Sonic 2008 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2008 Sonic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

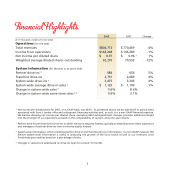

nancia Highlight

2008 2007 Change

($ in thousands, except per share data)

Operations (for the year)

Total revenues $804,713 $770,469 4%

Income from operations $144,208 $145,289 -1%

Net income per diluted share $ 0.97 $ 0.96 11%

Weighted average diluted shares outstanding 62,270 70,592 -12%

System Information (for the year or at year's end)

Partner drive-ins 2684 654 5%

Franchise drive-ins 2,791 2,689 4%

System-wide drive-ins 33,475 3,343 4%

System-wide average drive-in sales 3$ 1,125 $ 1,109 1%

Change in system-wide sales 35.6% 8.6%

Change in system-wide same-store sales 3, 4 0.9% 3.1%

1Net income per diluted share for 2007, on a GAAP basis, was $0.91. As presented above, we exclude $0.05 in special items

associated with Sonic's tender offer and subsequent financing activities and, as such, it is a non-GAAP financial measure.

We believe showing net income per diluted share, excluding debt extinguishment charges, provides additional insight

into the strength of our operations and aids in the comparability of current- and prior-year results.

2Partner drive-ins are those Sonic Drive-Ins in which we own a majority interest, typically at least 60 percent. Most supervisors

and managers of partner drive-ins own a minority equity interest.

3System-wide information, which combines partner drive-in and franchise drive-in information, is a non-GAAP measure. We

believe system-wide information is useful in analyzing the growth of the Sonic brand as well as our revenues, since

franchisees pay royalties based on a percentage of sales.

4Changes in same-store sales based on drive-ins open for at least 15 months.

1