Snapple 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Snapple annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

-

119

-

120

-

121

-

122

-

123

-

124

-

125

-

126

-

127

-

128

-

129

-

130

-

131

-

132

-

133

Table of contents

-

Page 1

-

Page 2

TO OUR STOCKHOLDERS

At Dr Pepper Snapple Group, our unmatched portfolio is a flavor powerhouse packed with well-loved brands that have been in people's lives for hundreds of years, and we are certain they will have a place there for many more. What gives us this confidence? It's simple - we're ...

-

Page 3

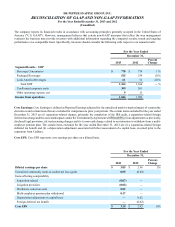

... and certain separation-related tax-related items, which increased reported EPS by 4 cents per share.

*Other, Net: $95

* SOURCES USES

...

RETURNING CASH TO SHAREHOLDERS OVER TIME

(In Millions)

Dividends Paid

$1,307*

Share Repurchases

ANNUALIZED TOTAL SHAREHOLDER RETURN

(2009-2013)

$702**

$400...

-

Page 4

... Coco Lemonade to bring new consumers to the coconut water category through a more mainstream flavor. In 2014, we will continue building upon our key base brands, including Dr Pepper, 7UP, Canada Dry and Snapple, through powerful marketing programs focused on increasing relevance with consumers and...

-

Page 5

... and retail customers to create and execute programs that drive sales. In 2013, we teamed up with Sam's Club and our bottling partners to offer new and exclusive Dr Pepper packages in more than 40 Sam's Clubs in Texas, increasing Dr Pepper trademark volume nearly 4 percent at this retailer. The...

-

Page 6

... of our flavors and fans, we're confident we have the brands, people and strategy in place to deliver value for our consumers, customers and shareholders in 2014 and beyond. Sincerely,

Wayne R. Sanders, Chairman of the Board Feb. 19, 2014

Larry D. Young, President & Chief Executive Officer

-

Page 7

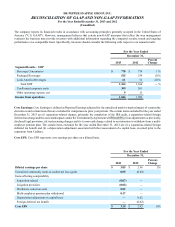

... information regarding the company's results, trends and ongoing performance on a comparable basis. Specifically, investors should consider the following with respect to our annual results: For the Year Ended December 31, Percent 2013 2012 Change Segment Results - SOP Beverage Concentrates Packaged...

-

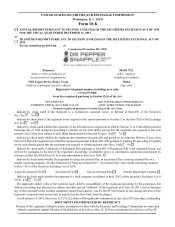

Page 8

... (I.R.S. employer identification number)

5301 Legacy Drive, Plano, Texas 75024 (Address of principal executive offices) (Zip code) Registrant's telephone number, including area code: (972) 673-7000 Securities registered pursuant to Section 12(b) of the Act: COMMON STOCK, $0.01 PAR VALUE

Title...

-

Page 9

... Market Risk Financial Statements and Supplementary Data Changes in and Disagreements With Accountants on Accounting and Financial Disclosure Controls and Procedures Other Information PART III. Item 10. Item 11. Item 12. Item 13. Item 14. Directors, Executive Officers of the Registrant and Corporate...

-

Page 10

... large retail customers; • dependence on third party bottling and distribution companies; • recession, financial and credit market disruptions and other economic conditions; • increases in the cost of raw materials and energy used in our business; • increases in the cost of employee benefits...

-

Page 11

... and other brands, significantly increasing our share of the U.S. NCB market segment. In 2003, we created Cadbury Schweppes Americas Beverages by integrating the way we managed our four North American businesses (Mott's, Snapple, Dr Pepper/Seven Up and Mexico). During 2006 and 2007, we acquired...

-

Page 12

... a leading grapefruit CSD in Mexico Founded in 1938

• • •

#3 orange CSD in the U.S. Flavors include orange, diet and other fruits Brand began as the all-natural orange flavor drink in 1906

• • •

#1 carbonated mineral water brand in Mexico Brand includes Flavors, Twist, Orangeade and...

-

Page 13

... of tea products including premium (regular and diet) and value teas Brand also includes premium juices and juice drinks Founded in Brooklyn, New York in 1972 #1 branded shelf-stable fruit punch brand in the U.S. Brand includes a variety of fruit flavored and reduced calorie juice drinks Developed...

-

Page 14

...the flavored CSD category. Our key brands are Dr Pepper, Canada Dry, 7UP, Squirt, Crush, A&W, Sunkist soda, Schweppes, Sun Drop, and we also sell regional and smaller niche brands. In the CSD market, we distribute finished beverages and manufacture beverage concentrates and fountain syrups. Beverage...

-

Page 15

... the sale of beverage concentrates or the bottling and distribution of our products. Additionally, our integrated business model enables us to be more flexible and responsive to the changing needs of our large retail customers by coordinating sales, service, distribution, promotions and product...

-

Page 16

... and responsive to the changing needs of our large retail customers by coordinating sales, service, distribution, promotions and product launches. Strengthen our route-to-market. Strengthening our route-to-market will ensure the ongoing health of our brands. We continue to invest in information...

-

Page 17

... include 7UP, Dr Pepper, A&W, Canada Dry, Sunkist soda, Squirt, RC Cola, Big Red, Vernors, Diet Rite and Sun Drop. Approximately 84% of our 2013 Packaged Beverages net sales of branded products come from our own brands, with the remaining from the distribution of third party brands such as Big Red...

-

Page 18

... Diet Dr Pepper brands in its Freestyle fountain program. The Freestyle fountain program agreement has a period of 20 years.

CUSTOMERS

We primarily serve two groups of customers: 1) bottlers and distributors and 2) retailers. Bottlers buy beverage concentrates from us and, in turn, they manufacture...

-

Page 19

... include new and reformulated products, improved packaging design, pricing and enhanced availability. We use advertising, sponsorships, merchandising, public relations, promotions and social media to provide maximum impact for our brands and messages.

MANUFACTURING

As of December 31, 2013, we...

-

Page 20

... fleet of approximately 6,000 delivery vehicles and third party logistics providers.

RAW MATERIALS

The principal raw materials we use in our business are aluminum cans and ends, glass bottles, PET bottles and caps, paper products, sweeteners, juice, fruit, water and other ingredients. The cost of...

-

Page 21

... energy drinks, bottled water and NCBs (including ready-to-drink teas, juice and juice drinks and sports drinks). Beverage Digest data does not include multi-serve juice products or bottled water in packages of 1.5 liters or more. Data is reported for certain sales channels, including grocery stores...

-

Page 22

... our business and financial performance. We operate in highly competitive markets. The LRB industry is highly competitive and continues to evolve in response to changing consumer preferences. Competition is generally based upon brand recognition, taste, quality, price, availability, selection and...

-

Page 23

... requirements. Costs for raw materials and energy costs may increase substantially. The principal raw materials we use in our products are aluminum cans and ends, glass bottles, PET bottles and caps, paperboard packaging, sweeteners, juice, fruit, water and other ingredients. The cost of such raw...

-

Page 24

... other benefits. In recent years, these costs have increased significantly due to factors such as increases in health care costs, declines in investment returns on pension assets and changes in discount rates used to calculate pension and related liabilities. These factors plus the enactment of the...

-

Page 25

... costs or capital expenditures. For example, changes in recycling and bottle deposit laws or special taxes on soft drinks or ingredients could increase our costs. Regulatory focus on the health, safety and marketing of food products is increasing. Certain state warning and labeling laws, such...

-

Page 26

... availability risks. Water is the main ingredient in substantially all of our products. Climate change may cause water scarcity and a deterioration of water quality in areas where we maintain operations. The competition for water among domestic, agricultural and manufacturing users is increasing...

-

Page 27

... 84% of our 2013 Packaged Beverages net sales of branded products come from our owned and licensed brands, with the remaining from the distribution of third party brands such as FIJI, Big Red, AriZona, Hydrive, Vita Coco and Neuro. We are subject to a risk of our allied brands terminating their...

-

Page 28

..._____ (1) The office building owned by our Beverage Concentrates operating segment is our corporate headquarters located in Plano, Texas. (2) The three manufacturing facilities owned by Latin America Beverages operating segment includes the manufacturing facility leased to our joint venture with...

-

Page 29

...ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

In the United States, our common stock is listed and traded on the New York Stock Exchange under the symbol "DPS". Information as to the high and low sales prices of our stock for the...

-

Page 30

..., 2010; and $1 billion of share repurchases were authorized on November 17, 2011.

We repurchased approximately 8.7 million shares of our common stock, valued at approximately $400 million, in the year ended December 31, 2013. Our share repurchase activity, on a monthly basis, for the quarter ended...

-

Page 31

...of Total Returns Assumes Initial Investment of $100

The Peer Group Index consists of the following companies: The Coca-Cola Company ("Coca-Cola"), PepsiCo, Inc. ("PepsiCo"), Monster Beverage Corporation, The Cott Corporation and National Beverage Corporation. We believe that these companies help to...

-

Page 32

... information included in Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations," and our Audited Consolidated Financial Statements and the related Notes thereto included elsewhere in this Annual Report on Form 10-K. 2013 Statements of Income Data: Net sales...

-

Page 33

...intake and sugar content in both regular CSDs and juices and the use of artificial sweeteners in diet CSDs. We believe the main beneficiaries of this trend include naturally sweetened, low calorie drinks, all natural and organic beverages, ready-to-drink teas and bottled waters. Increased government...

-

Page 34

... innovation. We believe brand owners and bottling companies will continue to create new products and packages, such as beverages with new ingredients and new premium flavors and innovative convenient packaging, that address changes in consumer tastes and preferences. Changing retailer landscape. As...

-

Page 35

... sales volume, we measure volume in bottler case sales ("volume (BCS)") as sales of packaged beverages, in equivalent 288 fluid ounce cases, sold by us and our bottling partners to retailers and independent distributors. Our contract manufacturing sales are not included or reported as part of volume...

-

Page 36

RESULTS OF OPERATIONS Executive Summary - 2013 Financial Overview and Recent Developments

Net sales totaled $5,997 million for the year ended December 31, 2013, an increase of $2 million from the year ended December 31, 2012. Net income for the year ended December 31, 2013 was $624 million, ...

-

Page 37

... in Snapple as a result of package and product innovation and a 3% increase in Mott's due to distribution gains in our juice and sauce categories. Our water category increased 3%, led by Aguafiel. Clamato increased 6%. Net Sales. Net sales increased $2 million for the year ended December 31, 2013...

-

Page 38

... increases in our commodity costs, led by apples and sweeteners, the $30 million unfavorable comparison for the mark-to-market activity on commodity derivative contracts and unfavorable mix due to a higher mix of finished goods rather than concentrates, as well as package and product mix. The change...

-

Page 39

... 1,229 778 $ 2012 1,221 774 $ Change 8 4

Net Sales. Net sales increased $8 million for the year ended December 31, 2013, compared with the year ended December 31, 2012. The increase was due to an increase in concentrate prices, favorable product mix and lower discounts, which were largely offset by...

-

Page 40

...in AriZona. These decreases were partially offset by a 3% increase in Mott's as a result of distribution gains in our juice and sauce categories and increased promotional activity, a 2% increase in our water category and a 2% increase in Clamato. Snapple was flat for the period. Net Sales. Net sales...

-

Page 41

... margin impact of favorable product mix, increased sales volumes and ongoing productivity improvements. These favorable drivers were partially offset by increases in people costs, marketing investments, other manufacturing costs, commodity costs, which were led by sweeteners, and higher logistics...

-

Page 42

... in Cherry and diet Dr Pepper. Our Core 4 brands increased 1% compared to the year ago period as a mid single-digit increase in Canada Dry was partially offset by low single-digit declines in 7UP and Sunkist soda. Peñafiel increased 5% as a result of package innovation. Schweppes grew 5% reflecting...

-

Page 43

... partially offset by higher costs for apples, flavors, apple juice concentrate, packaging, sweeteners and other commodities. The mark-to-market activity on commodity derivative contracts generated $22 million of unrealized losses for the year ended December 31, 2011. Income from Operations and SG...

-

Page 44

... Operations by Segment We report our business in three segments: Beverage Concentrates, Packaged Beverages and Latin America Beverages. The key financial measures management uses to assess the performance of our segments are net sales and SOP. The following tables set forth net sales and SOP for our...

-

Page 45

... 31, 2011. Volume for our Core 4 brands increased 2%, led by a high single-digit increase in Canada Dry, a mid single-digit increase in Sunkist soda, as a result of flavor expansion, and a low single-digit increase in A&W partially offset by a mid single-digit decrease in 7UP. Dr Pepper volumes...

-

Page 46

... or other economic downturn in the U.S., Canada, Mexico or the Caribbean, which could result in a reduction in our sales volume. Similarly, disruptions in financial and credit markets may impact our ability to manage normal commercial relationships with our customers, suppliers and creditors. These...

-

Page 47

... date for up to two additional one-year terms. An unused commitment fee is payable quarterly to the lenders on the unused portion of the commitments available under the Revolver equal to 0.08% to 0.20% per annum, depending upon our debt ratings. Shelf Registration Statement On February 7, 2013...

-

Page 48

...of our current year net sales. Net cash used in investing activities decreased $23 million for the year ended December 31, 2012, as compared to the year ended December 31, 2011, driven primarily by lower purchases of property, plant and equipment. Purchases of property, plant and equipment decreased...

-

Page 49

... for the years ended December 31, 2013 and 2012 primarily related to machinery and equipment, IT investments, expansion and replacement of existing cold drink equipment, plant improvements and our distribution fleet. Capital expenditures for the year ended December 31, 2011 primarily consisted...

-

Page 50

... shares of common stock valued at approximately $522 million for the years ended December 31, 2013, 2012 and 2011, respectively. Refer to Part II, Item 5 "Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities" of this Annual Report on Form 10...

-

Page 51

..., we may utilize cash on hand or amounts available under our financing arrangements, if necessary. Refer to Note 9 of the Notes to our Audited Consolidated Financial Statements for additional information regarding the senior unsecured notes payments and Commercial Paper described in this table. The...

-

Page 52

... the Notes to our Audited Consolidated Financial Statements. In general, we are covered under conventional insurance programs with high deductibles or are self-insured for large portions of many different types of claims. Our insurance liability for our losses related to these programs are estimated...

-

Page 53

... various risk premiums. For 2013, such discount rates ranged from 8.00% to 13.25%.

Customer Incentives and Marketing Programs Accruals for customer discounts, incentives and marketing programs are established for the expected payout based on contractual terms, volume-based metrics and/or historical...

-

Page 54

... our historical experience and our best judgment regarding future performance. Refer to Note 14 of the Notes to our Audited Consolidated Financial Statements for further information about the key assumptions. The effect of a 1% increase or decrease in the weighted-average discount rate used to...

-

Page 55

... given the nature of claims involved and length of time until their ultimate cost is known. Accrued liabilities related to the retained casualty and health risks are calculated based on loss experience and development factors, which contemplate a number of variables including claim history and...

-

Page 56

... higher pricing may be limited by the competitive environment in which we operate. Our principal commodities risks relate to our purchases of PET, diesel fuel, corn (for high fructose corn syrup), aluminum, sucrose, apple juice concentrate, apples and natural gas (for use in processing and packaging...

-

Page 57

... Sheets as of December 31, 2013 and 2012 Consolidated Statements of Cash Flows for the years ended December 31, 2013, 2012 and 2011 Consolidated Statements of Changes in Stockholders' Equity for the years ended December 31, 2013, 2012 and 2011 Notes to Audited Consolidated Financial Statements...

-

Page 58

... sheets of Dr Pepper Snapple Group, Inc. and subsidiaries (the "Company") as of December 31, 2013 and 2012, and the related consolidated statements of income, comprehensive income, changes in stockholders' equity, and cash flows for each of the three years in the period ended December 31, 2013...

-

Page 59

... Oversight Board (United States), the consolidated financial statements as of and for the year ended December 31, 2013 of the Company and our report dated February 19, 2014 expressed an unqualified opinion on those financial statements. /s/ Deloitte & Touche LLP Dallas, Texas February 19, 2014

49

-

Page 60

...124 11 1,092 125 (2) (9) 978 349 629 - 629 2.99 2.96 210.6 212.3 2011 5,903 2,485 3,418 2,257 - 126 11 1,024 114 (3) (12) 925 320 605 1 606 2.77 2.74 218.7 221.2

DR PEPPER SNAPPLE GROUP, INC.

$ $

$ $

$ $

The accompanying notes are an integral part of these consolidated financial statements.

50

-

Page 61

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

For the Years Ended December 31, 2013, 2012 and 2011 (In millions)

DR PEPPER SNAPPLE GROUP, INC.

For the Year Ended December 31, 2013 Net income Other comprehensive income (loss), net of tax: Foreign currency translation adjustments Net change in ...

-

Page 62

...-current liabilities Total liabilities Commitments and contingencies Stockholders' equity: Preferred stock, $.01 par value, 15,000,000 shares authorized, no shares issued Common stock, $.01 par value, 800,000,000 shares authorized, 197,979,971 and 205,292,657 shares issued and outstanding for 2013...

-

Page 63

...) 3 701 366 $ $

DR PEPPER SNAPPLE GROUP, INC.

2013

Operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation expense Amortization expense Amortization of deferred revenue Employee stock-based compensation expense Deferred income...

-

Page 64

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY

For the Years Ended December 31, 2013, 2012 and 2011 (In millions, except per share data) Common Stock Issued Shares Balance as of January 1, 2011 Shares issued under employee stock-based compensation plans and other Net income Other ...

-

Page 65

... ready-to-drink teas, juices, juice drinks, mixers and water. The Company's brand portfolio includes popular CSD brands such as Dr Pepper, Canada Dry, 7UP, Squirt, Crush, A&W, Peñafiel, Sunkist soda, Schweppes and Sun Drop, and NCB brands such as Snapple, Hawaiian Punch, Mott's, Clamato, Mr...

-

Page 66

... $ 2 24 (24) (24) (7) 12 482 (217) (217)

DR PEPPER SNAPPLE GROUP, INC.

For the Year Ended December 31, 2011 As previously reported Correction As corrected Consolidated Statement of Cash Flows: Change in other current and non-current liabilities Change in trade accounts payable Net cash provided by...

-

Page 67

... CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

DR PEPPER SNAPPLE GROUP, INC.

2. Significant Accounting Policies

Use of Estimates The process of preparing DPS' consolidated financial statements in conformity with U.S. GAAP requires the use of estimates and judgments that affect the reported amount...

-

Page 68

... over the estimated useful asset lives as follows: Type of Asset Buildings Building improvements Machinery and equipment Vehicles Cold drink equipment Computer software Useful Life 40 years 3 to 35 years 3 to 23 years 5 to 12 years 3 to 7 years 3 to 5 years

DR PEPPER SNAPPLE GROUP, INC.

Leasehold...

-

Page 69

... additional information. Capitalized Customer Incentive Programs The Company provides support to certain customers to cover various programs and initiatives to increase net sales, including contributions to customers or vendors for cold drink equipment used to market and sell the Company's products...

-

Page 70

... Retirement Income Security Act of 1974, as amended. Employee benefit plan obligations and expenses included in the Consolidated Financial Statements are determined from actuarial analyses based on plan assumptions, employee demographic data, years of service, compensation, benefits and claims...

-

Page 71

... years ended December 31, 2013, 2012 and 2011, respectively. The amounts of trade spend are larger in the Packaged Beverages segment than those related to other parts of our business. Accruals are established for the expected payout based on contractual terms, volume-based metrics and/or historical...

-

Page 72

...expense in the Consolidated Statements of Income related to the fair value of employee stock-based awards. Compensation cost is based on the grant-date fair value, which is estimated using the Black-Scholes option pricing model for stock options. The fair value of restricted stock units ("RSUs") and...

-

Page 73

...13.15 12.43 Annual Average Rates 1.03 1.00 0.99

DR PEPPER SNAPPLE GROUP, INC.

Canadian Dollar to U.S. Dollar Exchange Rate 2013 2012 2011

Differences arising from the translation of opening balance sheets of these entities to the rate ruling at the end of the financial year are recognized in AOCL...

-

Page 74

...DR PEPPER SNAPPLE GROUP, INC.

3. Acquisition

On February 25, 2013, the Company acquired certain assets of Dr. Pepper/7-Up Bottling Company of the West ("DP/7UP West") to strengthen the Company's route-to-market in the U.S. and support efforts to build and enhance our leading brands. The fair value...

-

Page 75

NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

DR PEPPER SNAPPLE GROUP, INC.

4. Inventories

Inventories as of December 31, 2013 and 2012 consisted of the following (in millions): December 31, 2013 Raw materials Spare parts Work in process Finished goods Inventories at first in ...

-

Page 76

... does not have a readily determinable fair value as the entity is not publicly traded.

DR PEPPER SNAPPLE GROUP, INC.

7. Goodwill and Other Intangible Assets

Changes in the carrying amount of goodwill for the years ended December 31, 2013 and 2012, by reporting unit, are as follows (in millions...

-

Page 77

...Year 2014 2015 2016 2017 2018

On October 1, 2013, DPS changed the date of its annual impairment tests for goodwill and indefinite-lived intangible assets from December 31 to October 1. The change in date for the goodwill impairment test is a change in accounting principle, which management believes...

-

Page 78

... cost of equity and cost of debt and were adjusted with various risk premiums. As of October 1, 2013, the results of the annual impairment tests indicated no impairment was required. The estimated fair value of each reporting unit exceeded the carrying value for all of the Company's goodwill by...

-

Page 79

... CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

DR PEPPER SNAPPLE GROUP, INC.

8. Other Current Liabilities

Other current liabilities consisted of the following as of December 31, 2013 and 2012 (in millions): December 31, 2013 Customer rebates and incentives Accrued compensation Insurance liability...

-

Page 80

... Carrying Amount December 31, December 31, 2013 2012 $ - 500 724 248 241 241 247 252 2,453 $ 250 500 724 253 247 254 249 271 2,748

DR PEPPER SNAPPLE GROUP, INC.

Issuance 2013 Notes 2016 Notes 2018 Notes 2019 Notes 2020 Notes 2021 Notes 2022 Notes 2038 Notes

(1)

Maturity Date May 1, 2013 January...

-

Page 81

...as of December 31, 2013 and 2012. The repayment of the 2013 Notes occurred on May 1, 2013 at maturity.

BORROWING ARRANGEMENTS

DR PEPPER SNAPPLE GROUP, INC.

Commercial Paper Program On December 10, 2010, the Company entered into a commercial paper program under which the Company may issue unsecured...

-

Page 82

..., 2013 and $27 million of which remains available for use.

DR PEPPER SNAPPLE GROUP, INC.

10. Derivatives

DPS is exposed to market risks arising from adverse changes in interest rates; foreign exchange rates; and commodity prices affecting the cost of raw materials and fuels.

The Company manages...

-

Page 83

... cost structure. During the years ended December 31, 2013, 2012 and 2011, the Company held forward and future contracts that economically hedged certain of its risks. In these cases, a natural hedging relationship exists in which changes in the fair value of the instruments act as an economic offset...

-

Page 84

... TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

FAIR VALUE OF DERIVATIVE INSTRUMENTS

DR PEPPER SNAPPLE GROUP, INC.

The following table summarizes the location of the fair value of the Company's derivative instruments within the Consolidated Balance Sheets as of December 31, 2013 and 2012...

-

Page 85

... HEDGES

DR PEPPER SNAPPLE GROUP, INC.

The following table presents the impact of derivative instruments designated as cash flow hedging instruments under U.S. GAAP to the Consolidated Statements of Income and Comprehensive Income for the years ended December 31, 2013, 2012 and 2011 (in millions...

-

Page 86

...)

IMPACT OF FAIR VALUE HEDGES

DR PEPPER SNAPPLE GROUP, INC.

The following table presents the impact of derivative instruments designated as fair value hedging instruments under U.S. GAAP to the Consolidated Statements of Income for the years ended December 31, 2013, 2012 and 2011 (in millions...

-

Page 87

...)

IMPACT OF ECONOMIC HEDGES

DR PEPPER SNAPPLE GROUP, INC.

The following table presents the impact of derivative instruments not designated as hedging instruments under U.S. GAAP to the Consolidated Statements of Income for the years ended December 31, 2013, 2012 and 2011 (in millions): Amount of...

-

Page 88

NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

DR PEPPER SNAPPLE GROUP, INC.

11. Other Non-Current Assets and Other Non-Current Liabilities

The table below details the components of other non-current assets and other non-current liabilities as of December 31, 2013 and 2012 (in ...

-

Page 89

...

DR PEPPER SNAPPLE GROUP, INC.

The following is a reconciliation of provision for income taxes computed at the U.S. federal statutory tax rate to the (benefit) provision for income taxes reported in the Consolidated Statements of Income (in millions): For the Year Ended December 31, 2013 2012 2011...

-

Page 90

...(1,208) (32) (434) $ 530 70 29 24 22 10 35 720 $ 557 115 18 22 25 12 57 806 December 31, 2012

DR PEPPER SNAPPLE GROUP, INC.

$

The Company recorded a significant U.S. deferred tax asset of $568 million during 2011 with respect to the PepsiCo and Coca-Cola deferred revenue balance as of December 31...

-

Page 91

... prior year Decreases related to tax positions taken during the prior year Decreases related to settlements with taxing authorities Decreases related to lapse of applicable statute of limitations Ending balance $ December 31, 2012 December 31, 2011 490 - 1 (7) - (4) 480

DR PEPPER SNAPPLE GROUP, INC...

-

Page 92

... and expenses included in the Company's Audited Consolidated Financial Statements are determined using actuarial analyses based on plan assumptions including employee demographic data such as years of service and compensation, benefits and claims paid and employer contributions, among others. The...

-

Page 93

... in the Company's financial statements and the plans' funded status for the years ended December 31, 2013 and 2012 (in millions): Postretirement Medical Plans 2013 2012 9 $ - - (1) (1) - - - 7 10 - - 1 (1) - (1) $ - 9 5 - 1 (1) - - 5 (4) 1 (5) 1 (1) (4) (4)

DR PEPPER SNAPPLE GROUP, INC.

Pension...

-

Page 94

... Plans For the Year Ended December 31, 2013 2012 2011 2013 2012 2011 Net Periodic Benefit Costs Service cost Interest cost Expected return on assets Amortization of actuarial loss Amortization of prior service credit Curtailments Settlements Net periodic benefit costs Changes Recognized in OCI...

-

Page 95

... Assumptions

The Company's pension expense was calculated based upon a number of actuarial assumptions including discount rate, retirement age, compensation rate increases, expected long-term rate of return on plan assets for pension benefits and the healthcare cost trend rate related to its...

-

Page 96

...DR PEPPER SNAPPLE GROUP, INC.

Weighted-average discount rate Expected long-term rate of return on assets Rate of increase in compensation levels

Pension Plans 2013 2012 4.30% 5.00% 6.00% 6.50% 3.00% 3.00%

2011 5.57% 6.50% 3.50%

The following table summarizes the weighted-average assumptions used...

-

Page 97

... 15% - 25% 5% - 10% 65% - 85%

DR PEPPER SNAPPLE GROUP, INC.

Cash and cash equivalents Equity securities U.S. Large-Cap equities International equities Fixed income securities Derivative financial instruments U.S. Municipal bonds U.S. Corporate bonds International bonds Total assets Fixed income...

-

Page 98

... CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

MULTI-EMPLOYER PLANS

DR PEPPER SNAPPLE GROUP, INC.

The Company participates in four trustee-managed multi-employer defined benefit pension plans for union-represented employees under certain collective bargaining agreements. The risks of participating...

-

Page 99

... as of December 31, 2013: Central States, Southeast and Southwest Areas Pension Fund ("Central States") 36-6044243 001 June 22, 2014 - February 17, 2018(3) Yes Red Red Yes

DR PEPPER SNAPPLE GROUP, INC.

Legal name of the plan Plan's Employer Identification Number Plan Number Expiration dates of the...

-

Page 100

... three years of service with the Company. The Company made contributions of $16 million to the EDC for the plan years ended December 31, 2013, 2012 and 2011.

DR PEPPER SNAPPLE GROUP, INC.

15. Fair Value

Under U.S. GAAP, fair value is defined as the price that would be received to sell an asset...

-

Page 101

... liabilities Level 2 5 35 40 1 3 2 6 $ $ $ Level 3

DR PEPPER SNAPPLE GROUP, INC.

$

$

$

The fair values of marketable securities are determined using quoted market prices from daily exchange traded markets based on the closing price as of the balance sheet date and were classified as Level...

-

Page 102

...39 23 18 6 138 26 250

DR PEPPER SNAPPLE GROUP, INC.

Cash and cash equivalents Equity securities(1) U.S. Large-Cap equities(2) International equities Fixed income securities Derivative financial instruments(3) U.S. Municipal bonds U.S. Corporate bonds International bonds Total assets Fixed income...

-

Page 103

...number of units held as of the measurement date and are classified as Level 2 assets. (3) Derivative financial instruments consist of U.S Treasury futures. The fair value of these futures is determined by using quoted market prices of the same or similar instruments. (4) U.S. Municipal and Corporate...

-

Page 104

... FINANCIAL STATEMENTS

(Continued) Fair Value Measurements at December 31, 2012 Quoted Prices in Active Significant Markets for Other Significant Identical Observable Unobservable Assets Inputs Inputs Total Level 1 Level 2 Level 3 $ 1 4 5 $ - - - $ 1 4 5 $ - - -

DR PEPPER SNAPPLE GROUP, INC.

Equity...

-

Page 105

... AUDITED CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

DR PEPPER SNAPPLE GROUP, INC.

16. Stock-Based Compensation

Stock-based compensation expense is recorded in SG&A expenses in the Consolidated Statements of Income. The components of stock-based compensation expense for the years ended December...

-

Page 106

... average assumptions used to value grant options are detailed below: For the Year Ended December 31, 2013 2012 2011 $ 6.92 $ 7.05 $ 6.59 0.68% 0.87% 2.51% 4.5 5.1 6.0 3.39% 3.52% 2.75% 27.42% 30.64% 22.70%

DR PEPPER SNAPPLE GROUP, INC.

Fair value of options at grant date Risk free interest rate...

-

Page 107

... FINANCIAL STATEMENTS

(Continued)

RESTRICTED STOCK UNITS

DR PEPPER SNAPPLE GROUP, INC.

The table below summarizes RSU activity for the year ended December 31, 2013. The fair value of restricted stock units is determined based on the number of units granted and the grant date price of common stock...

-

Page 108

... PSU activity for the year ended December 31, 2013. The fair value of performance share units is determined based on the number of units granted and the grant date price of common stock. Weighted Average Remaining Contractual Term (Years) 1.64

DR PEPPER SNAPPLE GROUP, INC.

PSUs Outstanding as...

-

Page 109

... available for share repurchase under the Board authorization.

DR PEPPER SNAPPLE GROUP, INC.

18. Accumulated Other Comprehensive Loss

The following table provides a summary of changes in the balances of each component of AOCL, net of taxes, for the years ended December 31, 2013, 2012 and 2011...

-

Page 110

... FINANCIAL STATEMENTS

(Continued)

DR PEPPER SNAPPLE GROUP, INC.

19. Supplemental Cash Flow Information

The following table details supplemental cash flow disclosures of non-cash investing and financing activities for the years ended December 31, 2013, 2012 and 2011 (in millions): For the Year...

-

Page 111

... Mexico, Caribbean, and other international markets from the manufacture and distribution of concentrates, syrup and finished beverages. Segment results are based on management reports. Net sales and SOP are the significant financial measures used to assess the operating performance of the Company...

-

Page 112

... Beverages Net sales $ 1,229 4,306 462 5,997 $ 2012 1,221 4,358 416 5,995 $ 2011 1,193 4,292 418 5,903

DR PEPPER SNAPPLE GROUP, INC.

$

$

$

For the Year Ended December 31, 2013 Segment Results - SOP Beverage Concentrates Packaged Beverages Latin America Beverages Total SOP Unallocated corporate...

-

Page 113

... were reported in DPS' Packaged Beverages and Latin America Beverages segments. Additionally, customers in the Company's Beverage Concentrates segment buy concentrate from DPS which is used in finished goods sold by the Company's third party bottlers to WalMart. These indirect sales further increase...

-

Page 114

NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

DR PEPPER SNAPPLE GROUP, INC.

22. Restructuring Costs

The Company incurred restructuring costs of $7 million during the year ended December 31, 2013, related to individually insignificant restructuring activities. These charges were ...

-

Page 115

... AUDITED CONSOLIDATED FINANCIAL STATEMENTS

(Continued) Condensed Consolidating Statements of Income For the Year Ended December 31, 2013 NonGuarantors Guarantors ...DR PEPPER SNAPPLE GROUP, INC.

Net sales Cost of sales Gross profit Selling, general and administrative expenses Multi-employer...

-

Page 116

NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS

(Continued) Condensed Consolidating Statements of Income For the Year Ended December 31, 2012 NonParent Guarantors ...349 629 - - 629

DR PEPPER SNAPPLE GROUP, INC.

Net sales Cost of sales Gross profit Selling, general and administrative expenses ...

-

Page 117

...TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS

(Continued) Condensed Consolidating Statements of Income For the Year Ended December 31, 2011 NonParent Guarantors Guarantors...320 605 - 1 606

DR PEPPER SNAPPLE GROUP, INC.

Net sales Cost of sales Gross profit Selling, general and administrative expenses ...

-

Page 118

NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS

(Continued) Condensed Consolidating Statements of Comprehensive Income For the Year Ended December 31, 2013 NonGuarantors Guarantors Eliminations Total (1,062) $ $ 1,036 $ 26 $ 624

DR PEPPER SNAPPLE GROUP, INC.

Net income Other comprehensive ...

-

Page 119

...13,347) $ $

DR PEPPER SNAPPLE GROUP, INC.

Parent Current assets: Cash and cash equivalents Accounts receivable: Trade, net Other Related party receivable Inventories Deferred tax assets Prepaid expenses and other current assets Total current assets Property, plant and equipment, net Investments in...

-

Page 120

... - (26) (11,127) $ $

DR PEPPER SNAPPLE GROUP, INC.

Parent Current assets: Cash and cash equivalents Accounts receivable: Trade, net Other Related party receivable Inventories Deferred tax assets Prepaid and other current assets Total current assets Property, plant and equipment, net Investments in...

-

Page 121

... 31, 2013 NonGuarantors Guarantors Eliminations

DR PEPPER SNAPPLE GROUP, INC.

Parent Operating activities: Net cash (used in) provided by operating activities Investing activities: Acquisition of business Purchase of property, plant and equipment Purchase of intangible assets Return of capital...

-

Page 122

...DR PEPPER SNAPPLE GROUP, INC.

Parent Operating activities: Net cash (used in) provided by operating activities Investing activities: Purchase of property, plant and equipment Purchase of intangible assets Return of capital Proceeds from disposals of property, plant and equipment Issuance of related...

-

Page 123

... Consolidating Statements of Cash Flows For the Year Ended December 31, 2011 NonGuarantors Guarantors Eliminations

DR PEPPER SNAPPLE GROUP, INC.

Parent Operating activities: Net cash (used in) provided by operating activities Investing activities: Purchase of property, plant and equipment Purchase...

-

Page 124

... FINANCIAL STATEMENTS

(Continued)

DR PEPPER SNAPPLE GROUP, INC.

24. Selected Quarterly Financial Data (unaudited)

The following table summarizes the Company's information on net sales, gross profit, net income, earnings per share and other quarterly financial data by quarter for the years...

-

Page 125

... as an exhibit to this Annual Report on Form 10-K. The Code of Conduct is also posted on our website at www.drpeppersnapplegroup.com under the Investors - Company and Governance captions.

PART III

Item 10. Directors. Executive Officers and Corporate Governance. Information not disclosed below that...

-

Page 126

... Sheets as of December 31, 2013 and 2012 Consolidated Statements of Cash Flows for the years ended December 31, 2013, 2012 and 2011 Consolidated Statements of Changes in Stockholders' Equity for the years ended December 31, 2013, 2012 and 2011 Notes to Consolidated Financial Statements for the years...

-

Page 127

...3.2 3.3 4.1 4.2 4.3 4.4 4.5 Separation and Distribution Agreement between Cadbury Schweppes plc and Dr Pepper Snapple Group, Inc. and, solely for certain provisions set forth therein, Cadbury plc, dated as of May 1, 2008 (filed as Exhibit 2.1 to the Company's Current Report on Form 8-K (filed on May...

-

Page 128

...incorporated herein by reference). Employee Matters Agreement between Cadbury Schweppes plc and Dr Pepper Snapple Group, Inc. and, solely for certain provisions set forth therein, Cadbury plc, dated as of May 1, 2008 (initially filed as Exhibit 10.3 to the Company's Current Report on Form 8-K (filed...

-

Page 129

... Dr Pepper Snapple Group, Inc. (filed as Exhibit 10.1 to the Company's Current Report on Form 8-K (filed on November 14, 2012) and incorporated herein by reference.

10.21 10.22 10.23 10.24 10.25 10.26

10.27

10.28

10.29*†Agreement dated July 22, 2013, among The American Bottling Company, Mott...

-

Page 130

... Code. The following financial information from Dr Pepper Snapple Group, Inc.'s Annual Report on Form 10-K for the year ended December 31, 2013, formatted in XBRL (eXtensible Business Reporting Language): (i) Consolidated Statements of Income for the years ended December 31, 2013, 2012 and 2011...

-

Page 131

... thereunto duly authorized. Dr Pepper Snapple Group, Inc. By: Date: February 19, 2014 Name: Title: /s/ Martin M. Ellen Martin M. Ellen Executive Vice President and Chief Financial Officer

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the...

-

Page 132

...:

/s/ Joyce M. Roché Joyce M. Roché Director

By: Date: February 19, 2014 Name: Title:

/s/ Ronald G. Rogers Ronald G. Rogers Director

By: Date: February 19, 2014 Name: Title: Jack L. Stahl Director

/s/ Jack L. Stahl

By: Date: February 19, 2014 Name: Title:

/s/ M. Anne Szostak M. Anne Szostak...

-

Page 133

DR PEPPER SNAPPLE GROUP, INC.

STOCKHOLDER INFORMATION

Corporate Headquarters Dr Pepper Snapple Group, Inc. 5301 Legacy Drive Plano, Texas 75024 (972) 673-7000 www.drpeppersnapple.com Annual Meeting of Stockholders May 15, 2014 10:00 a.m. CDT Westin Stonebriar Resort Conference Center 1549 Legacy ...