Starwood 2012 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.-2013Proxy Statement64

EXECUTIVE COMPENSATION

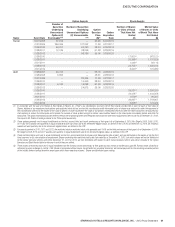

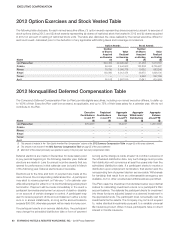

Change in Control

The following table discloses the amounts that would have become payable on account of an involuntary termination without cause

following a change in control or a voluntary termination with good reason following a change in control.

Name

Severance

Pay

($)

Medical

Benefi ts

($)

Vesting of

Restricted

Stock

($)(1)

Vesting

ofStock

Options

($)(2)

Outplacement

($)

401(k)

Payment

($)

Tax

Gross-Up

($) Total

($)

van Paasschen(3) 12,500,000 34,009 15,254,777 13,544,539 — — — 41,333,325

Prabhu 3,755,938 32,807 8,232,881 3,702,101 153,357 — — 15,877,084

Rivera 3,619,750 29,971 3,827,002 3,247,558 144,400 — — 10,868,681

Siegel 3,191,932 31,067 2,356,234 1,424,755 127,698 — — 7,131,686

Turner 3,663,535 31,610 3,954,972 7,659,459 153,357 — — 15,462,933

Avril 20,000 16,082 5,920,986 4,155,867 — — — 10,112,935

(1) Includes values for holdings of restricted stock and restricted stock units. Includes vested but deferred restricted stock units in accordance with the Executive Plan.

(2) Includes vested stock options. Vested stock options could be subject to loss by the named executive officers in the event of a termination for cause and certain other events but

could not in the event of an involuntary termination without cause following a change in control or a voluntary termination with good reason following a change in control.

(3) If the amount of severance pay and other benefits payable on account of a change in control is greater than three times certain base period taxable compensation for Mr.van Paasschen,

a 20% excise tax is imposed on the excess amount of such severance pay and other benefits. Excludes $706,003 of Mr.van Paasschen’s nonqualified deferred compensation that is

payable upon death, disability or certain changes in control as discussed in the section entitled 2012 Nonqualified Deferred Compensation Table beginning on page60

of this proxy statement.

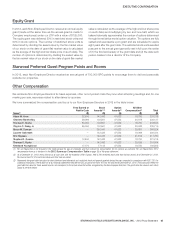

Director Compensation

We use a combination of cash and stock-based awards to attract

and retain qualifi ed candidates to serve on the Board. In setting

director compensation, we consider the signifi cant amount of

time that members of the Board spend in fulfi lling their duties to

us as well as the skill level required by us of our directors. The

compensation structure in effect for 2012 is described below.

For 2012, under our director share ownership guidelines, each

non-employee director (“Non-Employee Director”) was required to

own shares (or deferred compensation stock equivalents) having

a market price equal to four times the annual Non-Employee

Director’s fees paid to such Non-Employee Director. If any Non-

Employee Director fails to satisfy this requirement, sales of shares

by such Non-Employee Director shall be subject to a 35% retention

requirement. Any new Non-Employee Director shall be given a

period of three years to satisfy this requirement.

Non-Employee Directors receive compensation for their services

as described below.

Annual Fees

Each Non-Employee Director receives an annual fee in the amount

of $80,000, payable in four equal installments of shares issued

under our LTIP. The number of shares to be issued is based on the

fair market value of a share using the average of the high and low

price of our stock as of December31 of the year prior to grant.

A Non-Employee Director may elect to receive up to one-half of the

annual fee in cash and to defer (at an annual interest rate of LIBOR

plus 1.5% for deferred cash amounts) any or all of such annual

fee payable in cash. A Non-Employee Director is also permitted to

elect to defer to a deferred unit account any or all of the annual fee

payable in shares. Deferred cash or stock amounts are payable in

accordance with the Non-Employee Director’s advance election.

Non-Employee Directors serving as members of the Audit Committee

receive an additional annual fee payable in cash of $10,000 ($25,000

for the Chairman of the Audit Committee). The chairperson of each

other committee of the Board receives an additional annual fee

payable in cash of $12,500. The Chairman of the Board receives

an additional fee of $150,000, payable quarterly in restricted stock

units which vest in three years.

Attendance Fees

Non-Employee Directors do not receive fees for attendance at meetings.