Starwood 2012 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

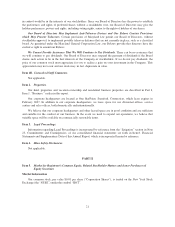

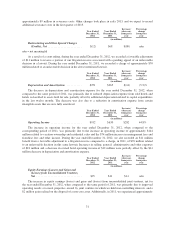

The following table sets forth the quarterly range of the high and low sale prices of the Corporation Shares

for the fiscal periods indicated as reported on the NYSE Composite Tape:

High Low

2012

Fourth quarter ...................................................... $58.48 $50.22

Third quarter ....................................................... $61.09 $48.37

Second quarter ...................................................... $60.81 $47.41

First quarter ........................................................ $59.10 $48.23

2011

Fourth quarter ...................................................... $54.15 $35.78

Third quarter ....................................................... $59.45 $37.88

Second quarter ...................................................... $61.70 $50.87

First quarter ........................................................ $65.51 $54.95

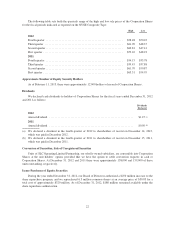

Approximate Number of Equity Security Holders

As of February 11, 2013, there were approximately 12,000 holders of record of Corporation Shares.

Dividends

We declared cash dividends to holders of Corporation Shares for the fiscal years ended December 31, 2012

and 2011 as follows:

Dividends

Declared

2012

Annual dividend ........................................................... $1.25 (a)

2011

Annual dividend ........................................................... $0.50 (b)

(a) We declared a dividend in the fourth quarter of 2012 to shareholders of record on December 14, 2012,

which was paid in December 2012.

(b) We declared a dividend in the fourth quarter of 2011 to shareholders of record on December 15, 2011,

which was paid in December 2011.

Conversion of Securities; Sale of Unregistered Securities

Units of SLC Operating Limited Partnership, our wholly-owned subsidiary, are convertible into Corporation

Shares at the unit holders’ option, provided that we have the option to settle conversion requests in cash or

Corporation Shares. At December 31, 2012 and 2011 there were approximately 158,000 and 159,000 of these

units outstanding, respectively.

Issuer Purchases of Equity Securities

During the year ended December 31, 2012, our Board of Directors authorized a $250 million increase to the

share repurchase program, and we repurchased 6.3 million common shares at an average price of $50.83 for a

total cost of approximately $320 million. As of December 31, 2012, $180 million remained available under the

share repurchase authorization.

22