Sallie Mae 2007 Annual Report Download - page 196

Download and view the complete annual report

Please find page 196 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

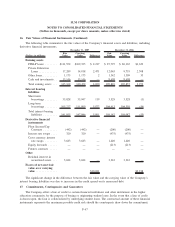

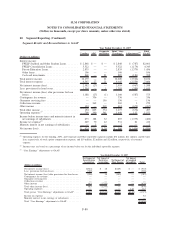

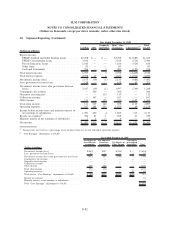

19. Income Taxes (Continued)

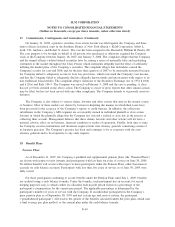

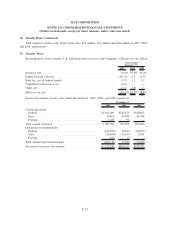

At December 31, 2007 and 2006, the tax effect of temporary differences that give rise to deferred tax

assets and liabilities include the following:

2007 2006

December 31,

Deferred tax assets:

Loan reserves ............................................ $ 867,840 $321,467

Market value adjustments on investments........................ 322,001 279,347

Deferred revenue ......................................... 61,780 59,825

Accrued expenses not currently deductible ....................... 60,821 57,863

Stock-based compensation plans .............................. 54,137 34,054

Operating loss and credit carryovers ........................... 43,600 57,125

Warrants issuance ......................................... 34,105 42,132

Partnership income ........................................ 15,433 21,629

Loan origination services ................................... 9,001 12,652

In-substance defeasance transactions ........................... 18,074 —

Other .................................................. 28,959 29,664

Total deferred tax assets .................................... 1,515,751 915,758

Deferred tax liabilities:

Securitization transactions ................................... 370,378 387,290

Unrealized investment gains recorded to other comprehensive income . . 124,459 183,684

Leases ................................................. 83,286 92,382

Depreciation/amortization ................................... 23,031 57,856

Contingent payment debt instruments .......................... — 100,632

In-substance defeasance transactions ........................... — 9,930

Other .................................................. 7,247 9,085

Total deferred tax liabilities .................................. 608,401 840,859

Net deferred tax assets ..................................... $ 907,350 $ 74,899

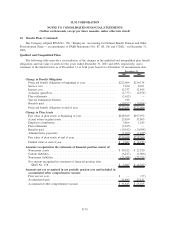

Included in other deferred tax assets is a valuation allowance of $7,635 and $3,778 as of December 31,

2007 and 2006, respectively, against a portion of the Company’s state and international deferred tax assets.

The ultimate realization of the deferred tax assets is dependent upon the generation of future taxable income

during the period in which the temporary differences become deductible. Management primarily considers the

scheduled reversals of deferred tax liabilities and the history of positive taxable income in making this

determination. The valuation allowance primarily relates to state deferred tax assets for which subsequently

recognized tax benefits will be allocated to goodwill.

As of December 31, 2007, the Company has federal net operating loss carryforwards of $89,052 which

begin to expire in 2022, apportioned state net operating loss carryforwards of $129,080 which begin to expire

in 2008, and federal and state credit carryovers of $1,921 which begin to expire in 2021.

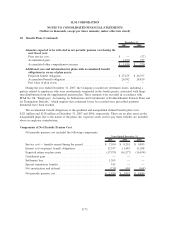

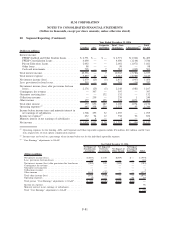

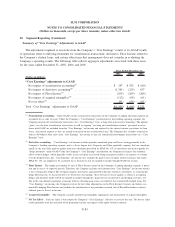

Accounting for Uncertainty in Income Taxes

The Company adopted the provisions of the FASB’s FIN No. 48, “Accounting for Uncertainty in Income

Taxes,” on January 1, 2007. As a result of the implementation of FIN No. 48, the Company recognized a

$6 million increase in its liability for unrecognized tax benefits, which was accounted for as a reduction to the

F-75

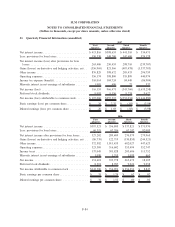

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in thousands, except per share amounts, unless otherwise stated)