Sallie Mae 2007 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

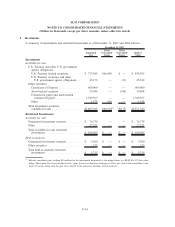

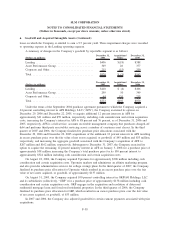

7. Short-Term Borrowings (Continued)

determined by the amount of the facility utilized and the Company’s credit rating. In addition to other general

operating covenants contained in the facilities, certain financial covenants must be maintained related to

tangible net worth, interest coverage and net revenue. Failure to maintain these thresholds could result in the

facilities being withdrawn.

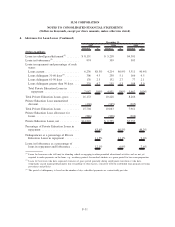

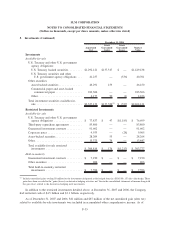

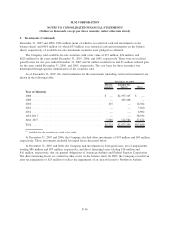

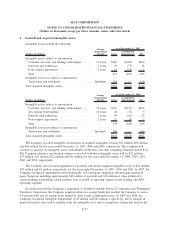

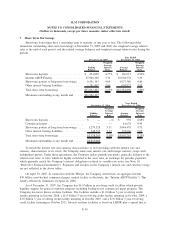

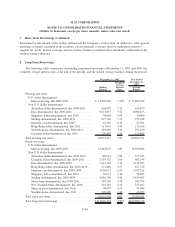

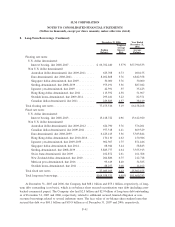

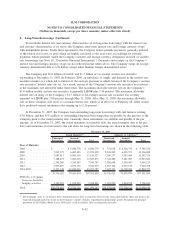

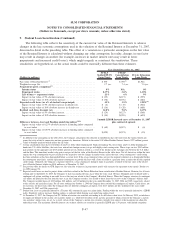

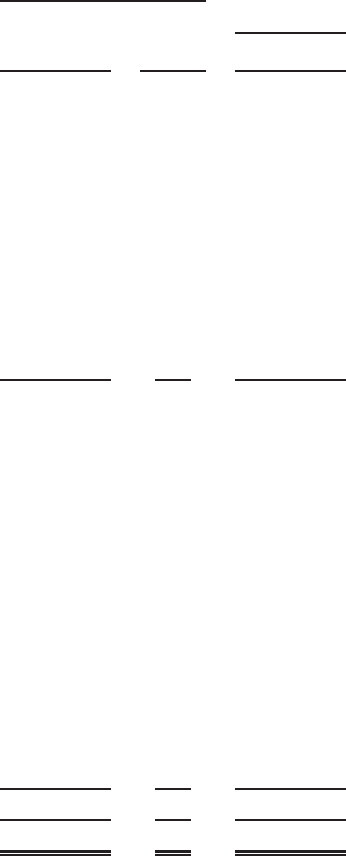

8. Long-Term Borrowings

The following tables summarize outstanding long-term borrowings at December 31, 2007 and 2006, the

weighted average interest rates at the end of the periods, and the related average balances during the periods.

Ending

Balance

Weighted

Average

Interest

Rate

Average

Balance

December 31, 2007 Year Ended

December 31,

2007

Floating rate notes:

U.S. dollar denominated:

Interest bearing, due 2009-2047 ............... $ 71,650,528 5.25% $ 73,683,228

Non U.S. dollar denominated:

Australian dollar-denominated, due 2009-2011 .... 626,030 7.23 625,870

Euro-denominated, due 2009-2041 ............. 9,073,835 3.72 8,900,473

Singapore dollar-denominated, due 2009 ......... 30,000 2.69 30,000

Sterling-denominated, due 2009-2039 ........... 975,746 5.73 975,618

Japanese yen-denominated, due 2009 ........... 42,391 0.19 42,391

Hong Kong dollar-denominated, due 2011 ....... 113,641 4.38 113,616

Swedish krona-denominated, due 2009-2011 ...... 293,459 3.49 293,450

Canadian dollar-denominated, due 2011 ......... 229,885 5.32 229,885

Total floating rate notes . . ....................... 83,035,515 5.09 84,894,531

Fixed rate notes:

U.S. dollar denominated:

Interest bearing, due 2009-2043 ............... 12,683,074 4.89 12,999,204

Non U.S. dollar denominated:

Australian dollar-denominated, due 2009-2012 .... 749,514 4.80 577,015

Canadian dollar-denominated, due 2009-2011 ..... 1,179,132 3.66 987,145

Euro-denominated, due 2009-2039 ............. 7,313,381 2.70 5,132,707

Hong Kong dollar-denominated, due 2010-2016 . . . 171,689 4.57 167,519

Japanese yen-denominated, due 2009-2035 ....... 1,036,625 1.63 1,052,326

Singapore dollar-denominated, due 2014 ......... 76,631 3.10 58,863

Sterling-denominated, due 2009-2039 ........... 4,084,309 4.42 3,439,887

Swiss franc-denominated, due 2009-2011 ........ 349,326 2.48 302,704

New Zealand dollar-denominated, due 2010 ...... 219,282 6.32 213,017

Mexican peso-denominated, due 2016........... 90,057 8.92 91,504

Swedish krona-denominated, due 2011 .......... 109,609 2.48 68,050

Total fixed rate notes ........................... 28,062,629 4.05 25,089,941

Total long-term borrowings ...................... $111,098,144 4.83% $109,984,472

F-40

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in thousands, except per share amounts, unless otherwise stated)