Starwood 2007 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2007 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

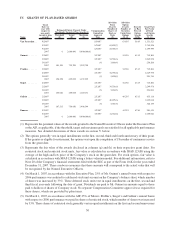

Name 2006 Amount Deferred 2007 Amount Deferred

Van Paasschen ............................... — 134,600

Ouimet..................................... 188,125 213,028

Prabhu ..................................... 189,280 183,603

Siegel...................................... 168,480 195,013

Gellein ..................................... 246,750 —

Duncan .................................... — 240,000

Heyer...................................... — —

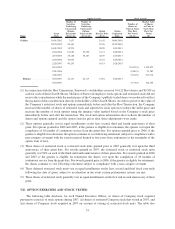

(4) Pursuant to SEC rules, perquisites and personal benefits are not reported for any Named Executive Officer for

whom such amounts were less than $10,000 in the aggregate for 2007 and 2006 but must be identified by type

for each Named Executive Officer for whom such amounts were equal to or greater than $10,000 in the

aggregate. In that regard, the All Other Compensation column of the Summary Compensation Table includes

perquisites and other personal benefits consisting of the following: annual physical examinations, COBRA

premiums paid by the Company, Company contributions to the Company’s tax-qualified 401(k) plan, country

club dues, dividends on restricted stock, legal fees paid by the Company, personal use of Company automobiles,

rent and utilities paid by the Company, spousal accompaniment while on business travel, and tax and financial

planning services. SEC rules require specification of the cost of any perquisite or personal benefit when this

cost exceeds $25,000. This applies to Mr. Heyer’s personal travel (discussed below). It also applies to

Mr. Ouimet’s commuting via commercial air carriers and chartered aircraft, which had an aggregate cost of

$892,204 ($53,594 commercial, based on actual ticket cost, and $838,610 charter, based on actual charter fees)

in 2007 and $197,036 ($33,130 commercial, based on actual ticket cost, and $163,906 charter, based on actual

charter fees) in 2006, and his relocation benefits, which had an aggregate cost 2006 of $122,756 (the amount

paid to the relocation company) and $68,547 in 2007. These amounts are included in the All Other

Compensation column.

The amount reported as All Other Compensation for Mr. Heyer does not include business travel expenses

incurred by Mr. Heyer that the Company determined do not constitute perquisites or personal benefits. For

example, the employment agreement between the Company and Mr. Heyer provided that in addition to

Mr. Heyer’s office at the Company’s headquarters in White Plains, New York, the Company would provide

Mr. Heyer with an office in Atlanta and reimburse Mr. Heyer for travel from the Company’s Atlanta office to the

Company’s headquarters office in White Plains, not exceeding an average of one round trip per week. For

income tax purposes, Mr. Heyer is a resident of the State of Georgia. The net aggregate incremental cost to the

Company for (i) Mr. Heyer’s travel on the Company-owned airplane or chartered aircraft between New York

and Atlanta, (ii) the use of a car and driver while in New York, and (iii) stays at our hotels in the New York area

was $349,869 in 2007 and $866,178 in 2006. The net aggregate incremental cost of Mr. Heyer’s personal use of

the Company-owned plane and chartered aircraft was $33,122 in 2007 and $284,669 in 2006. The value of the

hotel stays for Mr. Heyer was determined on the same basis as payments to hotels for guests staying under the

Starwood Preferred Guest Program. Chartered aircraft were used when the Company-owned airplane was out of

service. The Company’s use of chartered aircraft increased in 2006 because maintenance issues caused the

Company-owned airplane to be out of service. The Company received a recovery from the maintenance

company, and the amount of the recovery been taken into account to reduce the cost reported for personal use of

the airplane as well as for the trips between New York and Atlanta for Mr. Heyer.

Prior to his promotion to President — Global Development Group, Mr. Gellein was Chairman and Chief

Executive Officer of Starwood Vacation Ownership, Inc. (Formerly Vistana, Inc.), the Company’s vacation

ownership subsidiary, and maintained an office at its headquarters in Orlando, Florida. The aggregate

incremental cost to the Company without deducting costs attributable to business use for (i) Mr. Gellein’s

travel on the Company-owned airplane or chartered aircraft between New York and Orlando, (ii) ground

transportation costs and (iii) stays at our hotels in the New York area was $1,092,081 in 2007 and $418,599 in

2006. The value of the hotel stays for Mr. Gellein was determined based on the actual amounts billed to

Mr. Gellein and reimbursed by the Company.

28