note 13

of the Notes to the Consolidated Financial Statements for further discussion.

On March 12, 2015, the Company announced that its Board of Directors declared a quarterly dividend of $0.075 per common share which

will be paid on April 17, 2015 to shareholders of record on April 2, 2015.