Starwood 2007 Annual Report Download - page 144

Download and view the complete annual report

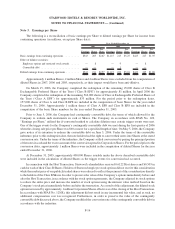

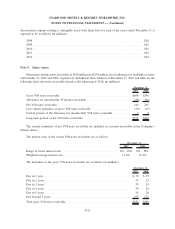

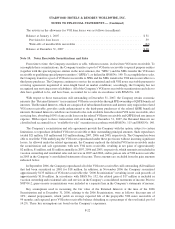

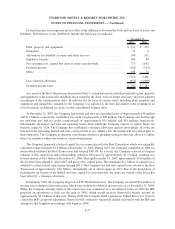

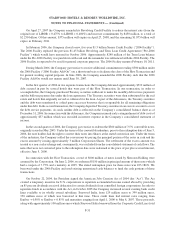

Please find page 144 of the 2007 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.At December 31, 2007, the Company completed a sensitivity analysis on the net present value of the Retained

Interests to measure the change in value associated with independent changes in individual key variables. The

methodology applied unfavorable changes for the key variables of expected prepayment rates, discount rates and

expected gross credit losses as of December 31, 2007. The aggregate net present value and carrying value of

Retained Interests for the Company’s three note sales at December 31, 2007 was approximately $40 million, with

the following key assumptions used in measuring the fair value: an average discount rate of 10.4%, an average

expected annual prepayment rate, including defaults, of 7.7%, and an expected weighted average remaining life of

prepayable notes receivable of 78 months. The decreases in value of the Retained Interests that would result from

various independent changes in key variables are shown in the chart that follows (dollar amounts are in millions).

The factors may not move independently of each other.

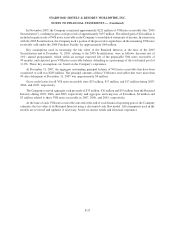

Annual prepayment rate:

100 basis points-dollars .................................................. $ 0.3

100 basis points-percentage ............................................... 0.8%

200 basis points-dollars .................................................. $ 0.6

200 basis points-percentage ............................................... 1.5%

Discount rate:

100 basis points-dollars .................................................. $ 0.8

100 basis points-percentage ............................................... 2.1%

200 basis points-dollars .................................................. $ 1.6

200 basis points-percentage ............................................... 4.1%

Gross annual rate of credit losses:

100 basis points-dollars .................................................. $ 6.6

100 basis points-percentage ............................................... 16.9%

200 basis points-dollars .................................................. $12.9

200 basis points-percentage ............................................... 32.9%

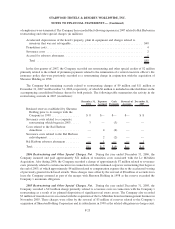

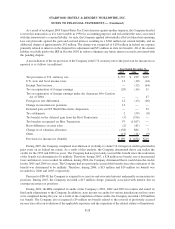

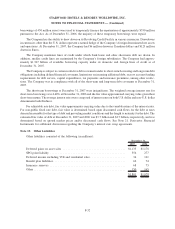

Note 11. Deferred Gains

The Company defers gains realized in connection with the sale of a property for which the Company continues

to manage the property through a long-term management agreement and recognizes the gains over the initial term of

the related agreement. As of December 31, 2007 and 2006, the Company had total deferred gains of $1.216 billion

and $1.258 billion, respectively, included in accrued expenses and other liabilities in the Company’s consolidated

balance sheets. Amortization of deferred gains is included in management fees, franchise fees and other income in

the Company’s consolidated statements of income and totaled approximately $81 million, $62 million and

$12 million in 2007, 2006 and 2005, respectively. The increase in deferred gain amortization in 2007 and

2006 is primarily due to the Host Transaction discussed in Note 5.

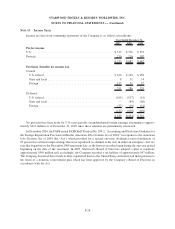

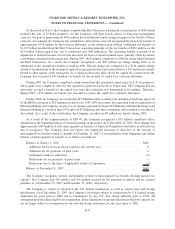

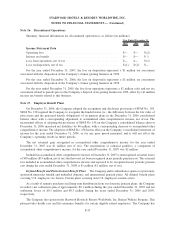

Note 12. Restructuring and Other Special Charges, Net

During the year ended December 31, 2007, the Company recorded net restructuring and other special charges

of approximately $53 million primarily related to the Company’s redevelopment of the Sheraton Bal Harbour Beach

Resort (“Bal Harbour”). The Company demolished the hotel in late 2007 and plans to rebuild a St. Regis hotel along

with branded residences and fractional units. Bal Harbour was closed for business on July 1, 2007, and the majority

F-24

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)