Sallie Mae 2007 Annual Report Download - page 170

Download and view the complete annual report

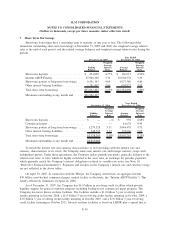

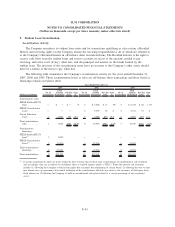

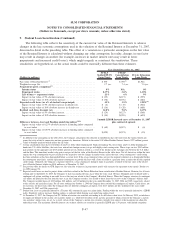

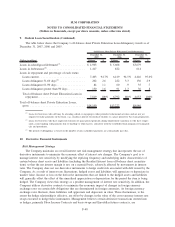

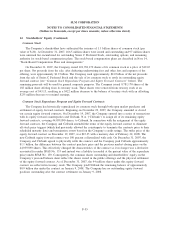

Please find page 170 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.10. Derivative Financial Instruments (Continued)

economically effective; however, those transactions generally do not qualify for hedge accounting under

SFAS No. 133 (as discussed below) and thus may adversely impact earnings.

Although the Company uses derivatives to offset (or minimize) the risk of interest rate and foreign

currency changes, the use of derivatives does expose the Company to both market and credit risk. Market risk

is the chance of financial loss resulting from changes in interest rates, foreign exchange rates and/or stock

prices. Credit risk is the risk that a counterparty will not perform its obligations under a contract and it is

limited to the loss of the fair value gain in a derivative that the counterparty owes the Company. When the fair

value of a derivative contract is negative, the Company owes the counterparty and, therefore, has no credit

risk. The Company minimizes the credit risk in derivative instruments by entering into transactions with highly

rated counterparties that are reviewed periodically by the Company’s credit department. The Company also

maintains a policy of requiring that all derivative contracts be governed by an International Swaps and

Derivative Association Master Agreement. Depending on the nature of the derivative transaction, bilateral

collateral arrangements generally are required as well. When the Company has more than one outstanding

derivative transaction with a counterparty, and there exists legally enforceable netting provisions with the

counterparty (i.e. a legal right to offset receivable and payable derivative contracts), the “net” mark-to-market

exposure represents the netting of the positive and negative exposures with the same counterparty. When there

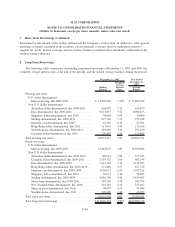

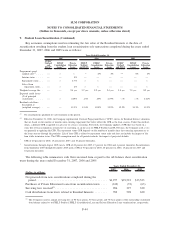

is a net negative exposure, the Company considers its exposure to the counterparty to be zero. At December 31,

2007 and 2006, the Company had a net positive exposure (derivative gain positions to the Company less

collateral which has been posted by counterparties to the Company) related to corporate derivatives of

$463 million and $97 million, respectively.

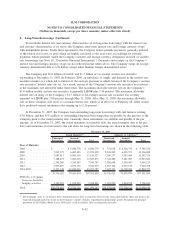

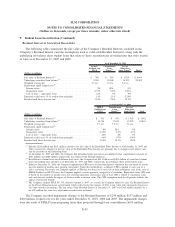

The majority of the Company’s ISDA Master Agreements provide that the counterparty may declare a

“Termination Event” and terminate its positions if a “Designated Event” occurs and the Company’s unsecured

and unsubordinated long-term debt rating fall to either of the pre-determined levels, which is typically “Baa3”

for Moody’s and “BBB-” from S&P. For purposes of these ISDA Master Agreements, the execution of the

Merger Agreement constituted a “Designated Event.” On February 4, 2008, Standard & Poor’s Ratings

Services announced that it lowered the Company’s long-term debt rating to “BBB-/A-3” from “BBB+/A-2.”

Standard & Poor’s also announced that the Company’s rating remains on CreditWatch with negative

implications. As of February 28, 2008, 92 percent of the counterparties (on a notional basis) have agreed in

writing to waive their rights (or do not have the rights) to declare a “Termination Event” arising from the

Company executing the Merger Agreement and the resulting ratings downgrade. Depending upon interest rates

and exchange rates, the Company could be liable for substantial payments to terminate these positions if the

counterparties exercise their right to terminate at any point in the future. It would be the Company’s intent to

replace any terminated positions with derivatives executed with other counterparties, however, the Company

may not be able to readily replace any terminated positions or may incur substantial additional costs to do so.

The Company’s liquidity could be adversely affected by these additional payments and costs. In addition, prior

to the recent ratings downgrade, the Company had the use of cash collateral posted by these counterparties. As

a result of the Company’s recent ratings downgrade, its ability to use that cash collateral will become restricted

unless the counterparties waive these restrictions. The Company is currently in negotiations with its

counterparties to waive these restrictions so that use of such cash collateral once again becomes unrestricted.

If not waived, these cash collateral balances will appear in the “Restricted cash and investments” line of the

consolidated balance sheet.

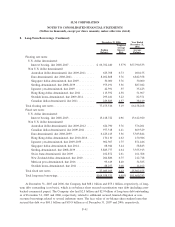

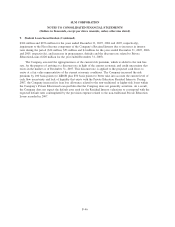

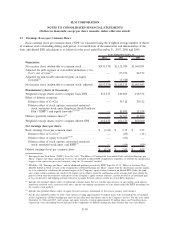

The Company’s on-balance sheet securitization trusts have $11.0 billion of Euro and British Pound

Sterling denominated bonds outstanding as of December 31, 2007. To convert these non-U.S. dollar denomi-

nated bonds into U.S. dollar liabilities, the trusts have entered into foreign-currency swaps with highly-rated

F-49

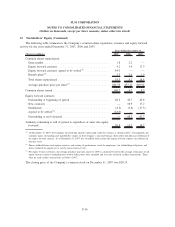

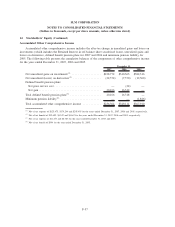

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in thousands, except per share amounts, unless otherwise stated)