Snapple 2013 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2013 Snapple annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

There’s no doubt that consumers love our avors, and our brand

strength scores reect just that. Our agship brand, Dr Pepper,

connues to score well among consumers for its likeability, uniqueness

and value, performing well in brand relevance, brand strength and

brand equity among CSD consumers in 2013. Clearly our brands are

strong individually, and it’s the strength of our enre porolio that

allows us to provide consumers with the avor variety they crave in the

packaging opons they want and with the range of calorie opons that

ts their lifestyles.

We’re pleased with last year’s launch of the 10-calorie versions of our

Core 4 avors – 7UP TEN, A&W TEN, Sunkist TEN soda and Canada Dry

TEN – which helped Core 4 volume outperform the CSD category by

3 percentage points in 2013. With 52 percent of Core 4 and RC TEN

volume incremental to the CSD category, the TEN lineup is successfully

bringing back lapsed consumers who had previously stopped drinking

so drinks or were drinking fewer servings.

Creang excitement from the rst sip, our TEN products have consumers returning for more. In 2013, repeat purchases of

these innovave products were more than three mes higher than trial rates, proving that trial drives repeat purchases.

In 2014, we will connue to drive trial and promote the TEN products as a group, as demonstrated in January by the An-

Resoluon series of videos featuring Chelsea Handler, the host of “Chelsea Lately” on the E! network.

Our eorts to connue the expansion of the Canada Dry trademark earned it recognion as the

fastest-growing CSD in the category and increased trademark volume more than 6 percent over 2012.

Canada Dry Sparkling Seltzer Waters saw posive growth in measured channels – up 13 percent –

and outpaced the unsweetened sparkling water segment. To build upon this success, we’re adding

a new avor to the brand’s lineup – Canada Dry Peach Mango Sparkling Seltzer Water – as well as

new graphics to emphasize the all-natural aspects of these unsweetened and calorie-free products.

We love our brands like a mom loves her kids, so we understand wanng the best for

them. That’s why we’re pleased that we can provide mom with Mo’s, the No. 1 branded

juice and sauce trademark, and plenty of packaging opons to accommodate her family’s

lifestyle. Building on Mo’s trademark volume growth of 3 percent in 2013, the brand

is poised to grow again in 2014 as we make three popular applesauce avors – Granny

Smith, mixed berry and mango peach – available in pouches, and add a new juice line with

40 percent less sugar than fruit juices and no arcial sweeteners.

Building our brands isn’t limited to new avors and innovaon – we’re also being more ecient

with our markeng spend by invesng in plaorms where we will see the most posive results,

thereby improving our markeng return on investment. For example, we redirected a poron of our

Snapple markeng spend toward digital media in 2013, resulng in a signicant increase in consumer

engagement on Facebook.

We connued to expand our reach into new categories in 2013 by leveraging our allied brands, earning more than

37 percent volume growth in Vita Coco and signing new distribuon agreements with Bai and Sparkling Fruit20. In 2014,

Neuro will add new avors to its Bliss, Sleep and Sonic funconal plaorms, and Vita Coco will launch Vita Coco Lemonade

to bring new consumers to the coconut water category through a more mainstream avor.

In 2014, we will connue building upon our key base brands, including Dr Pepper, 7UP, Canada Dry and Snapple, through

powerful markeng programs focused on increasing relevance with consumers and conversion with our shoppers.

#1 MOTT’S

is the No. 1

branded juice

and sauce

BUILDING OUR BRANDS

4

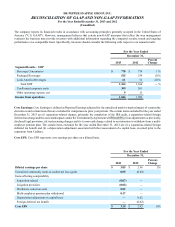

52 percent of volume for Core 4 and RC TEN

was incremental to the CSD category in 2013.

*The non-CSD category excludes sll water in the chart above.

CORE 4 AND RC TEN ARE

DRIVING CATEGORY GROWTH

Consumers

Switching from

Sll Water

Consumers

Switching

from Non-CSDs*

Consumers

Drinking

more CSDs

13%

33%

6%