Snapple 2013 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2013 Snapple annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

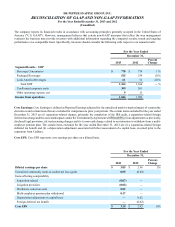

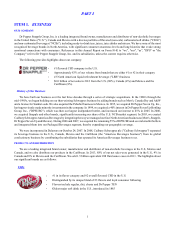

flat

flat

+10%

2012 | $2.92

2013 | $3.20

2012 | $1,364

2013 | $1,364

2012 | $5,995

2013 | $5,997

NET

SALES

SEGMENT

OPERATING

PROFIT

CORE

EARNINGS

PER SHARE*

$702**

‘13

Dividends Paid

Share Repurchases

$1,307*

$773**

$684**

‘10 ‘11 ‘12

$1,113

$194 $251

$522 $400 $400

$302

$284

*2013 core earnings per share (EPS) excludes unrealized

commodity-related mark-to-market losses, separaon-

related charges, an adjustment to a previously disclosed legal

provision, restructuring charges and a non-cash charge related

to our intenon to withdraw from the Local 710 mul-employer

pension plan, which decreased reported EPS by 15 cents per

share. 2012 core EPS excludes unrealized commodity-related

mark-to-market gains and a depreciaon adjustment on capital

leases and certain separaon-related tax-related items, which

increased reported EPS by 4 cents per share.

Compound annual growth rate includes changes in stock price

since Dec. 31, 2008, and reinvestment of dividends. The Peer

Group Index comprises: The Coca-Cola Co., PepsiCo. Inc., Monster

Beverage Corp., The Co Corp. and Naonal Beverage Corp.

*One-me payments of more than $1.6 billion from The Coca-Cola Co. and

PepsiCo. Inc. in 2010 helped fund addional share repurchases.

**DPS made tax payments of $54 million in 2011 and $531 million in 2012

related to the PepsiCo. Inc. and The Coca-Cola Co. licensing agreements.

2013

FINANCIAL SNAPSHOT

(In Millions, Except Earnings Per Share)

PRIMARY SOURCES AND

USES OF CASH

(Five-Year Cumulave Total 2009-2013)

RETURNING CASH TO

SHAREHOLDERS OVER TIME

(In Millions)

ANNUALIZED TOTAL

SHAREHOLDER RETURN

(2009-2013)

.........................................................................................................

2013 FINANCIAL HIGHLIGHTS

3

DPS

S&P 500

PEER GROUP INDEX

28%

15%

11%

SOURCES

Pepsi/Coke

Licensing

Agreements

Operations

Share

Repurchases

Dividends

Net Repayment

of Credit

Facility and Notes

Net Capital Spending

$5.6 Billion $5.7 Billion

USES

$2,435

$1,614

$3,917

*Other,

Net: $95 *

$1,031

$1,163

$1,163

$1,063