Sonic 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 Sonic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 0 1 1 A n n u a l R e p o r t t o S t o c k h o l d e r s

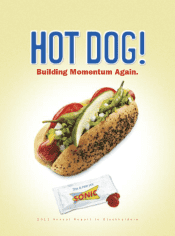

Building Momentum Again.

Table of contents

-

Page 1

Building Momentum Again. 2 0 1 1 A n n u a l R e p o r t t o S t o c k h o l d e r s -

Page 2

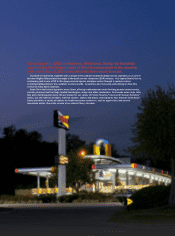

... system. A smiling Carhop delivers the customer's order car-side. Customers also may enjoy patio dining or drive-thru service at many Sonic locations. Sonic Drive-Ins feature signature menu items, offering made-when-you-order footlong quarter pound coneys, six-inch premium beef hot dogs, loaded... -

Page 3

... outstanding 2010 Change ($ in thousands, except per share data and drive-in count) $ $ $ $ 545,951 84,253 0.31 0.53 61,943 $ $ $ $ 550,926 70,881 0.34 0.48 61,576 -1% 19% -9% 10% 1% System Information (for the fiscal year or at fiscal year's end) Company drive-ins Franchise drive-ins System... -

Page 4

...inch premium beef hot dogs. Including tried-and-true favorites along with bold, innovative taste sensations, this new hot dog line-up - along with compelling limited time offers and other new product news - not only expands Sonic's distinctive products, but also delivers great value to our customers... -

Page 5

..., the results achieved and the foundation set for further advancement mean that Sonic is aimed in the right direction and positioned for challenging consumer conditions that are likely to shape the near term. Despite the obstacles we face, we have continued to move forward in several key areas in... -

Page 6

... much of the United States do have the next best thing - a nearby Sonic, where you can personalize your order without limits. Imagine, adding jalapeño peppers to your SuperSonic® Bacon Double Cheeseburger for a lunchtime flavor jolt, or going for one of Sonic's great new hot dogs, like the Bacon... -

Page 7

...years, we have improved menu items representing more than half of our sales with the introduction of real ice cream for our Frozen Favorites® treats, a true footlong quarter pound coney, a line-up of 100% pure beef loaded burgers and, most recently, a selection of new six-inch premium beef hot dogs... -

Page 8

We often talk about driving our sales and business, implementing strategies to meet current economic challenges and moving our brand forward in meaningful and rewarding ways over the years ahead. 6 -

Page 9

... directs the company's marketing and payroll (right and left, respectively, on opposite page), epitomize the drive, determination and passion of our franchisees. Winner of the Chain Leader Award for 2011, Penny has been with Sonic since joining her stepfather in the business in 1984 to run 24 drive... -

Page 10

...with true national stature. As same-store sales improve and drive-in level profits increase, both of which were the case in 2011, they in turn should drive other elements of our multi-layered growth strategy. These elements include our ascending royalty rate and renewed vigor in drive-in development... -

Page 11

9 -

Page 12

Emigrating from Bangladesh in 1990, Zahid Haque came to this country seeking the American dream of opportunity. 1 0 -

Page 13

...for Sonic, offers both advice and seasoned experience to support his objectives. Zahid is just one of the reasons our company drive-ins have seen the resurgence they experienced last year. Same-store sales growth at company drive-ins has exceeded system same-store sales for five consecutive quarters... -

Page 14

1 2 -

Page 15

...'t be matched by the stand-inline, wait-for-your-order-to-be-called kind of fast-food place. Our Carhops, many skating, speed orders car-side and table-side on the patio, adding a personal touch to each Sonic visit and a level of interaction that can only happen at the drive-in. And, armed with our... -

Page 16

Total Revenues (in millions) Net Income Per Diluted Share As Reported Adjusted $0.961 $0.942 $0.723 $0.484 07 08 09 10 11 07 08 09 10 11 System-wide Drive-Ins System-wide Average Sales Per Drive-In (in thousands) 3,544 3,572 3,475 3,343 3,561 $1,125 $1,093 $1,109 $1,023 07... -

Page 17

System-wide Drive-In Locations 10 2 7 14 18 4 12 24 22 81 58 137 197 79 97 223 94 73 270 195 122 108 119 170 964 73 28 46 48 19 6 54 4 4 3 7 5 15 29 17 2 2 New states entered since 2005 99 Day Part Mix Lunch/Dinner Afternoon After Dinner Morning 12% 5% 16% 49% 6% 16% 73% 23% Sonic QSR 1 5 -

Page 18

...,192 Income Statement Data: Company Drive-In sales Franchise Drive-Ins: Franchise royalties Franchise fees Lease revenue Other Total revenues Cost of Company Drive-In sales Selling, general and administrative Depreciation and amortization Provision for impairment of long-lived assets Total expenses... -

Page 19

..., six-inch premium beef hot dogs, footlong quarter pound chili cheese coneys, hand-battered onion rings, tater tots, and a unique breakfast menu. We derive our revenues primarily from Company Drive-In sales and royalties from franchisees. We also receive revenues from leasing real estate to... -

Page 20

... the years indicated as well as the system-wide change in sales and average unit volume. System-wide information includes both Company Drive-In and Franchise Drive-In information, which we believe is useful in analyzing the growth of the brand as well as the company's revenues, since franchisees pay... -

Page 21

... sales Franchise Drive-Ins: Franchise royalties Franchise fees Lease revenue Other Total revenues The following table reflects the changes in sales and same-store sales at Company Drive-Ins. It also presents information about average unit volumes and the number of Company Drive-Ins, which is useful... -

Page 22

...(2): Total at beginning of period Opened Acquired from (sold to) Company, net Closed (net of re-openings) Total at end of period Franchise Drive-In sales Percentage change Effective royalty rate Average sales per Franchise Drive-In Change in same-store sales(3) (1) 3,117 40 5 (47) 3,115 $3,278... -

Page 23

...year 2009. Same-store sales decreases combined with a lower effective royalty rate in 2010 resulted in a decrease in royalties of $11.5 million, which was partially offset by $7.2 million in incremental royalties from newly constructed and refranchised drive-ins. Franchise fees declined $1.0 million... -

Page 24

...an effective tax rate of 32.3% for fiscal year 2011 compared with 29.7% for fiscal year 2010. The increase for fiscal year 2011 was primarily attributable to a $1.8 million tax benefit associated with the stock option exchange program that was implemented during the third quarter of fiscal year 2010... -

Page 25

... and Analysis of Financial Condition and Results of Operations the $1.8 million tax benefit recognized in 2010 discussed earlier. Our tax rate may continue to vary significantly from quarter to quarter depending on the timing of option exercises and dispositions by option-holders, changes to... -

Page 26

...available free cash flow. For additional information on our May 2011 refinancing, see note 10 - Debt, included in Part II, Item 8, "Financial Statements and Supplementary Data" in this Annual Report on Form 10-K. Prior to the refinancing, during the second quarter of fiscal year 2011, we repurchased... -

Page 27

... and Analysis of Financial Condition and Results of Operations On October 13, 2011, subsequent to the end of our 2011 fiscal year, our Board of Directors approved a stock repurchase program. Under the stock repurchase program, we are authorized to purchase up to $30 million of our outstanding shares... -

Page 28

... agreements to pay royalties to Sonic each month based on a percentage of actual sales. However, the royalty payments and supporting financial statements are not due until the following month under the terms of our franchise agreements. As a result, we accrue royalty revenue in the month earned... -

Page 29

... allowable for tax purposes, allowable tax credits for items such as wages paid to certain employees, effective rates for state and local income taxes and the tax deductibility of certain other items. We account for uncertain tax positions under ASC Topic 740, Income Taxes, which sets out criteria... -

Page 30

... effective rate of 5.4%, before amortization of debt-related costs. At August 31, 2011, the fair value of the 2011 Fixed Rate Notes approximated the carrying value of $497.0 million (including accrued interest). Management used market information available for public debt transactions for companies... -

Page 31

... outstanding Common stock, par value $.01; 245,000,000 shares authorized; shares issued 118,309,094 in 2011 and 118,313,450 in 2010 Paid-in capital Retained earnings Accumulated other comprehensive loss Treasury stock, at cost; 56,315,651 shares in 2011 and 56,676,425 shares in 2010 Total Sonic Corp... -

Page 32

...148 706,281 (In thousands, except per share data) 2011 Revenues: Company Drive-In sales Franchise Drive-Ins: Franchise royalties Franchise fees Lease revenue Other Costs and expenses: Company Drive-Ins: Food and packaging Payroll and other employee benefits Other operating expenses, exclusive of... -

Page 33

... sale of noncontrolling interests in Company Drive-Ins Changes to noncontrolling interests Stock-based compensation expense Exercise of stock options Purchase of treasury stock Deferred tax shortfall from stock-based compensation Balance at August 31, 2009 Comprehensive Income: Net income Net change... -

Page 34

...obligations Accounts and notes receivable and decrease in capital lease obligations from property and equipment sales Stock options exercised by stock swap Change in obligation for purchase of property and equipment The accompanying notes are an integral part of the consolidated financial statements... -

Page 35

... of Significant Accounting Policies Operations Sonic Corp. (the "company") operates and franchises a chain of quick-service drive-ins in the United States. It derives its revenues primarily from Company Drive-In sales and royalty fees from franchisees. The company also leases signs and real estate... -

Page 36

... value is recorded as a reduction in paid-in capital. Revenue Recognition, Franchise Fees and Royalties Revenue from Company Drive-In sales is recognized when food and beverage products are sold. Company Drive-In sales are presented net of sales tax and other sales-related taxes. Initial franchise... -

Page 37

...company has the right to control the use of the leased property, which can occur before rent payments are due under the terms of the lease. Contingent rent is generally based on sales levels and is accrued at the point in time it is probable that such sales levels will be achieved. Advertising Costs... -

Page 38

... at fair value on a recurring basis. The company categorizes its assets and liabilities recorded at fair value based upon the following fair value hierarchy established by the Financial Accounting Standards Board ("FASB"): • Level 1 valuations use quoted prices in active markets for identical... -

Page 39

... balance sheets. It also requires the amount of consolidated net income related to noncontrolling interests to be clearly presented on the face of the consolidated statements of income. Additionally, Topic 810 clarifies that changes in a parent's ownership interest in a subsidiary that do not result... -

Page 40

... Per Share The following table sets forth the computation of basic and diluted earnings per share for the years ended August 31: 2011 Numerator: Net income - attributable to Sonic Corp. Denominator: Weighted average common shares outstanding - basic Effect of dilutive employee stock options and... -

Page 41

... the year Goodwill disposed of for noncontrolling interests in Company Drive-Ins Goodwill disposed of related to the sale of Company Drive-Ins Balance as of August 31 The gross carrying amount of franchise agreements, franchise fees and other intangibles subject to amortization was $6.8 million and... -

Page 42

... of leasing land, building and signs for a period of 15 years and are classified as operating leases. There are four renewal options at the end of the primary term for periods of five years for property that is owned by the company. For property owned by third parties, the lease term runs concurrent... -

Page 43

...in 2010 Present value of net minimum lease payments Less amount due within one year Amount due after one year Maturities of these obligations under capital leases and future minimum rental payments required under operating leases that have initial or remaining noncancelable lease terms in excess of... -

Page 44

... to Consolidated Financial Statements August 31, 2011, 2010 and 2009 (In thousands, except per share data) 8. Property, Equipment and Capital Leases Property, equipment and capital leases consist of the following at August 31: Estimated Useful Life Property and equipment: Home office: Leasehold... -

Page 45

... closing, and has the ability to draw additional amounts under the facility from time to time as needed. In June 2011, the company repaid the outstanding balance under its 2011 Variable Funding Notes. Sonic used the $535 million of net proceeds from the issuance of the 2011 Fixed Rate Notes and 2011... -

Page 46

...,562 1,370 (1,504) (1,471) 12 $ 8,969 2009 $ 28,112 2,542 (1,401) - 1,625 $ 30,878 Amount computed by applying a tax rate of 35% State income taxes (net of federal income tax benefit) Employment related and other tax credits, net Benefit from stock option exchange program Other Provision for income... -

Page 47

... leases, including differences related to capitalization and amortization Investment in partnerships, including differences in capitalization, depreciation and direct financing leases State net operating losses Property, equipment and capital leases Deferred income from affiliated franchise fees... -

Page 48

... of stock that employees may purchase under this plan is limited to 1,139 shares. The purchase price will be between 85% and 100% of the stock's fair market value and will be determined by the company's Board of Directors. Stock-Based Compensation The Sonic Corp. 2006 Long-Term Incentive Plan (the... -

Page 49

...the years ended August 31, 2011, 2010 and 2009, respectively. Stock Options A summary of stock option activity under the company's stock-based compensation plans for the year ended August 31, 2011 is presented in the following table: Weighted Average Remaining Contractual Life (Yrs.) Outstanding at... -

Page 50

... a controlling ownership interest and derives its revenues from operating drive-in restaurants. The Franchise Operations segment consists of franchising activities and derives its revenues from royalties, initial franchise fees and lease revenues received from franchisees. The accounting policies of... -

Page 51

... the fiscal years ended August 31, 2011, 2010 and 2009 were $1.5 million, $1.0 million and $1.0 million, respectively. The company has Cash Incentive Plans (the "Incentive Plans") that apply to certain members of management and grants of awards under the incentive plans are at all times subject to... -

Page 52

... Statements August 31, 2011, 2010 and 2009 (In thousands, except per share data) 18. Selected Quarterly Financial Data (Unaudited) First Quarter 2011 2010 Income statement data: Company Drive-In sales Franchise operations Other Total revenues Company Drive-In operating expenses Selling, general... -

Page 53

..., 2011, the company's Board of Directors approved a stock repurchase program. Under the stock repurchase program, the company is authorized to purchase up to $30 million of its outstanding shares of common stock through August 31, 2012. The purchases may be made from time to time on the open market... -

Page 54

...the period ended August 31, 2011, in conformity with U.S. generally accepted accounting principles. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the effectiveness of Sonic Corp.'s internal control over financial reporting as... -

Page 55

... reasonable assurance with respect to financial statement preparation and presentation. The company's management assessed the effectiveness of the company's internal control over financial reporting as of August 31, 2011. In making this assessment, it used the criteria set forth by the Committee of... -

Page 56

... Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Sonic Corp. as of August 31, 2011 and 2010, and the related consolidated statements of income, stockholders' equity (deficit), and cash flows for each of the three years in the period ended August 31, 2011... -

Page 57

... of Investor Relations and Treasurer Renee G. Shaffer Vice President of Supply Chain Management C. Nelson Taylor Vice President of Technical Services Anita K. Vanderveer Vice President of People Barbara A. Williams Vice President of Performance Analysis Charles B. Woods Vice President of Tax Hans... -

Page 58

... Annual Meeting of Stockholders will be held at 1:30 p.m. Central Standard Time on January 19, 2012, at our Corporate Offices, 4th Floor, 300 Johnny Bench Drive, Oklahoma City, Oklahoma. Annual Report on Form 10-K A copy of our annual report on Form 10-K for the year ended August 31, 2011, as filed... -

Page 59

-

Page 60

Sonic Corp. 300 Johnny Bench Drive Oklahoma City, Oklahoma 73104 405 / 225-5000 www.sonicdrivein.com