Sallie Mae 2008 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2008 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240

|

|

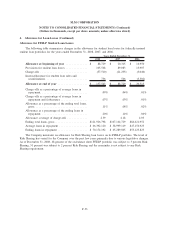

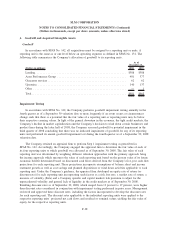

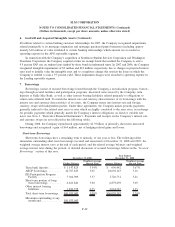

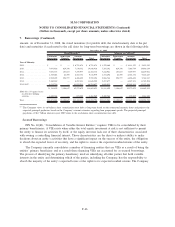

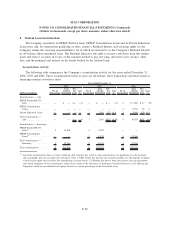

7. Borrowings (Continued)

Ending Balance

Weighted Average

Interest Rate Average Balance

Weighted Average

Interest Rate

December 31, 2007

Year Ended

December 31, 2007

Term bank deposits ........ $ 254,029 4.77% $ 166,013 4.94%

ABCP borrowings ......... 25,960,348 5.32 10,604,570 3.29

Short-term portion of long-

term borrowings ........ 8,451,163 4.86 4,975,380 4.86

Other interest bearing

liabilities .............. 1,281,867 3.06 638,927 4.85

Total short-term borrowings. . $35,947,407 5.13% $16,384,890 3.84%

Maximum outstanding at any

month end............. $36,980,307

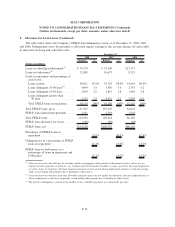

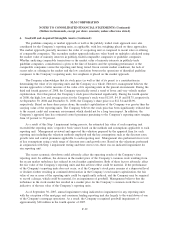

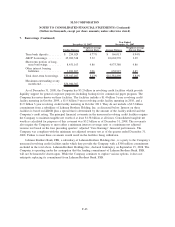

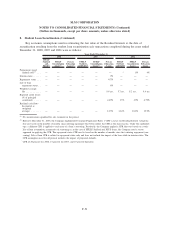

As of December 31, 2008, the Company has $5.2 billion in revolving credit facilities which provide

liquidity support for general corporate purposes including backup for its commercial paper program. The

Company has never drawn on these facilities. The facilities include a $1.4 billion 5-year revolving credit

facility maturing in October 2009, a $1.9 billion 5-year revolving credit facility maturing in 2010, and a

$1.9 billion 5-year revolving credit facility maturing in October 2011. They do not include a $0.3 billion

commitment from a subsidiary of Lehman Brothers Holding, Inc. as discussed below. Interest on these

facilities is based on LIBOR plus a spread that is determined by the amount of the facility utilized and the

Company’s credit rating. The principal financial covenants in the unsecured revolving credit facilities require

the Company to maintain tangible net worth of at least $1.38 billion at all times. Consolidated tangible net

worth as calculated for purposes of this covenant was $3.2 billion as of December 31, 2008. The covenants

also require the Company to meet either a minimum interest coverage ratio or a minimum net adjusted

revenue test based on the four preceding quarters’ adjusted “Core Earnings” financial performance. The

Company was compliant with the minimum net adjusted revenue test as of the quarter ended December 31,

2008. Failure to meet these covenants would result in the facilities being withdrawn.

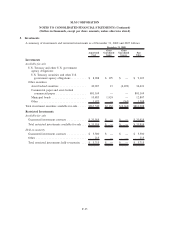

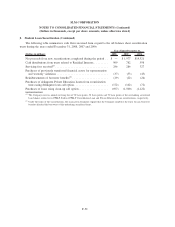

Lehman Brothers Bank, FSB, a subsidiary of Lehman Brothers Holdings Inc., is a party to the Company’s

unsecured revolving credit facilities under which they provide the Company with a $308 million commitment

excluded in the total above. Lehman Brothers Holdings Inc., declared bankruptcy on September 15, 2008. The

Company is operating under the assumption that the lending commitment of Lehman Brothers Bank, FSB,

will not be honored if drawn upon. While the Company continues to explore various options, it does not

anticipate replacing its commitment from Lehman Brothers Bank, FSB.

F-43

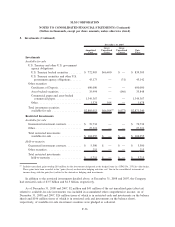

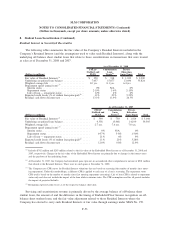

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)