Starwood 2007 Annual Report Download - page 134

Download and view the complete annual report

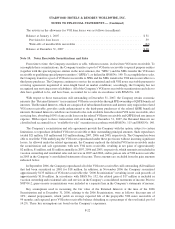

Please find page 134 of the 2007 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the fair values of the acquired assets, including goodwill, and assumed liabilities, with only limited exceptions even

if the acquirer has not acquired 100% of its target. As a consequence, the current step acquisition model will be

eliminated. (II.) Contingent consideration arrangements will be fair valued at the acquisition date and included on

that basis in the purchase price consideration. The concept of recognizing contingent consideration at a later date

when the amount of that consideration is determinable beyond a reasonable doubt, will no longer be applicable.

(III.) All transaction costs will be expensed as incurred. SFAS 141 (R) is effective as of the beginning of an entity’s

first fiscal year beginning after December 15, 2008. Adoption is prospective and early adoption is not permitted.

The Company is currently evaluating the impact that the adoption of SFAS 141 (R) will have on its consolidated

financial statements.

In December 2007, the FASB issued SFAS No. 160, “Non-controlling Interests in Consolidated Financial

Statements — An Amendment of ARB No. 51, or SFAS No. 160.” SFAS No. 160 establishes new accounting and

reporting standards for the non-controlling interest in a subsidiary and for the deconsolidation of a subsidiary.

SFAS No. 160 is effective for fiscal years beginning on or after December 15, 2008. The Company does not believe

that SFAS 160 will have a material impact on the consolidated financial statements.

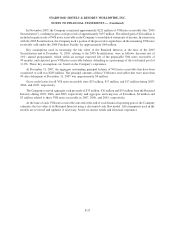

In December 2007, the EITF reached a consensus on EITF issue No. 07-6 “Accounting for the Sale of Real

Estate Subject to the Requirements of FASB Statement No. 66 When the Agreement Includes a Buy-Sell

Clause”(“EITF 07-6”). EITF 07-6 establishes that a buy-sell clause, in and of itself does not constitute a prohibited

form of continuing involvement that would preclude partial sales treatment under FASB Statement No. 66.

EITF 07-6 will be effective for new arrangements entered into in fiscal years beginning after December 15, 2007

and interim periods within those fiscal years. The Company does not believe the adoption of EITF 07-6 will have a

material impact on the consolidated financial statements.

In November 2006, the EITF reached a consensus on EITF Issue No. 06-8, “Applicability of the Assessment of

a Buyer’s Continuing Investment under FASB Statement No. 66, Accounting for Sales of Real Estate, for Sales of

Condominiums” (“EITF 06-8”). EITF 06-8 will require condominium sales to meet the continuing involvement

criterion of SFAS No. 66 in order for profit to be recognized under the percentage of completion method. EITF 06-8

will be effective for annual reporting periods beginning after March 15, 2007. The cumulative effect of applying

EITF 06-8, if any, is to be reported as an adjustment to the opening balance of retained earnings in the year of

adoption. The adoption of EITF 06-8 will not have a significant impact on the Company’s financial statements or

require a cumulative effect adjustment.

In September 2006, the FASB issued SFAS No. 158, “Employers’ Accounting for Defined Benefit Pension and

Other Postretirement Plans — an amendment of FASB Statements No. 87, 88, 106, and 132(R),” which requires

plan sponsors of defined benefit pension and other postretirement benefit plans (collectively, “Benefit Plans”) to

recognize the funded status of their Benefit Plans in the consolidated balance sheet, measure the fair value of plan

assets and benefit obligations as of the date of the fiscal year-end statement of financial position, and provide

additional disclosures. On December 31, 2006, the Company adopted the recognition and disclosure provisions of

SFAS No. 158. The effect of adopting SFAS No. 158 on the Company’s financial condition at December 31, 2006

has been included in the accompanying consolidated financial statements. SFAS No. 158 has been applied

prospectively and does not impact the Company’s prior year financial statements. SFAS No. 158’s provisions

regarding the change in the measurement date of Benefit Plans are not applicable as the Company currently uses a

measurement date of December 31 for its benefit plans.

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements,” which provides enhanced

guidance for using fair value to measure assets and liabilities. SFAS No. 157 establishes a common definition of fair

value, provides a framework for measuring fair value under U.S. generally accepted accounting principles and

expands disclosure requirements about fair value measurements. SFAS No. 157 is effective for financial statements

issued in fiscal years beginning after November 15, 2007, and interim periods within those fiscal years. The

Company does not believe that the adoption of SFAS No. 157 will have a material impact on the consolidated

financial statements.

F-14

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)