Starwood 2007 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2007 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

that currently anticipated results will be achieved or that we will be able to complete dispositions on commercially

reasonable terms or at all.

We maintain non-U.S.-dollar-denominated debt, which provides a hedge of our international net assets and

operations but also exposes our debt balance to fluctuations in foreign currency exchange rates. During the year

ended December 31, 2007, the effect of changes in foreign currency exchange rates was a net increase in debt of

approximately $5 million. Our debt balance is also affected by changes in interest rates as a result of our interest rate

swap agreements under which we pay floating rates and receive fixed rates of interest (the “Fair Value Swaps”). The

fair market value of the Fair Value Swaps is recorded as an asset or liability and as the Fair Value Swaps are deemed

to be effective, an adjustment is recorded against the corresponding debt. At December 31, 2007, our debt included a

decrease of approximately $6 million related to the fair market value of current Fair Value Swap liabilities. At

December 31, 2006 our debt included a decrease of approximately $17 million related to the unamortized gains on

terminated Fair Value Swaps and the fair market value of current Fair Value Swap liabilities.

If we are unable to generate sufficient cash flow from operations in the future to service our debt, we may be

required to sell additional assets, reduce capital expenditures, refinance all or a portion of our existing debt or obtain

additional financing. Our ability to make scheduled principal payments, to pay interest on or to refinance our

indebtedness depends on our future performance and financial results, which, to a certain extent, are subject to

general conditions in or affecting the hotel and vacation ownership industries and to general economic, political,

financial, competitive, legislative and regulatory factors beyond our control.

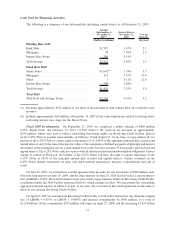

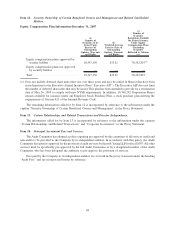

We had the following contractual obligations

(1)

outstanding as of December 31, 2007 (in millions):

Total

Due in Less

Than 1 Year

Due in

1-3 Years

Due in

3-5 Years

Due After

5 Years

Debt ............................ $3,593 $ 5 $1,048 $1,590 $ 950

Capital lease obligations

(2)

............ 2 — — — 2

Operating lease obligations ............ 1,144 82 160 136 766

Unconditional purchase obligations

(3)

.... 114 43 49 19 3

Other long-term obligations ........... 4 — — 4 —

Total contractual obligations ........... $4,857 $130 $1,257 $1,749 $1,721

(1) The table below does not reflect unrecognized tax benefits of $469 million, the timing of which is uncertain.

Refer to Note 13 of the Consolidated Financial Statements for additional discussion on this matter.

(2) Excludes sublease income of $2 million.

(3) Included in these balances are commitments that may be satisfied by our managed and franchised properties.

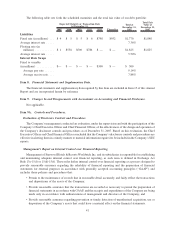

We had the following commercial commitments outstanding as of December 31, 2007 (in millions):

Total

Less Than

1 Year 1-3 Years 3-5 Years

After

5 Years

Amount of Commitment Expiration Per Period

Standby letters of credit .................. $133 $133 $— $— $—

On July 26, 2006, Standard & Poor’s upgraded our rating to BBB- from BB+ and revised their outlook from

positive to stable.

On August 28, 2006, Moody’s Investors Service upgraded our rating to Baa3 from Bal and revised their

outlook from positive to stable.

On October 24, 2006, Fitch’s Investors Service upgraded our rating to BBB- from BB+ and revised their

outlook from positive to stable.

A distribution of $0.90 per Share was paid in January 2008 to shareholders of record as of December 31, 2007.

In connection with the Host Transaction, on February 17, 2006, the Trust declared a distribution of $0.21 per Share

to shareholders of record on February 28, 2006, which was paid on March 10, 2006. In addition, on March 15, 2006,

the Trust declared a distribution of $0.21 per Share to shareholders of record on March 27, 2006, which was paid on

39